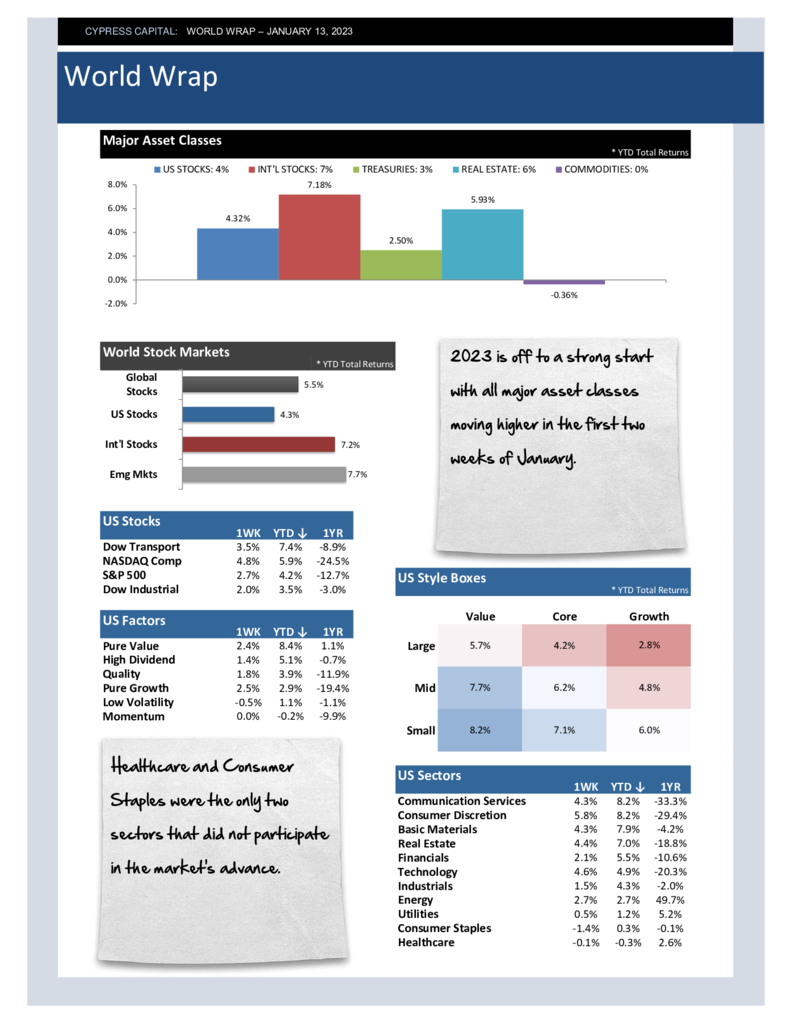

– Global stocks rallied and commodities faltered on falling oil prices.

– It has been a textbook risk-on rally as the “safest” sectors – Healthcare, Utilities, and Staples are the only three sectors with negative ytd returns.

– Emerging markets are up 10% year to date as China continues to outperform. China is up 17% ytd.

– US Dollar has fallen 10% from its 2022 high, entering its first correction since 2021.