Archive

World Wrap

– Federal Reserve meeting week was a tough one for global financial assets – all major asset classes finished the week in the red.

– All factors, styles and sectors closed the week lower. Small cap value returns for 2023 have turned negative.

– Emerging and developed market equities declined. Thirteen of 44 countries are down year-to-date after last week’s stock market weakness.

– The dollar was up, as were bond yields. The yield on the 10 Yr. Treasury Inflation Protected Securities climbed above 2% for the first time since 2009.

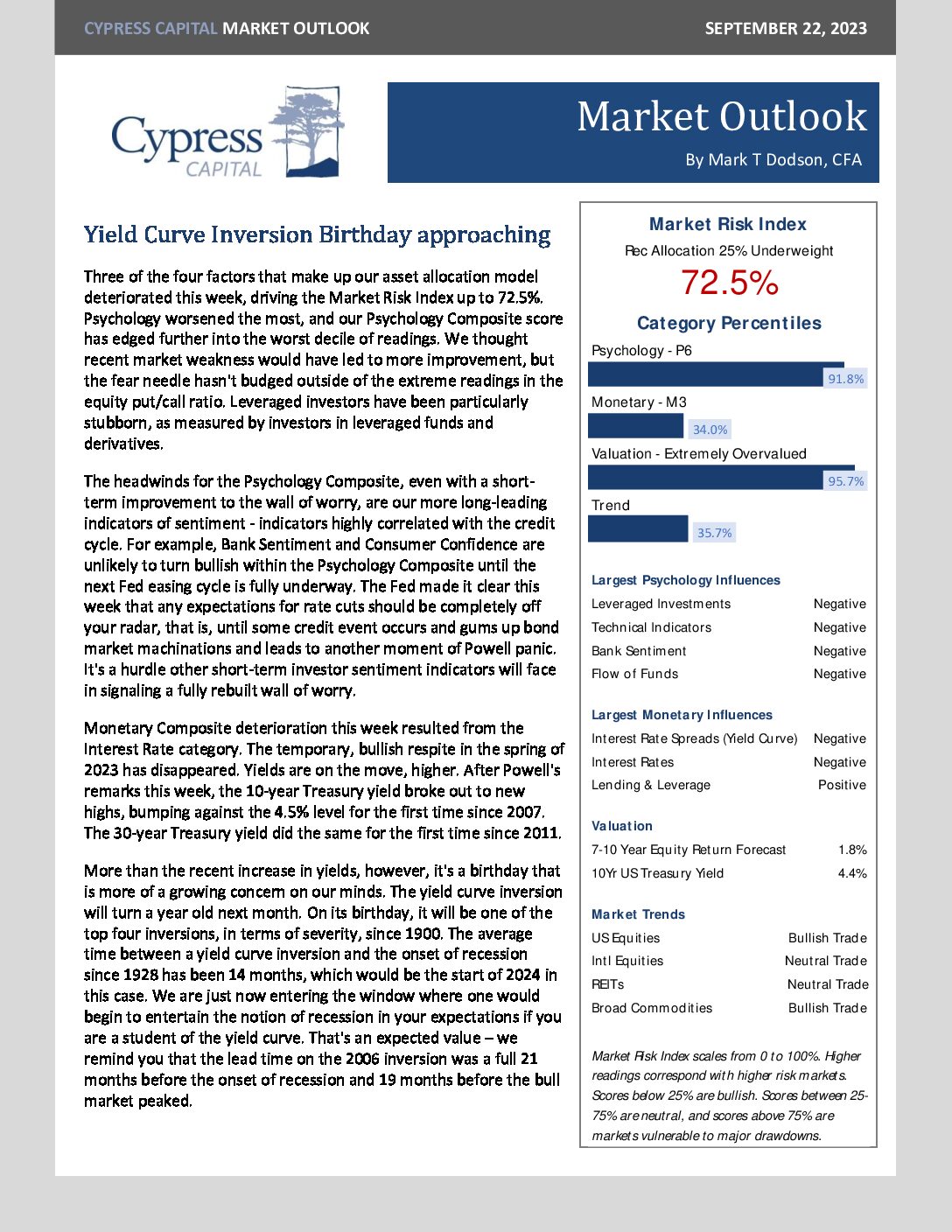

Market Outlook – Yield Curve Inversion Birthday approaching

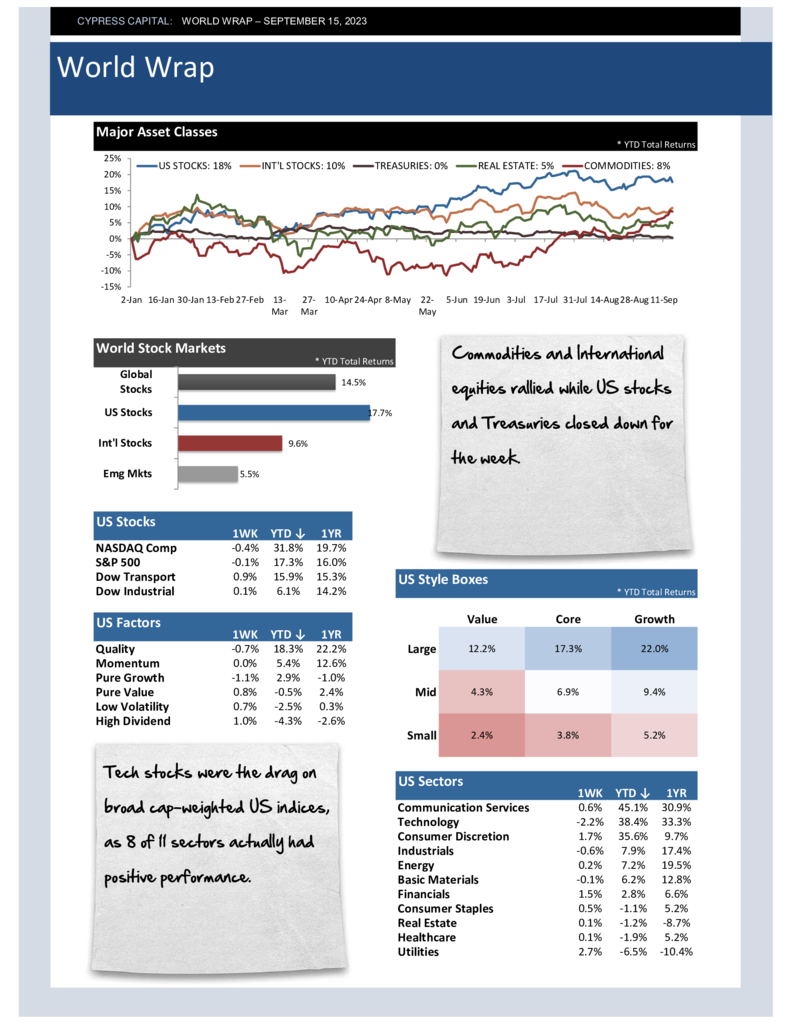

World Wrap

– Commodities and International equities rallied while US stocks and Treasuries closed down for the week.

– Tech stocks were the drag on broad cap-weighted US indices, as 8 of 11 sectors actually had positive performance.

– Strong performance from Japan and Latin America boosted international indices.

– Crude oil closed the week above $90 a barrel for the first time in 10 months. Treasury yields are testing bear market highs.

%

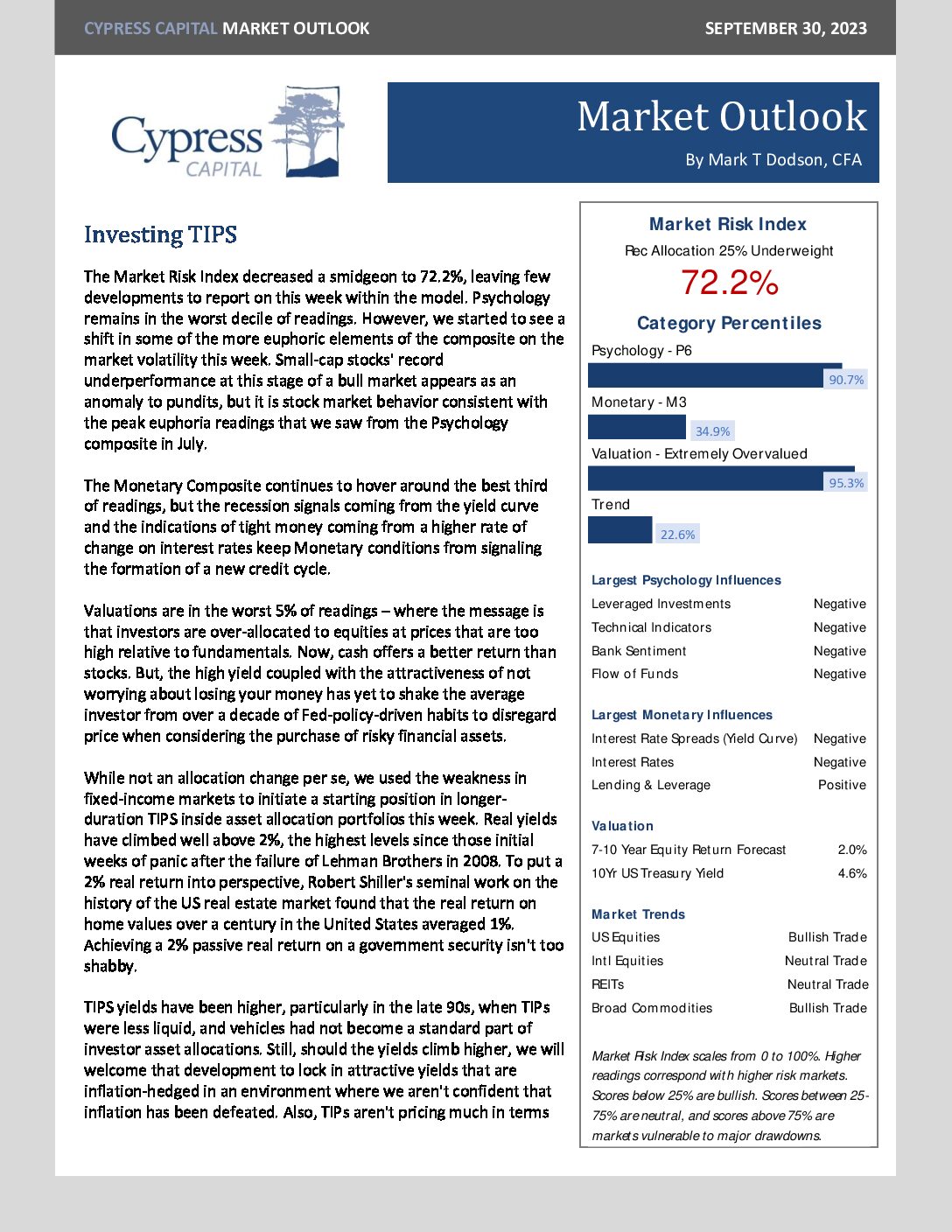

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 99.7%

- Monetary 87.2%

- Valuation 99.3%

- Market Trend 9.8%