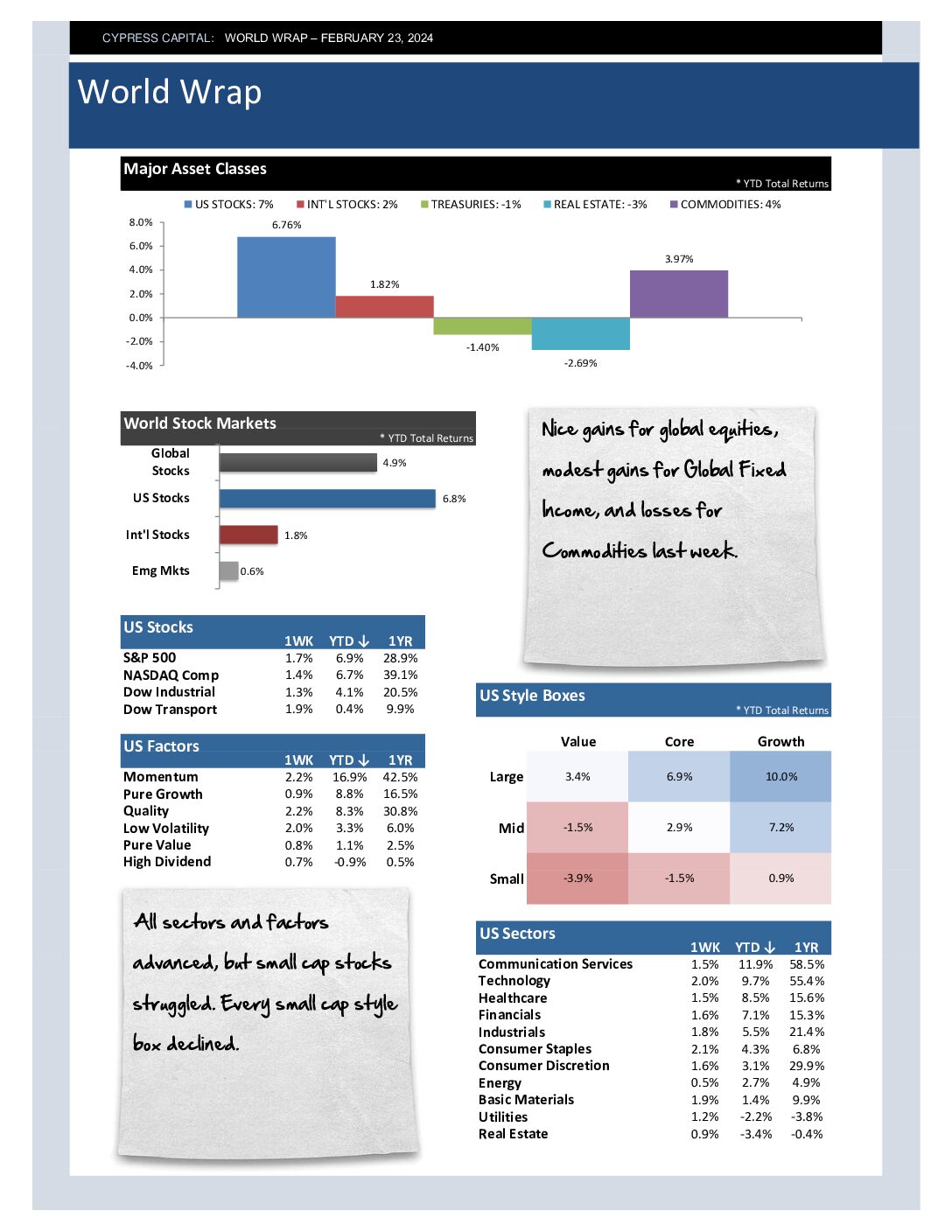

– Global equities rallied, led by US stocks. Commodities declined.

– Broad rally among styles, factors, and sectors. Momentum and Growth were the biggest winners.

– Two out of every three countries we follow advanced, but emerging markets lagged on declines in Chinese equities.

– The US Dollar and prices on US Treasuries finished the week higher on a dovish sounding Fed.