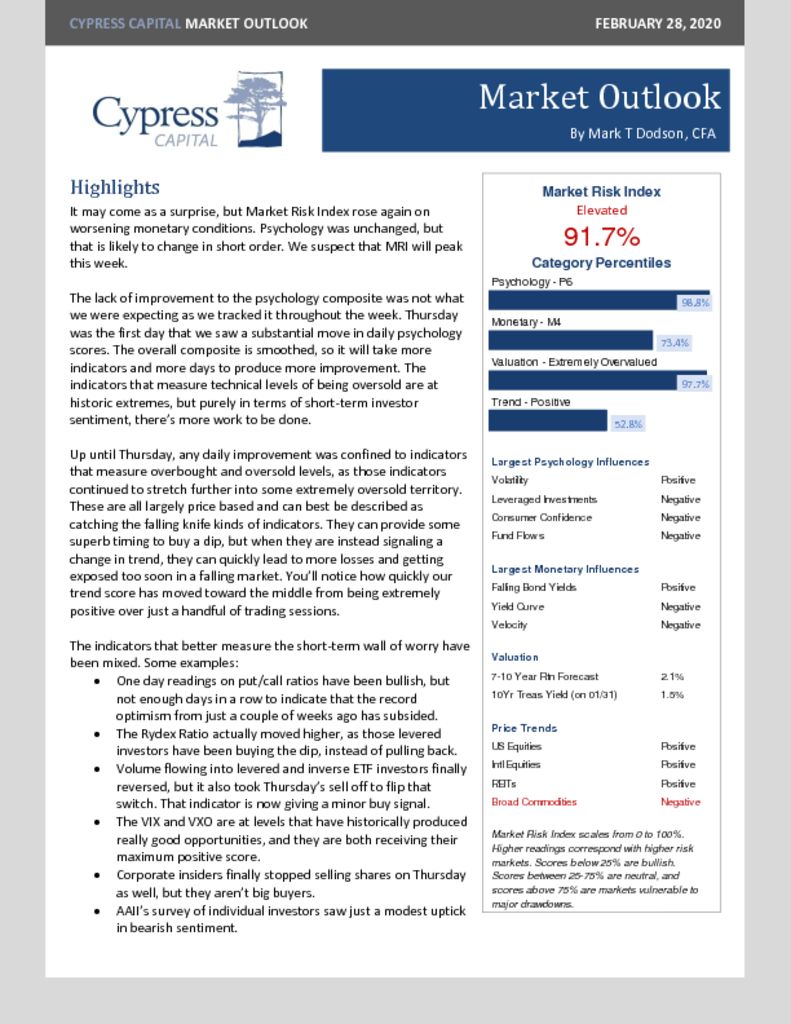

– Market Risk Index increases slightly. Investor psychology was flat, and monetary conditions worsened, but MRI has likely peaked this week.

– The daily point totals of our psychology composite point to a quant-driven sell off more than one driven by investor fear.

– Most extreme readings in McClellan Oscillator and VIX since 2011.

– This week’s price move has been technically historic, but it hasn’t produced much investor anxiety. The desire to make a great call and buy the dip is still there.