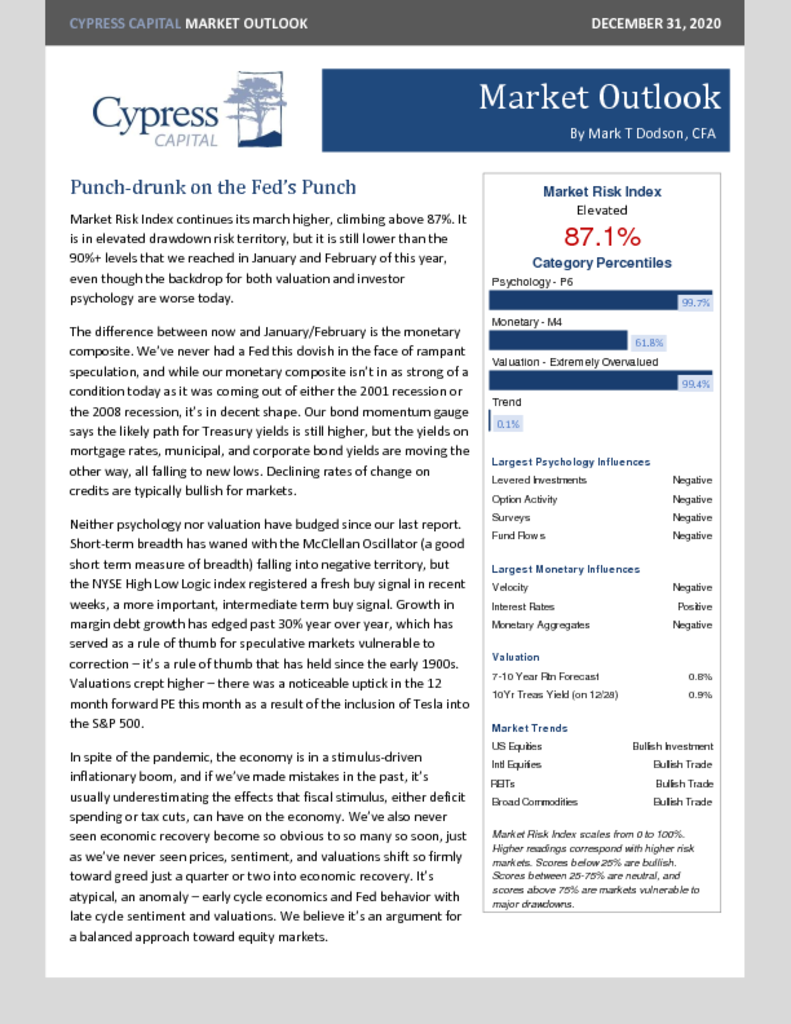

– Dovish Fed is the biggest difference between MRI readings at the start and end of 2020.

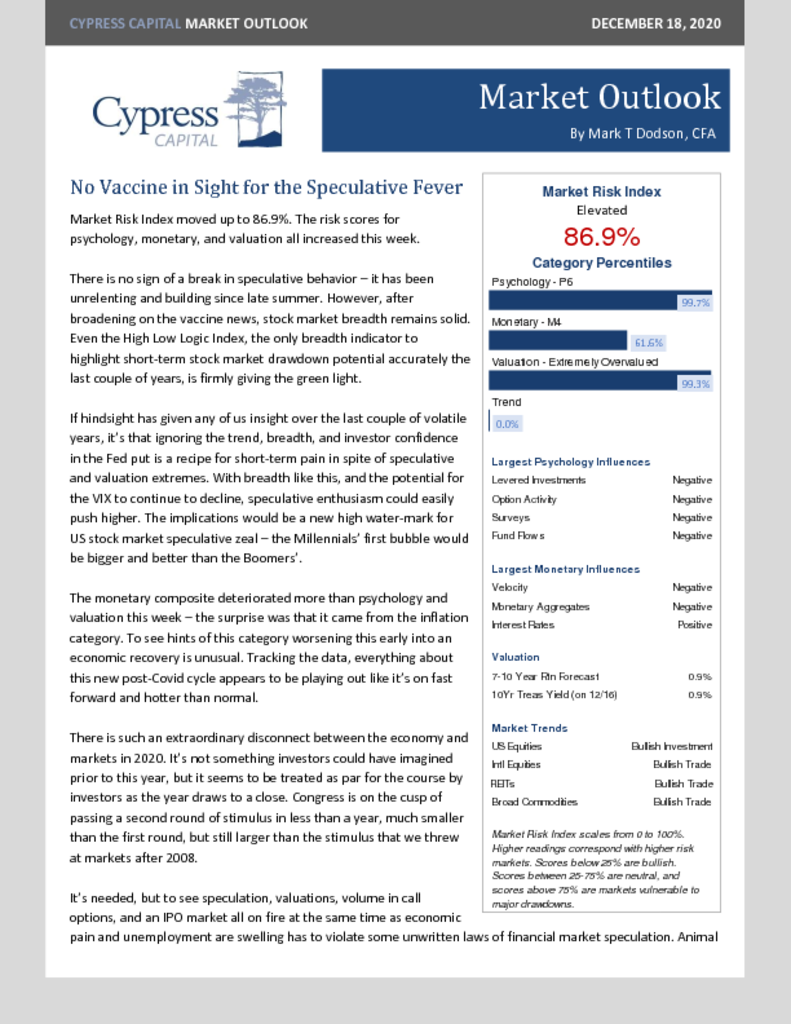

– Short-term breadth weakens, but the High Low Logic Index has given a new buy signal.

– Margin debt growth climbs above 30% – our longstanding rule of thumb for speculative markets vulnerable to correction.