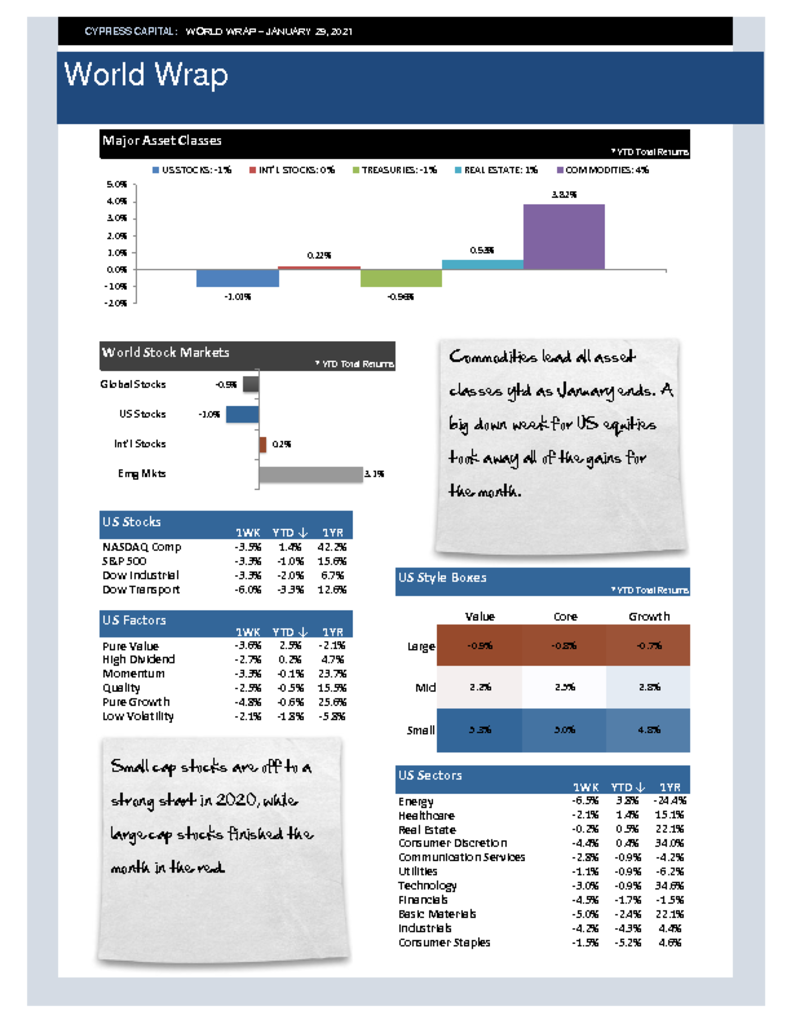

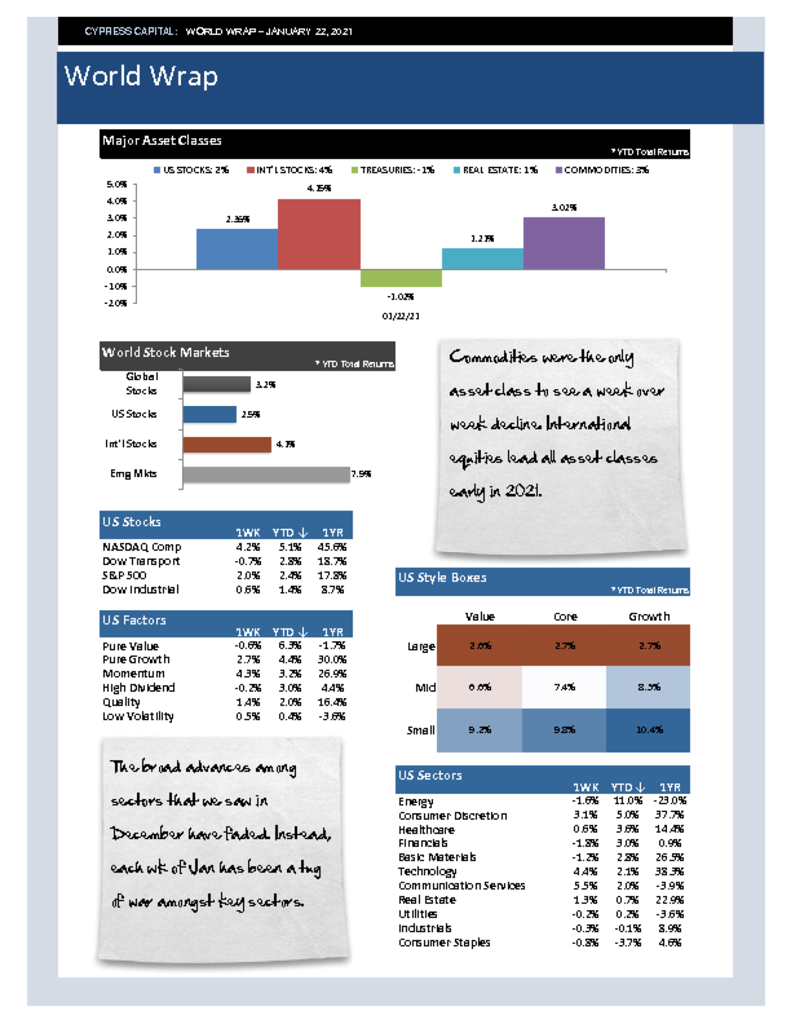

– Commodities lead all asset classes ytd as January ends. A big down week for US equities took away the gains for the month.

– Small cap stocks are off to a strong start in 2020, while large cap stocks finished the month in the red.

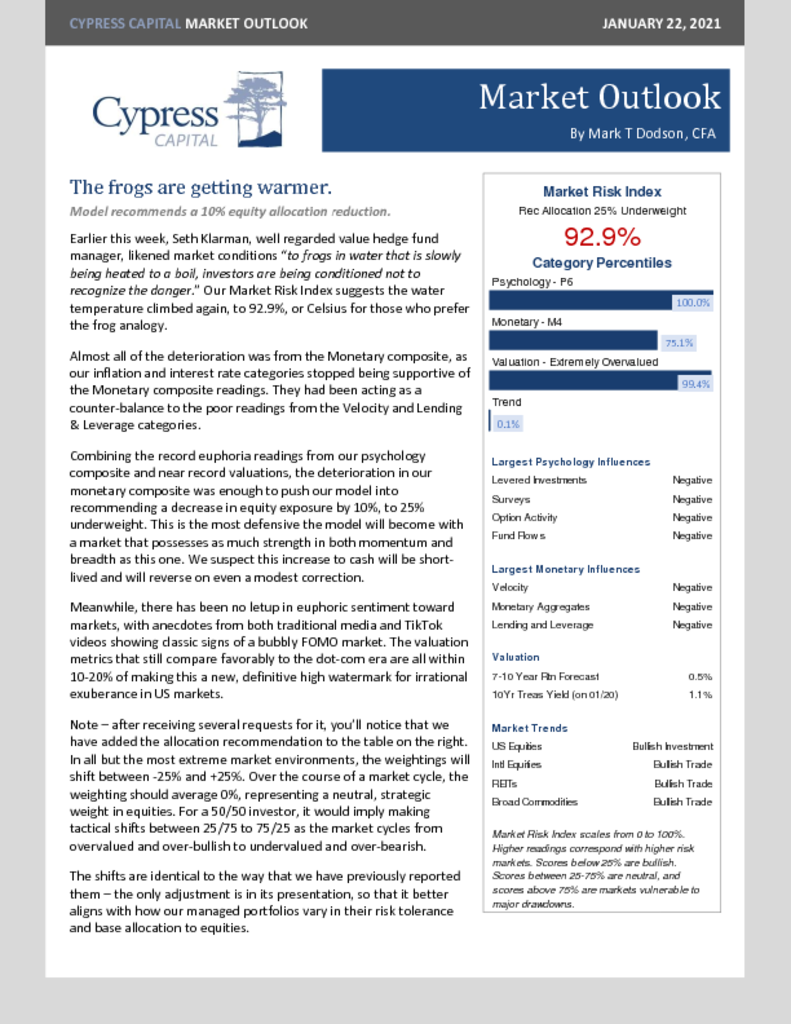

– Emerging markets are leading and positive ytd. Developed equities finished the month with a negative return.

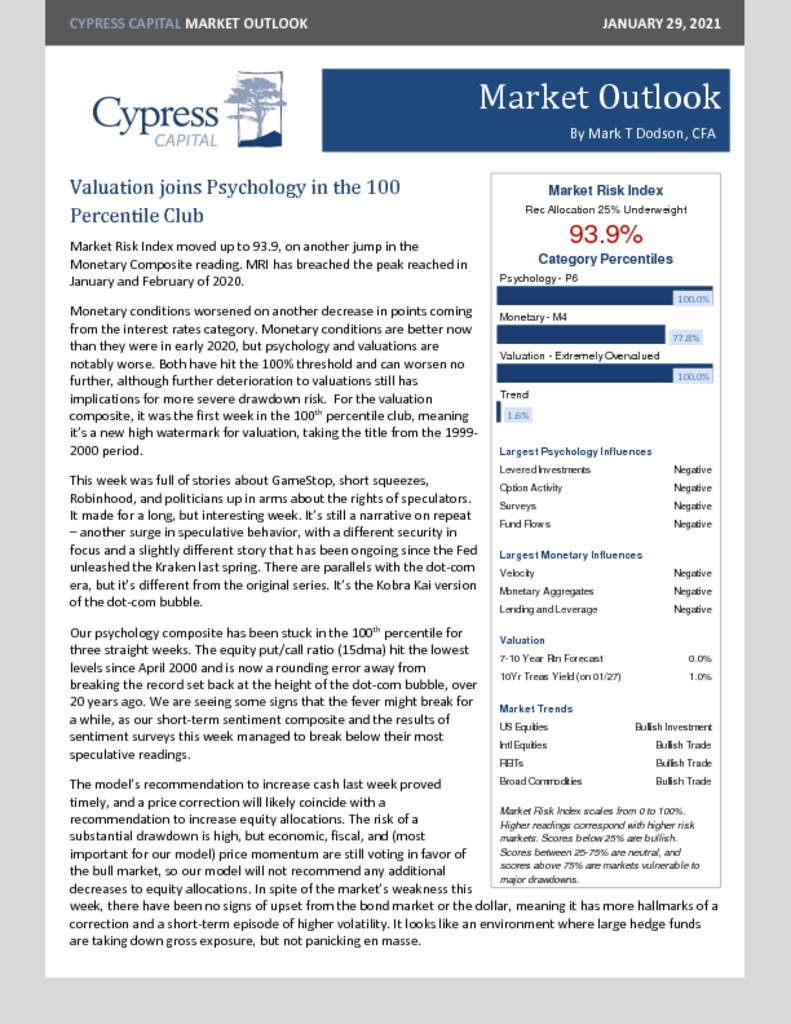

– In spite of all the GameStop news and volatility in equity markets, there was little concern in the bond market or the US dollar.