Archive

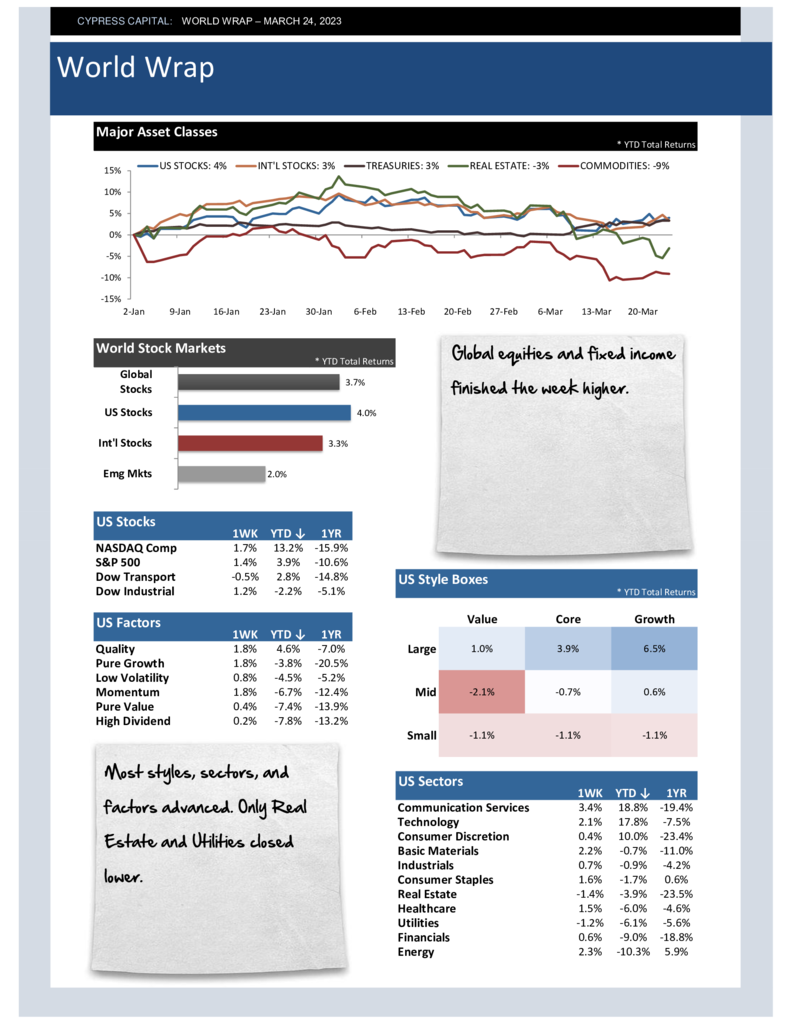

World Wrap

– Global equities and fixed income finished the week higher.

– Most styles, sectors, and factors advanced. Only Real Estate and Utilities closed lower.

– International equities outperformed, with 38 of 44 countries closing up for the week.

– After a sharp rebound the prior week, Lumber prices slid 9.1%.

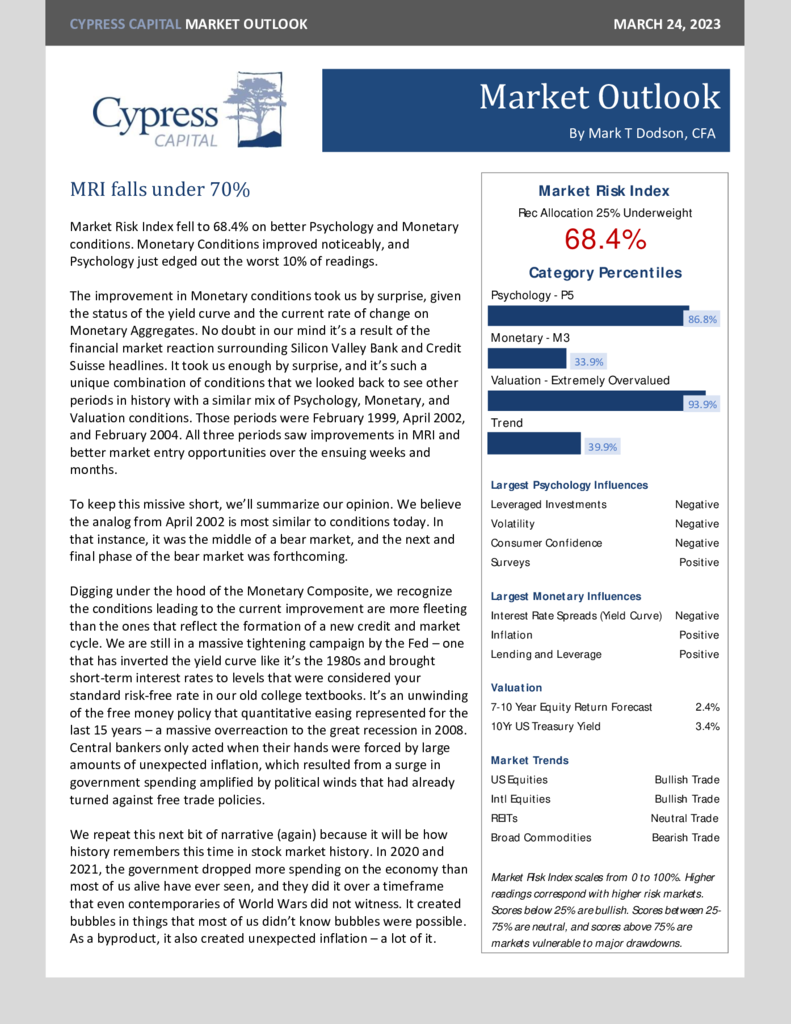

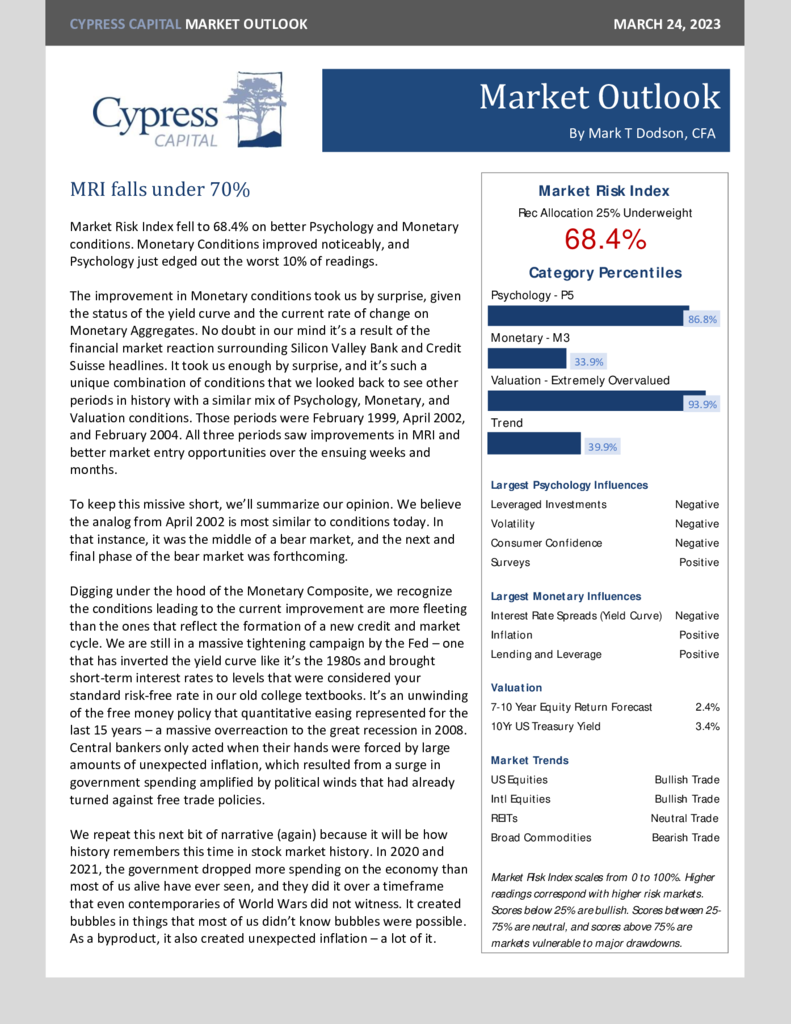

Market Outlook – MRI falls under 70%

World Wrap

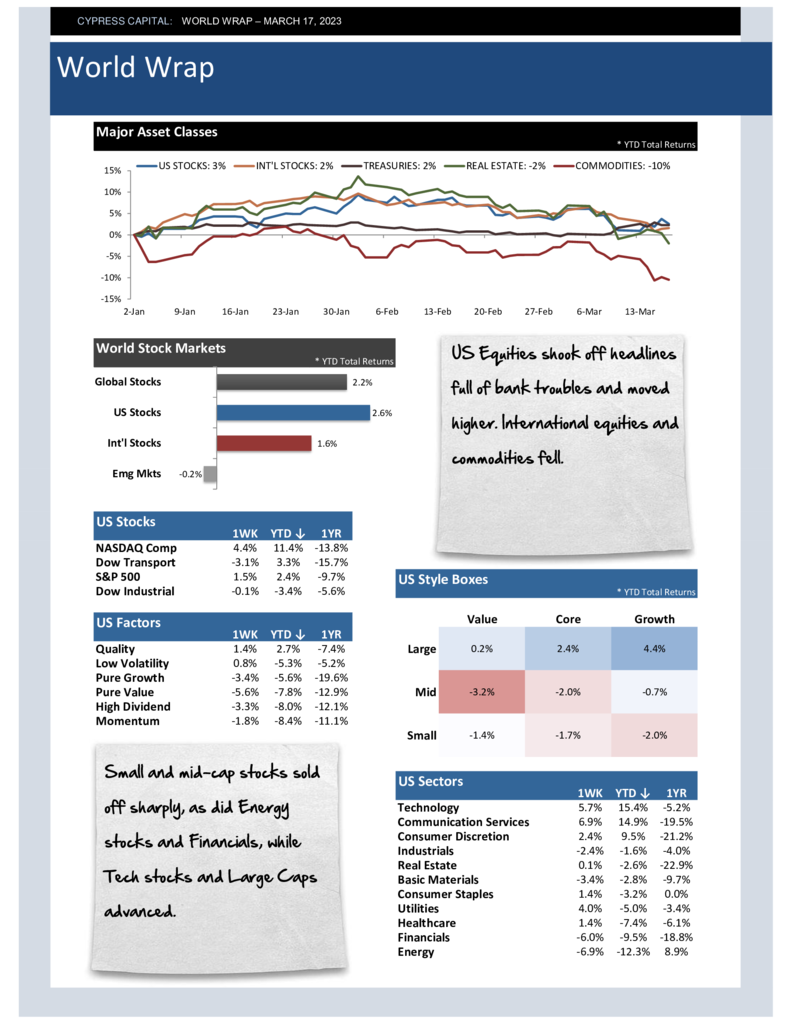

– US Equities shook off headlines full of bank troubles and moved higher. International equities and commodities fell.

– Small and mid-cap stocks sold off sharply, as did Energy stocks and Financials, while Tech stocks and Large Caps advanced.

– Developed markets declined on weakness in European stocks. Emerging markets fared better as China was the second best performing country in the world.

– Treasuries and Gold were safe havens during a volatile week. Bitcoin rebounded sharply, climbing more than 30% for the week.

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 99.7%

- Monetary 87.2%

- Valuation 99.3%

- Market Trend 9.8%