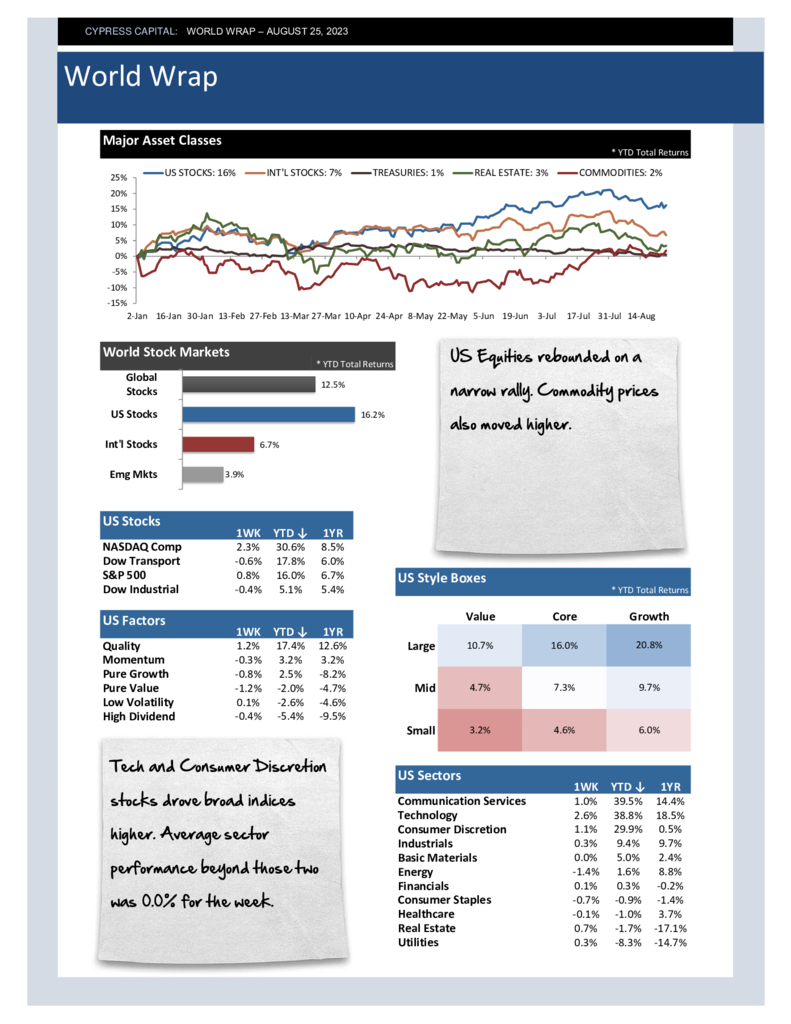

– US Equities rebounded on a narrow rally. Commodity prices also moved higher.

– Tech and Consumer Discretion stocks drove broad indices higher. Average sector performance beyond those two was 0.0% for the week.

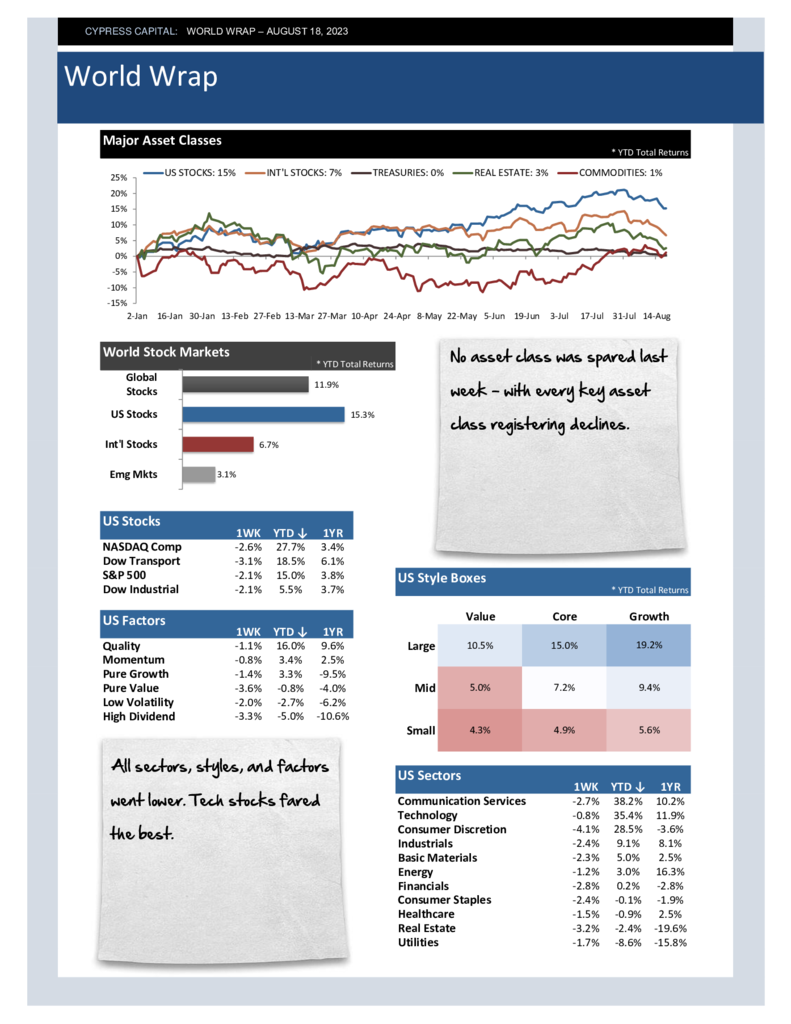

– A rally in Latin American stocks pushed emerging market indices higher. Developed markets declined slightly.

– Precious metals and the US dollar rallied. US Dollar rally stopped just short of making its first higher high of 2023.