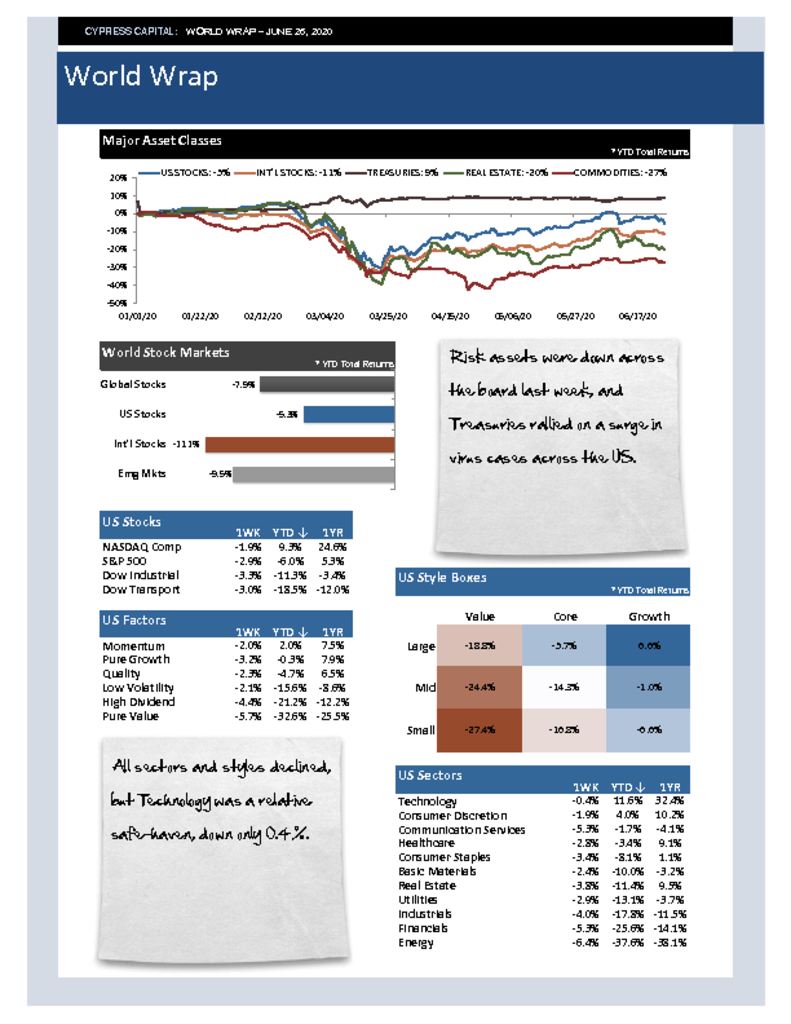

– Risk assets were down across the board last week, and Treasuries rallied on a surge in virus cases across the US.

– All sectors and styles declined, but Technology was a relative safe-haven, down only 0.4%.

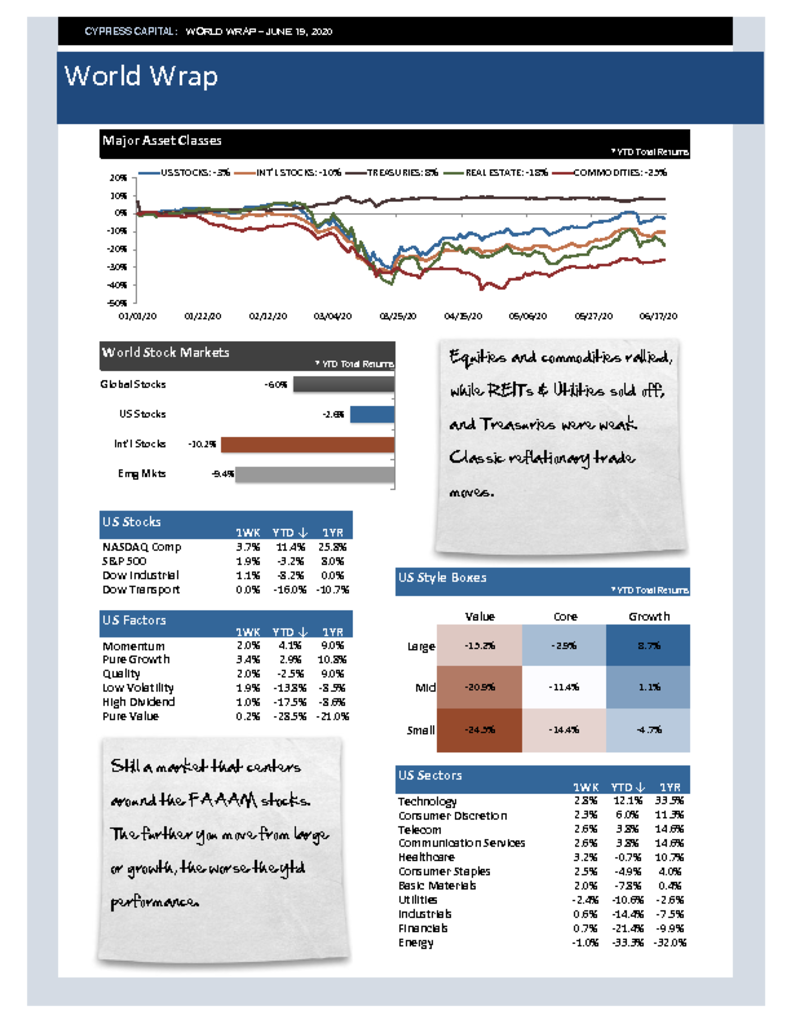

– Asian markets bucked the global trend and closed flat. The region leads all others year to date.

– Lumber and copper managed to continue their advances alongside gold last week and not signaling a return of deflationary pressures.