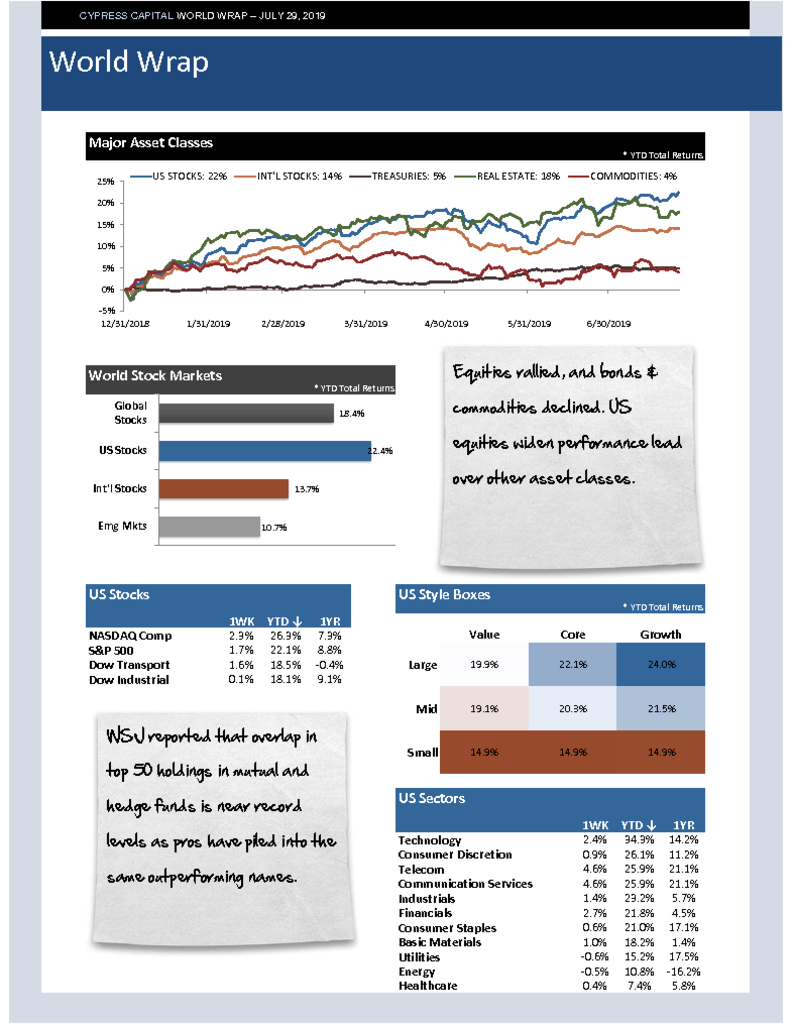

– Equities rallied, and bonds & commodities declined. US equities widen performance lead over other asset classes.

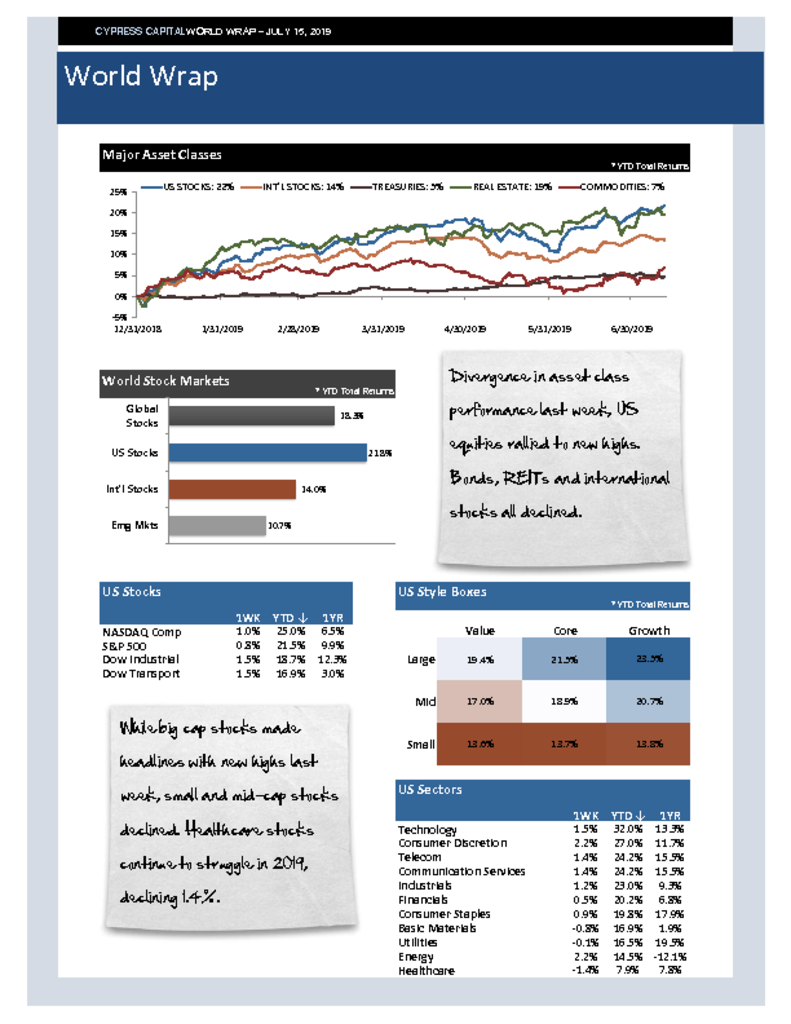

– WSJ reported that overlap in top 50 holdings in mutual and hedge funds is near record levels as pros have piled into the same outperforming names.

– US & China set to resume trade talks this week. Low expectations for any substantial breakthroughs.

– Fed expected to cut rates by 25 basis points on Wednesday. Uncertainty is building about what likely policy will be after that.