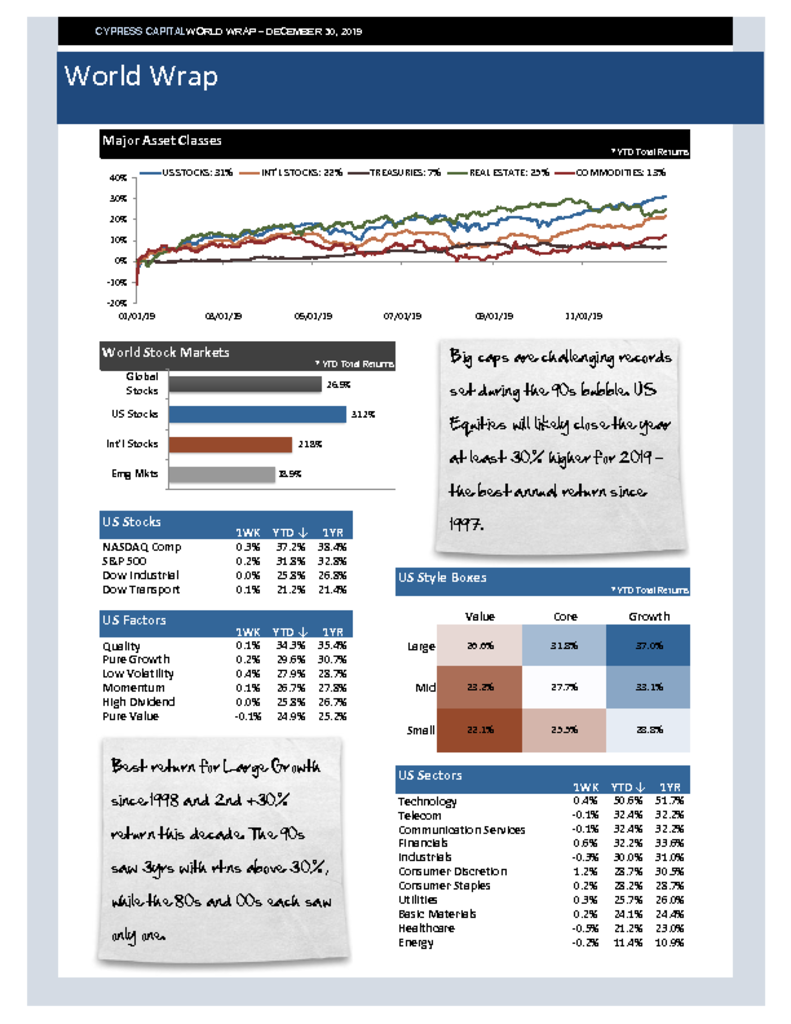

– Big caps are challenging records set during the 90s bubble. US Equities will likely close the year at least 30% higher for 2019 – the best annual return since 1997.

– Best return for Large Growth since 1998 and 2nd +30% return this decade. The 90s saw 3yrs with rtns above 30%, while the 80s and 00s each saw only one.

– The trade deficit in U.S. goods declined to the lowest short fall in three years as exports increased and imports declined.

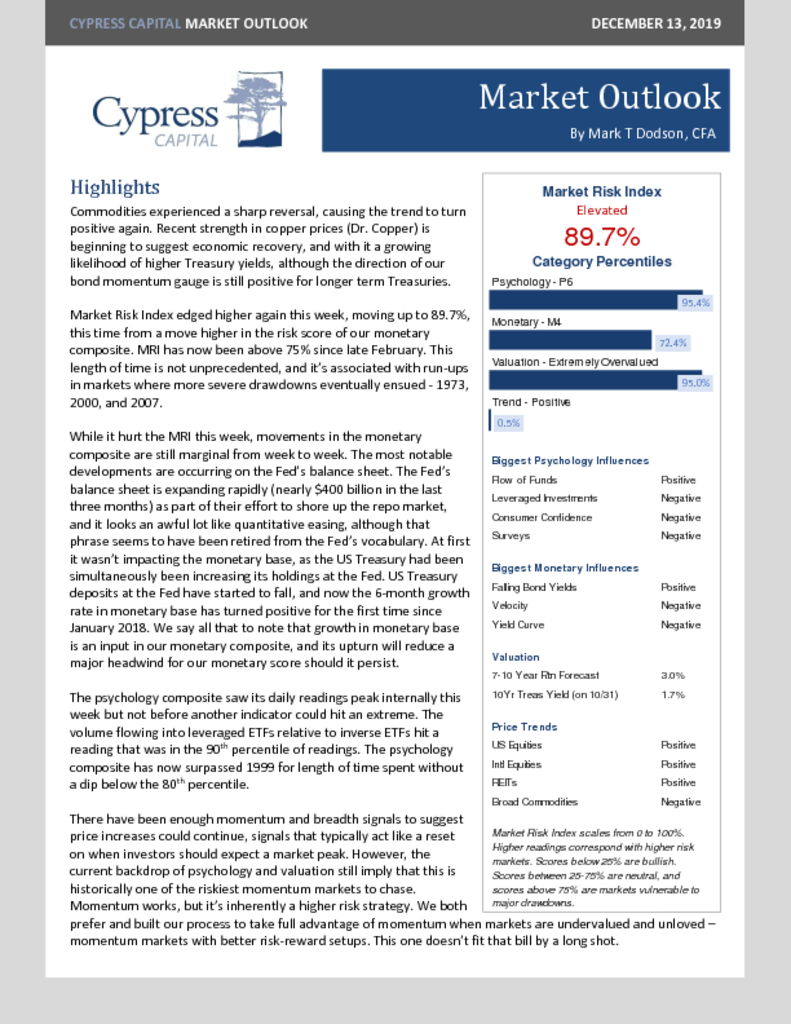

– Fed has added nearly $500 billion in cash to repo markets over the last 3 months, reversing around half of the balance sheet drawdown that took over 3 years.