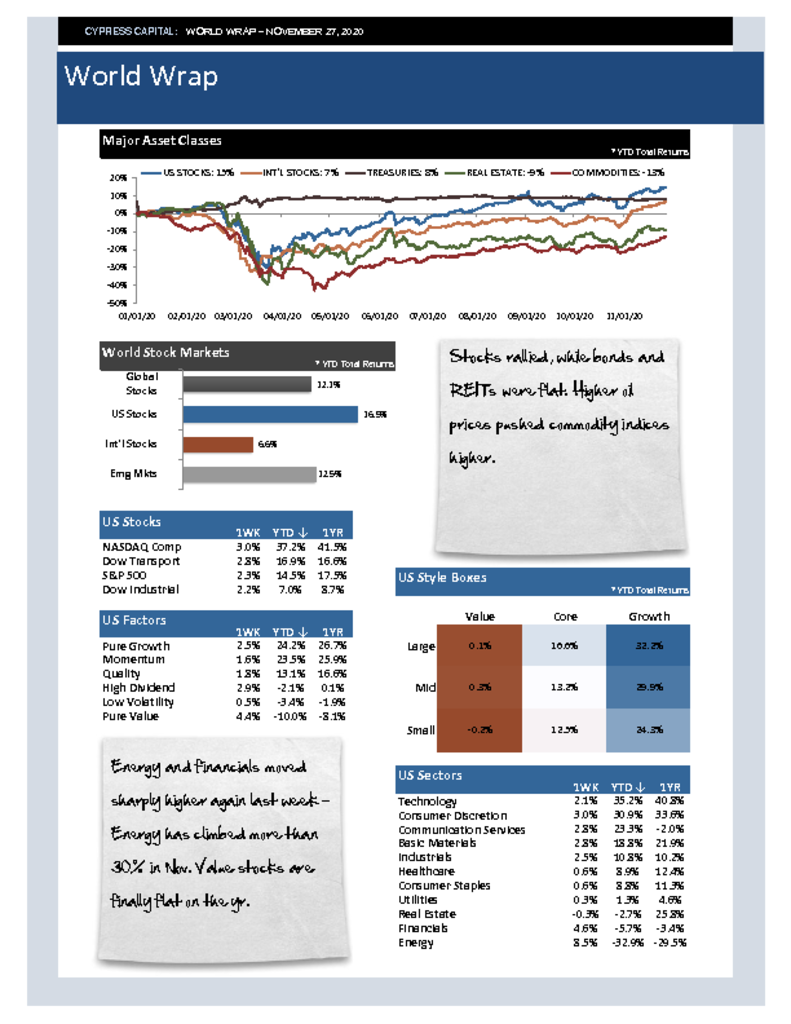

– Stocks rallied, while bonds and REITs were flat. Higher oil prices pushed commodity indices higher.

– Energy and financials moved sharply higher again last week – Energy has climbed more than 30% in Nov. Value stocks are finally flat on the yr.

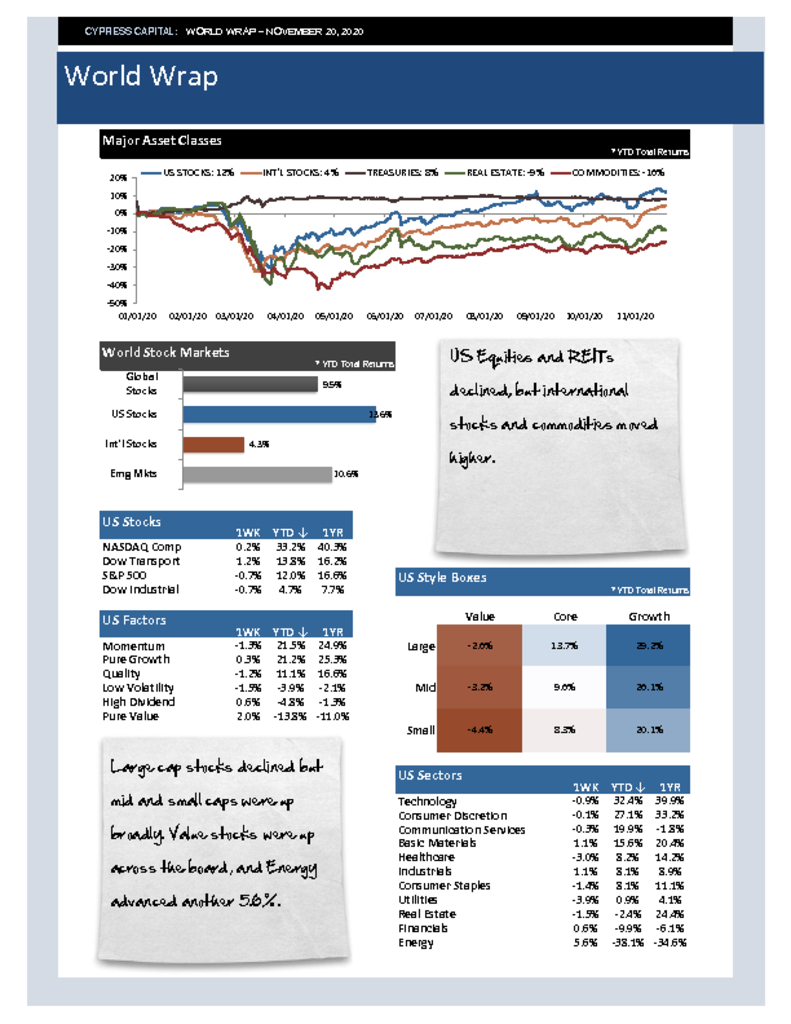

– Intl developed equities finally managed to outperform Emerging markets during a week, but still lagging significantly ytd.

– Purchasing power of the US dollar continues to decline, as the dollar hit fresh new lows for the year.