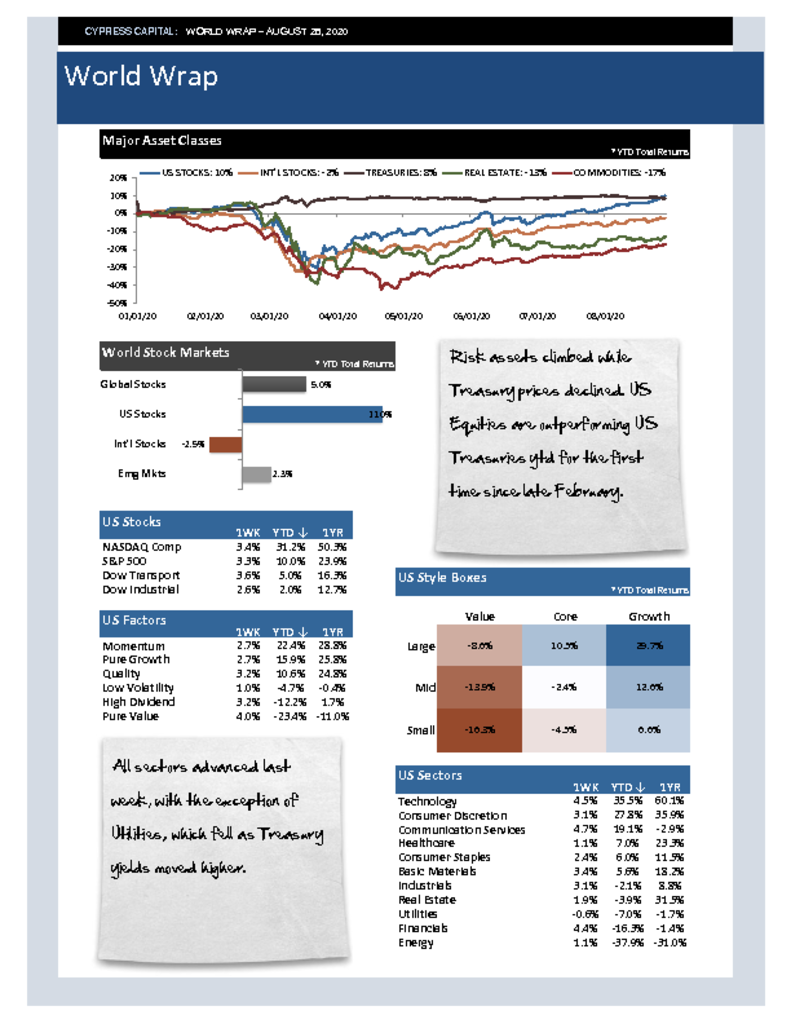

– Risk assets climbed while Treasury prices declined. US Equities are outperforming US Treasuries ytd for the first time since late February.

– All sectors advanced last week, with the exception of Utilities, which fell as Treasury yields moved higher.

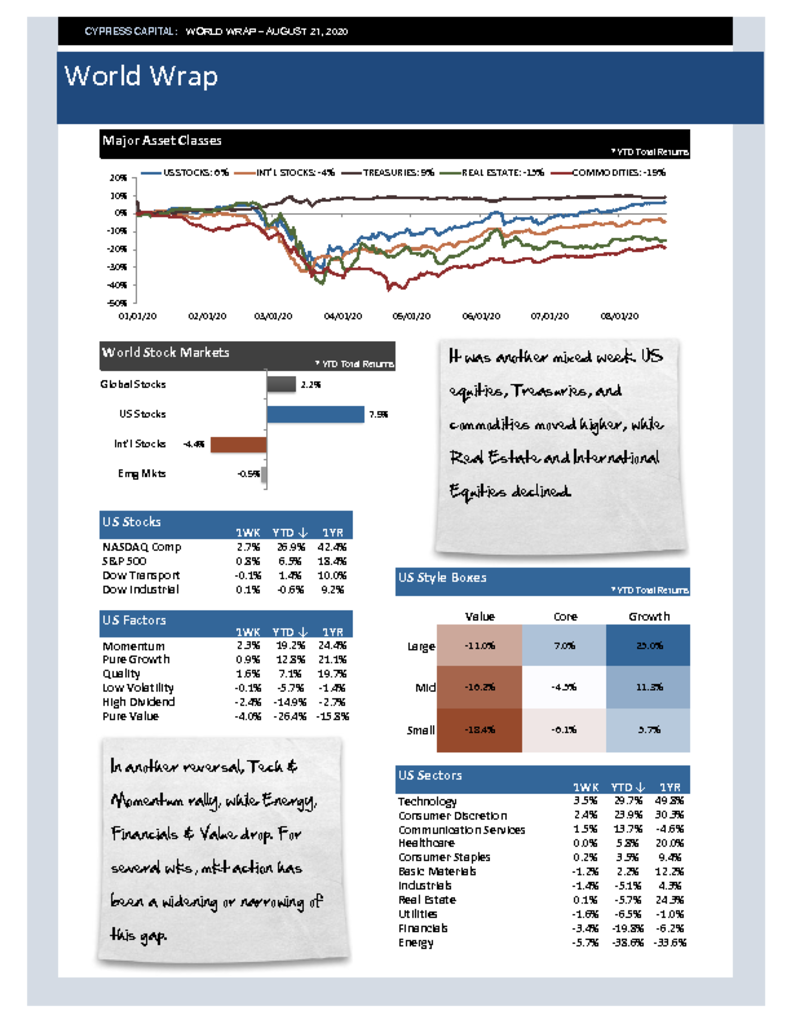

– Prices for long duration Treasuries fell nearly 3% last week, and our bond momentum gauge is likely to close out the month with an official sell signal.

– Lumber prices continued their streak, advancing another 10% and have climbed over 125% year to date as a result of Covid related supply disruptions.