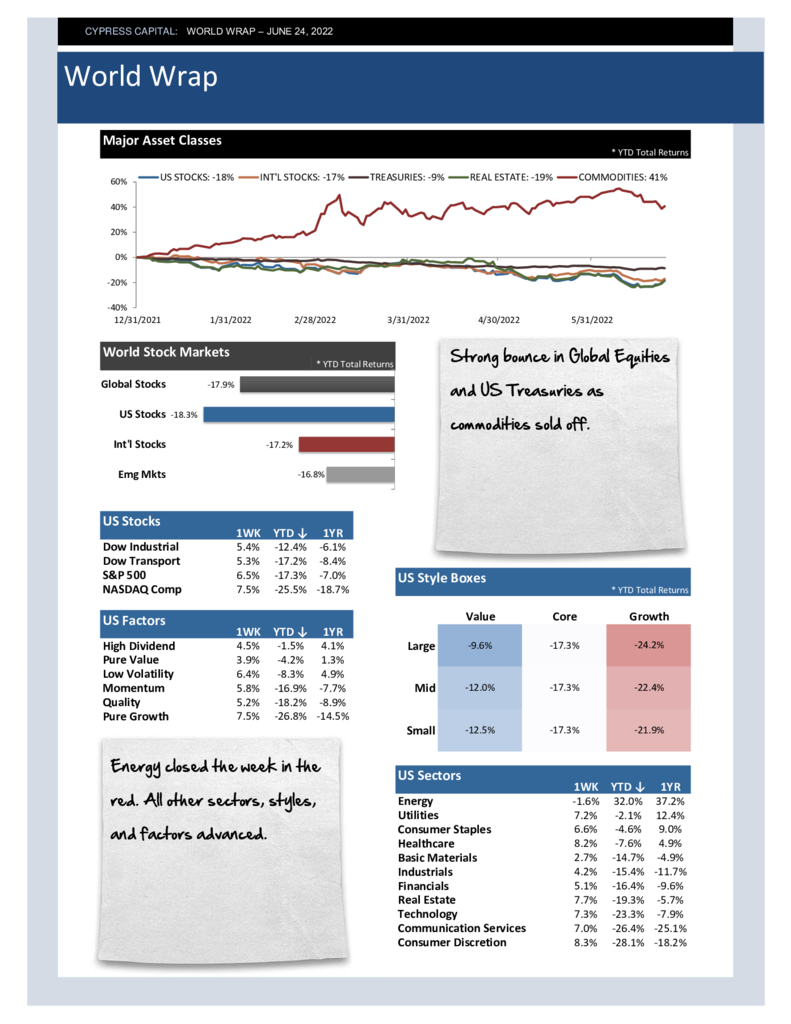

– Strong bounce in Global Equities and US Treasuries as commodities sold off.

– Energy closed the week in the red. All other sectors, styles, and factors advanced.

– Despite strong performance from China, the emerging markets rally was weak, lagging developed markets.

– Broad commodity indices were weak, but oil prices only declined by 0.3%.