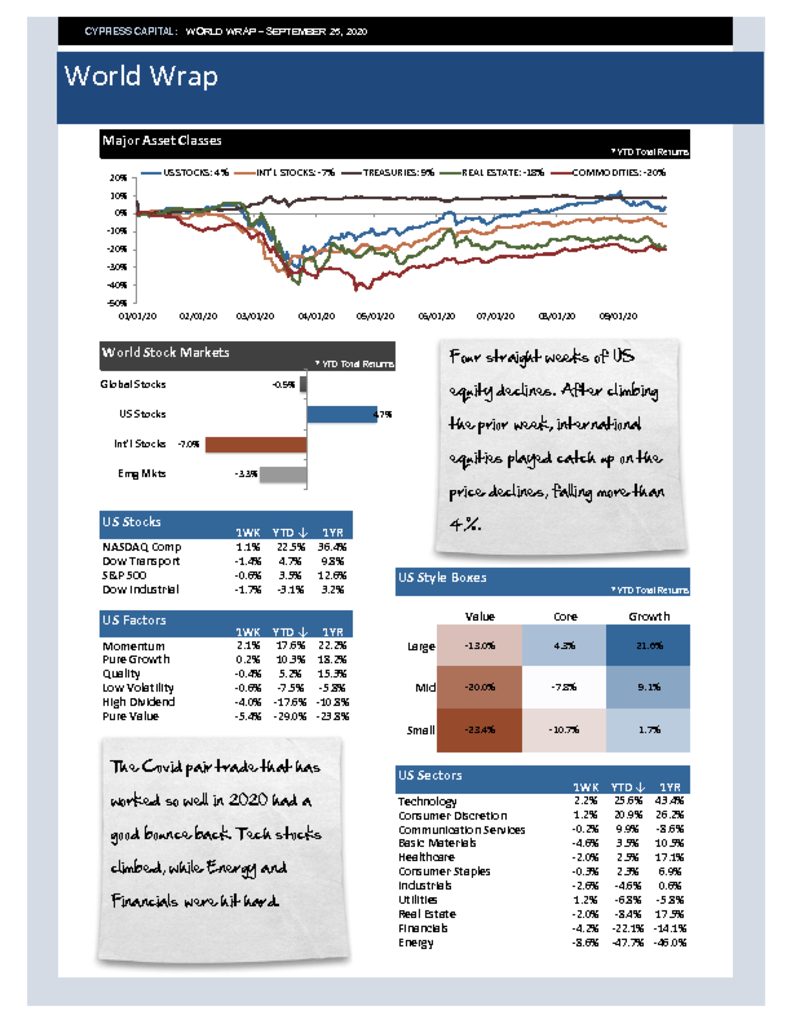

-Four straight weeks of US equity declines. After climbing the prior week, international equities played catch up on the price declines, falling more than 4%.

– The Covid pair trade that has worked so well in 2020 had a good bounce back. Tech stocks climbed, while Energy and Financials were hit hard.

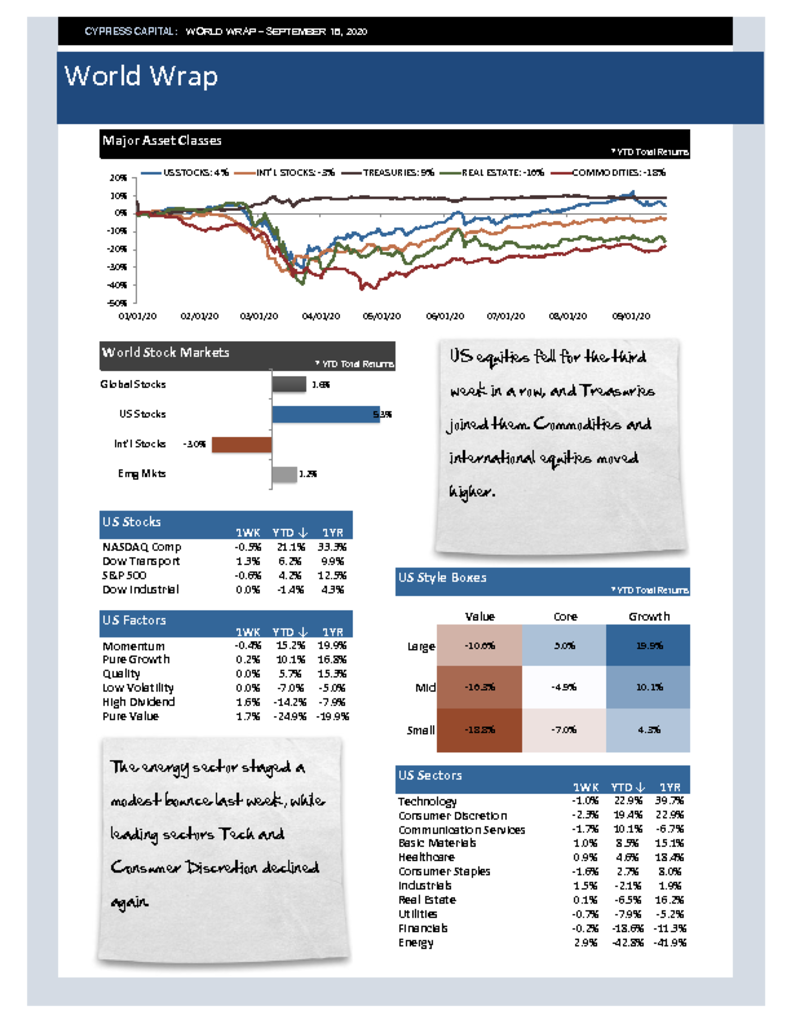

– Another week of US dollar strength led to declines in commodities and international equities.

– Yields on both junk and investment grade corporate credit moved higher. US Treasury prices rallied.