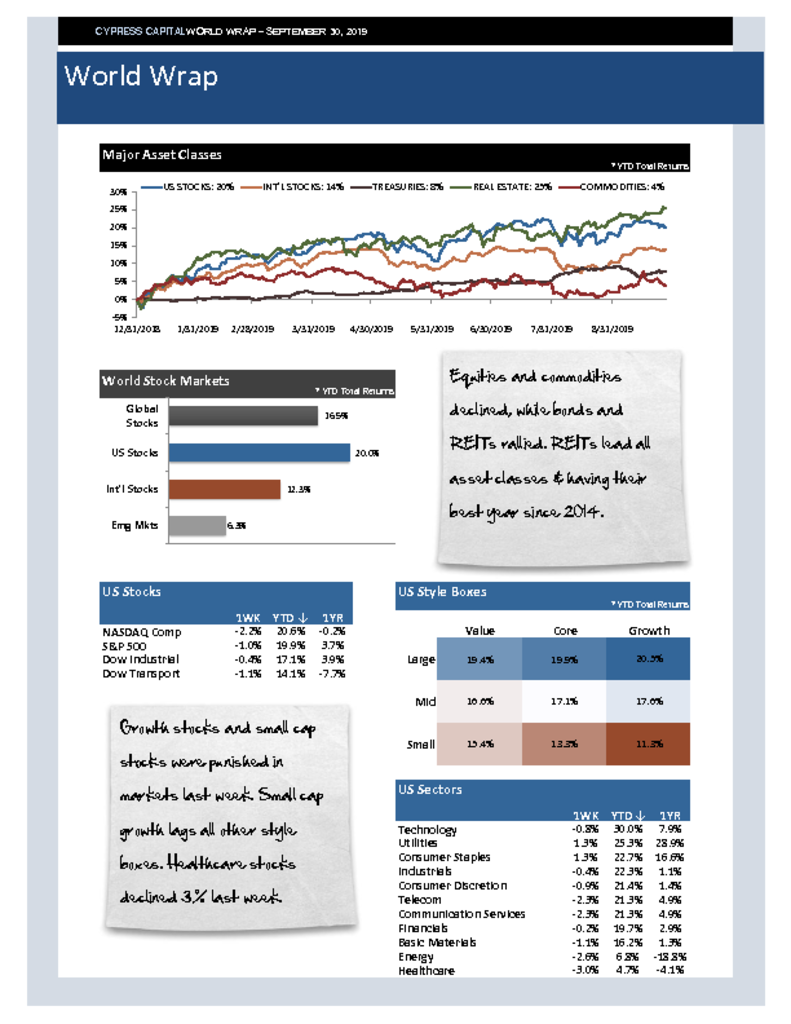

– Equities and commodities declined, while bonds and REITs rallied. REITs lead all asset classes & having their best year since 2014.

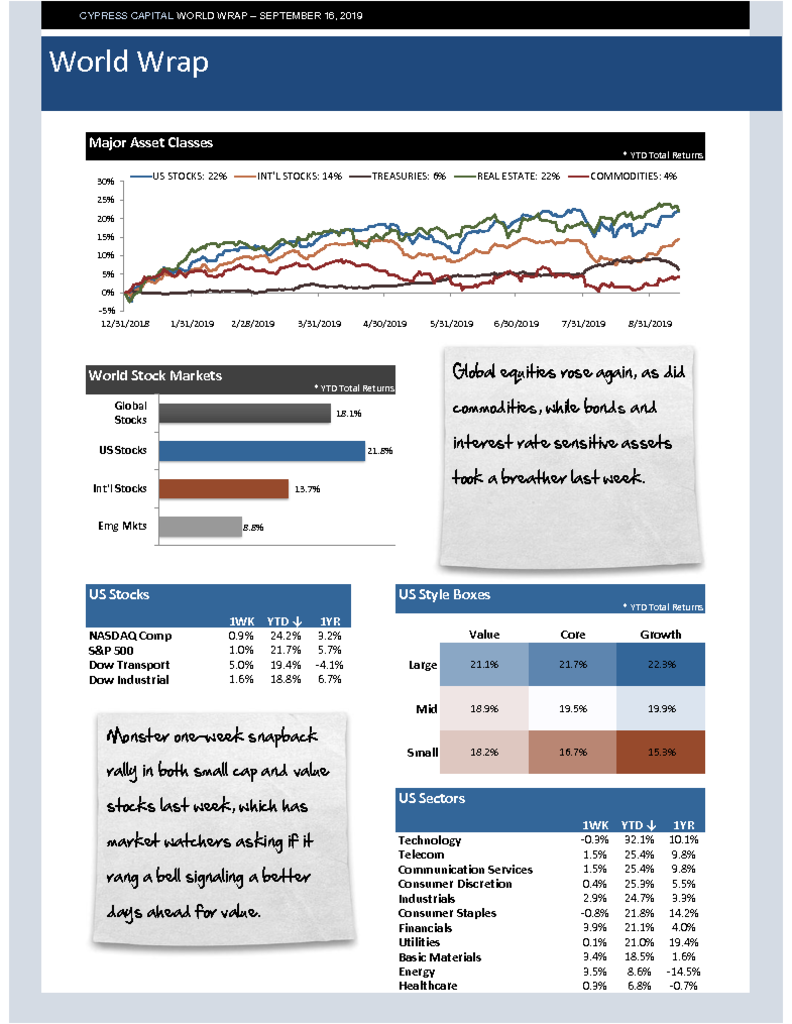

– Growth stocks and small cap stocks were punished in markets last week. Small cap growth lags all other style boxes. Healthcare stocks declined 3% last week.

– China manufacturing PMI improves but still in contraction. In response to rumors, Trump administration says no plan to block Chinese listings on US exchanges.

– A Reuters poll of fixed income strategists reveals 70% expect bond yields to remain depressed for at least 5 yrs.