– Global equities and fixed income climbed, while Commodities declined on lower oil prices.

– The advance was broad during the holiday shortened week with all factors, sectors and styles moving higher.

– China was the worst performing country in the world last week, declining 3.1% and weighing on Emerging market indices.

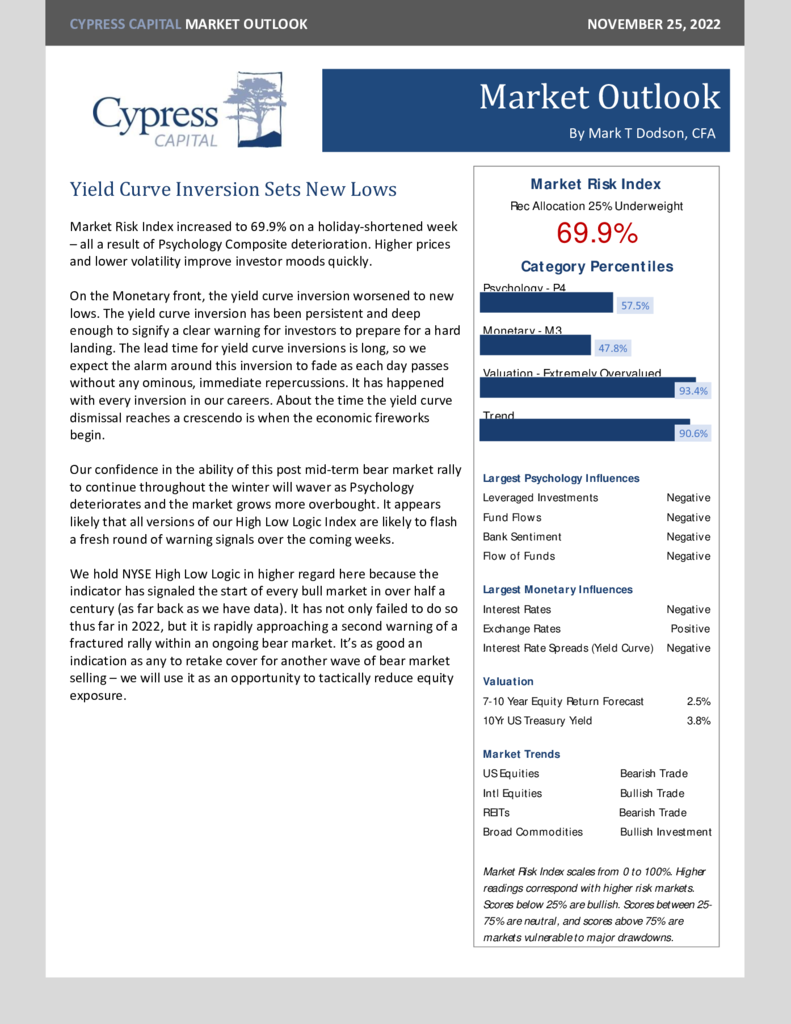

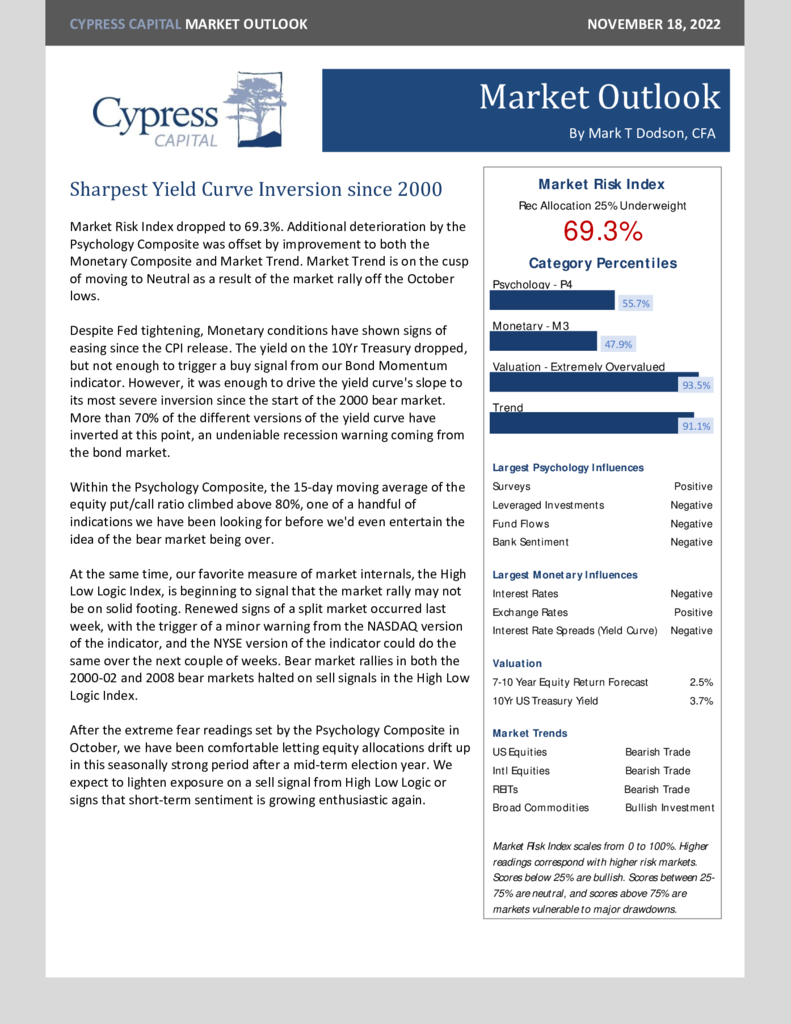

– Long-term Treasuries rallied causing the yield curve inversion to fall to new lows.