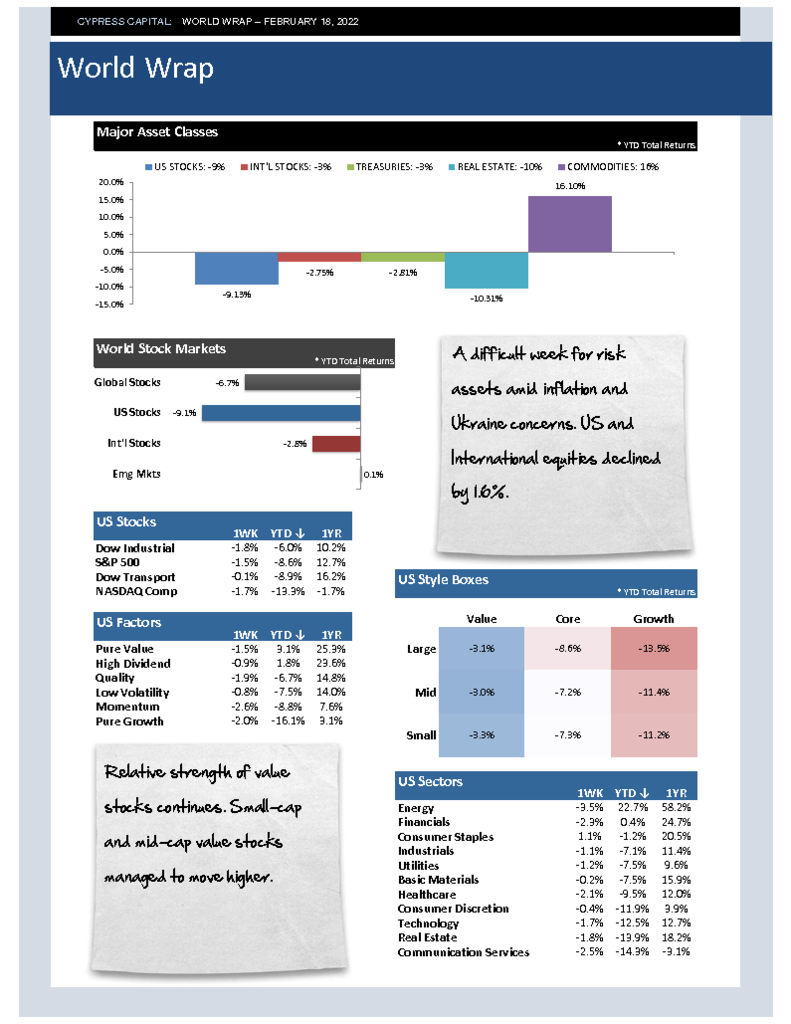

– The Russian invasion of Ukraine put more pressure on international equities rather than US equities, as domestic stocks rallied from oversold levels.

– Growth stocks staged a rebound after suffering persistent declines for the first two months of 2022.

– International stocks struggled. China declined 5.8%, and the Russian stock market fell more than 30% last week, much of it occurring the day the invasion began.

– Bitcoin has behaved like a proxy for the risk trade in markets and has suffered declines comparable to growth stocks, falling 15.8% ytd.