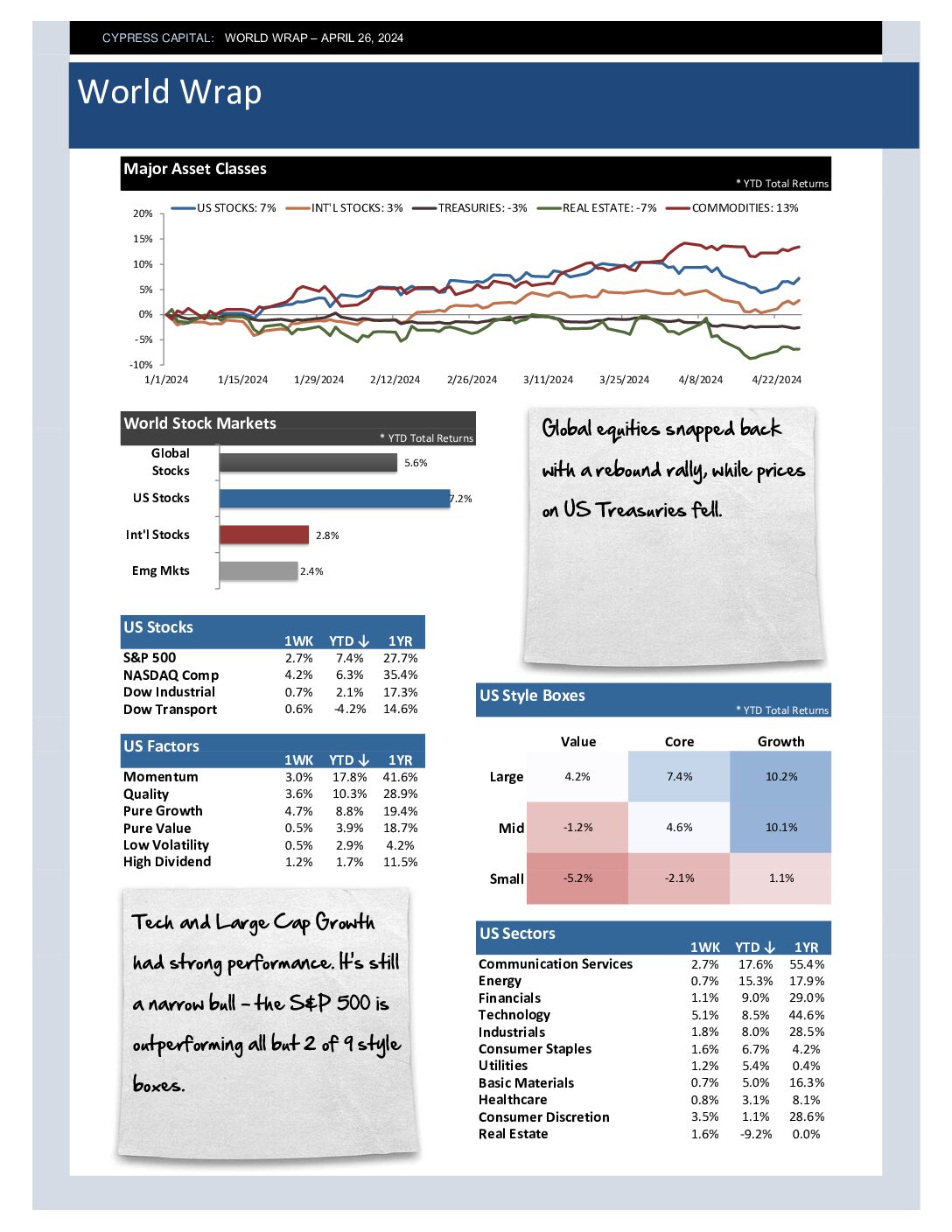

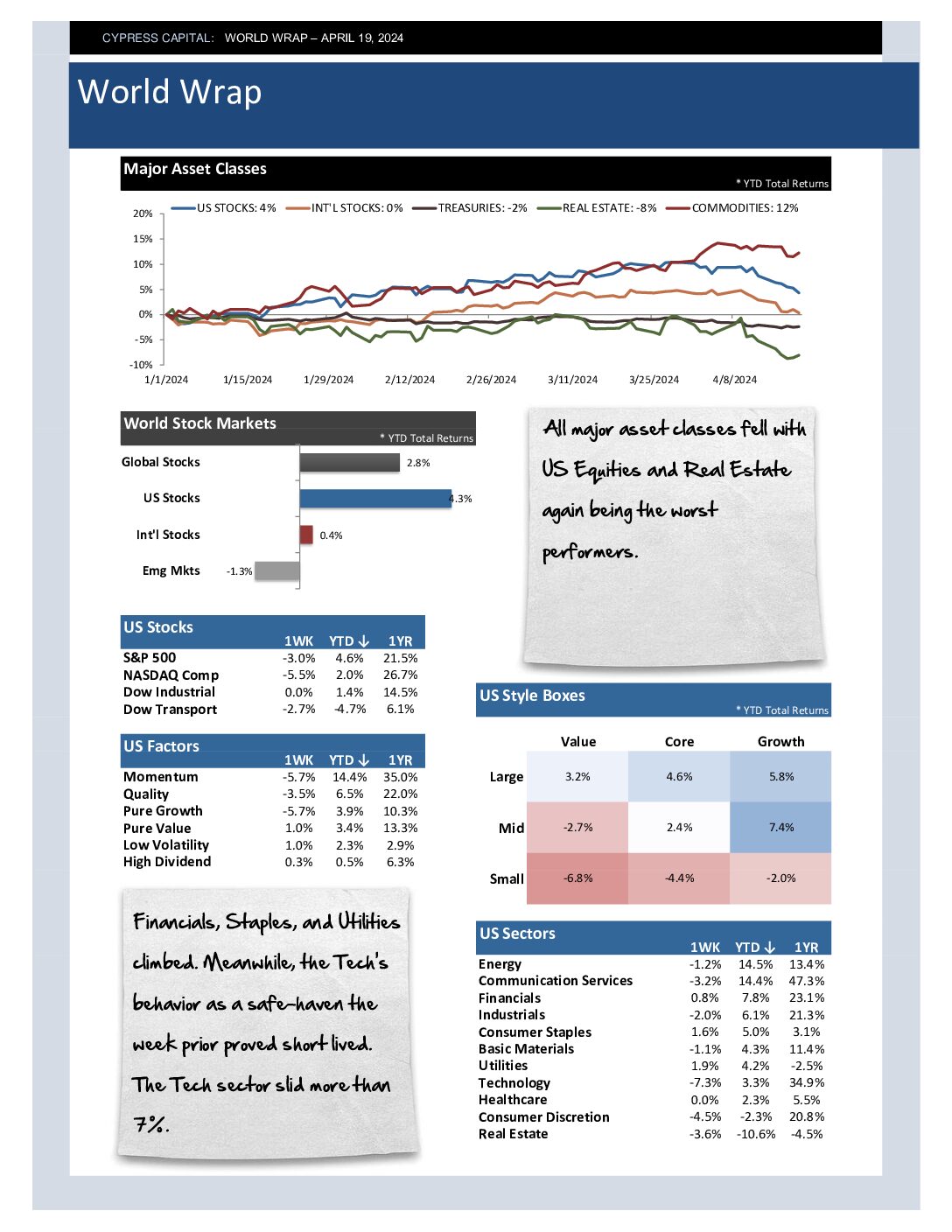

– Global equities snapped back with a rebound rally, while prices on US Treasuries fell.

– Tech and Large Cap Growth had strong performance. It’s still a narrow bull – the S&P 500 is outperforming all but 2 of 9 style boxes.

– Impressive move out of Asia – China and Hong Kong were up 8.2 and 9.5% for the week.

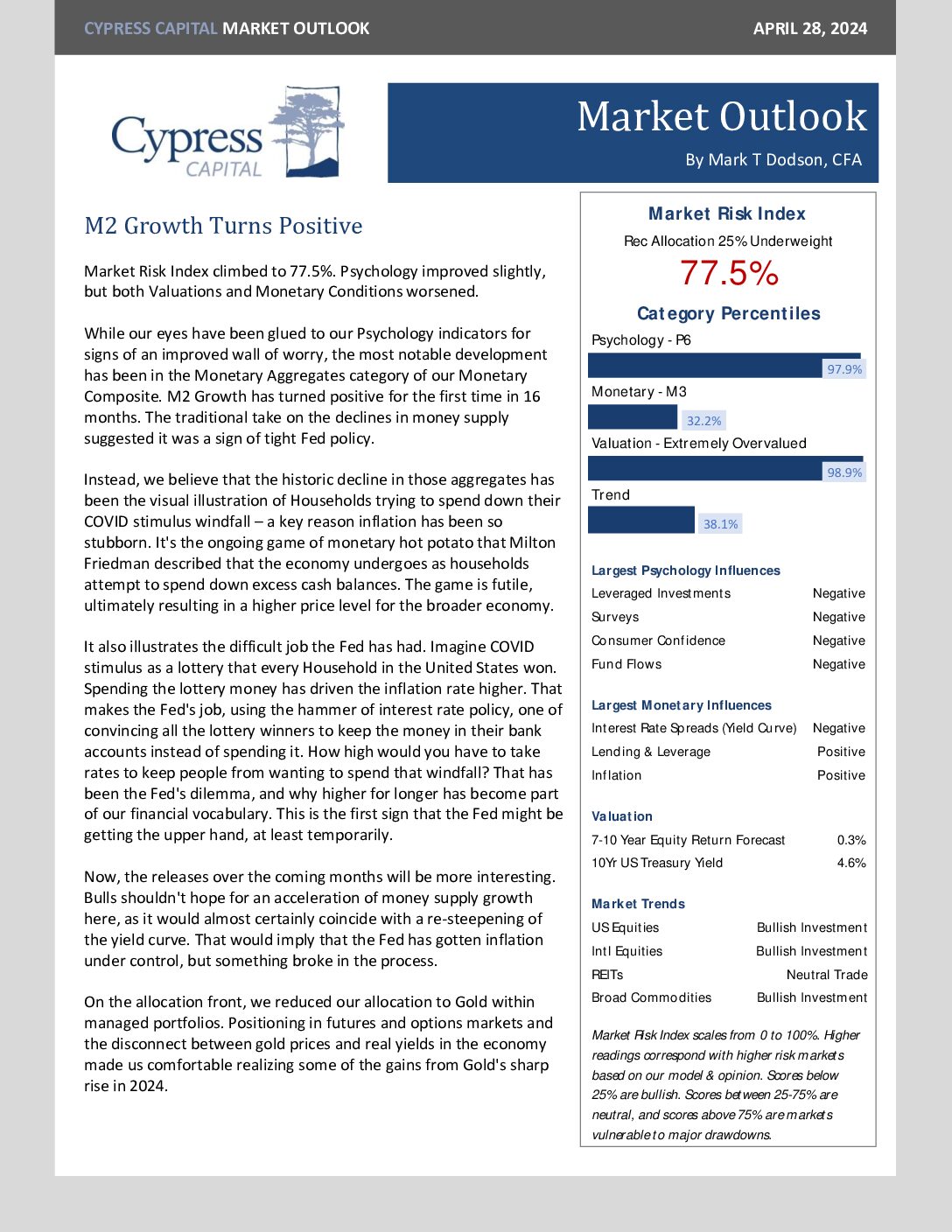

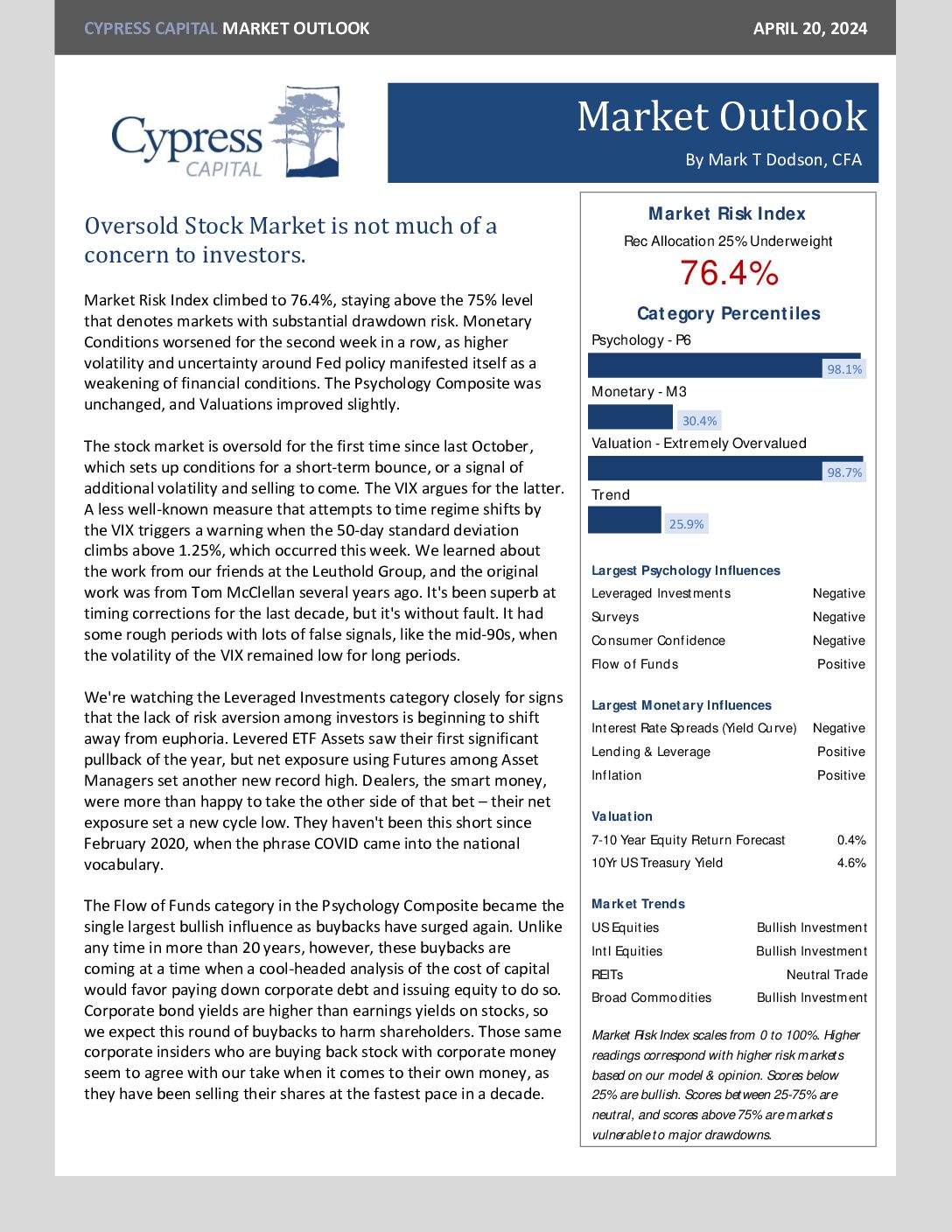

– Yields on the US 10Yr Treasury climbed as high as 4.7%, levels not seen since last November.