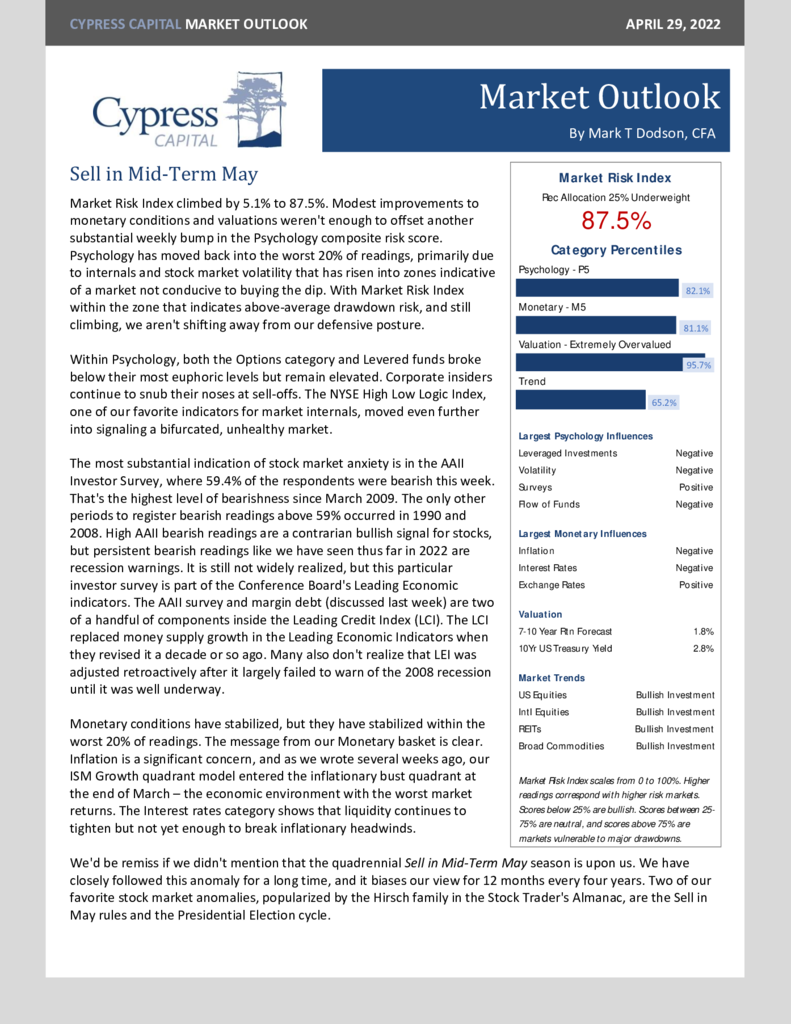

– Market Risk Index climbs on Psychology Composite move back into worst 20% of readings

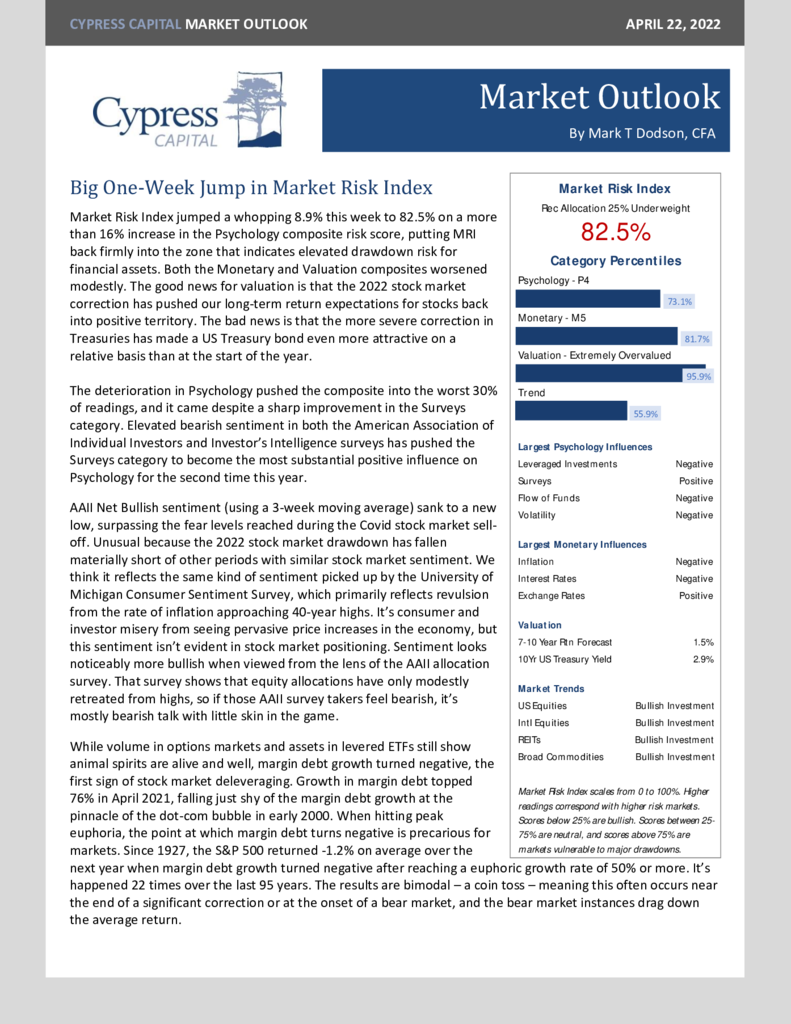

– Sell in Mid-Term May is here.

– Market Risk Index climbs on Psychology Composite move back into worst 20% of readings

– Sell in Mid-Term May is here.

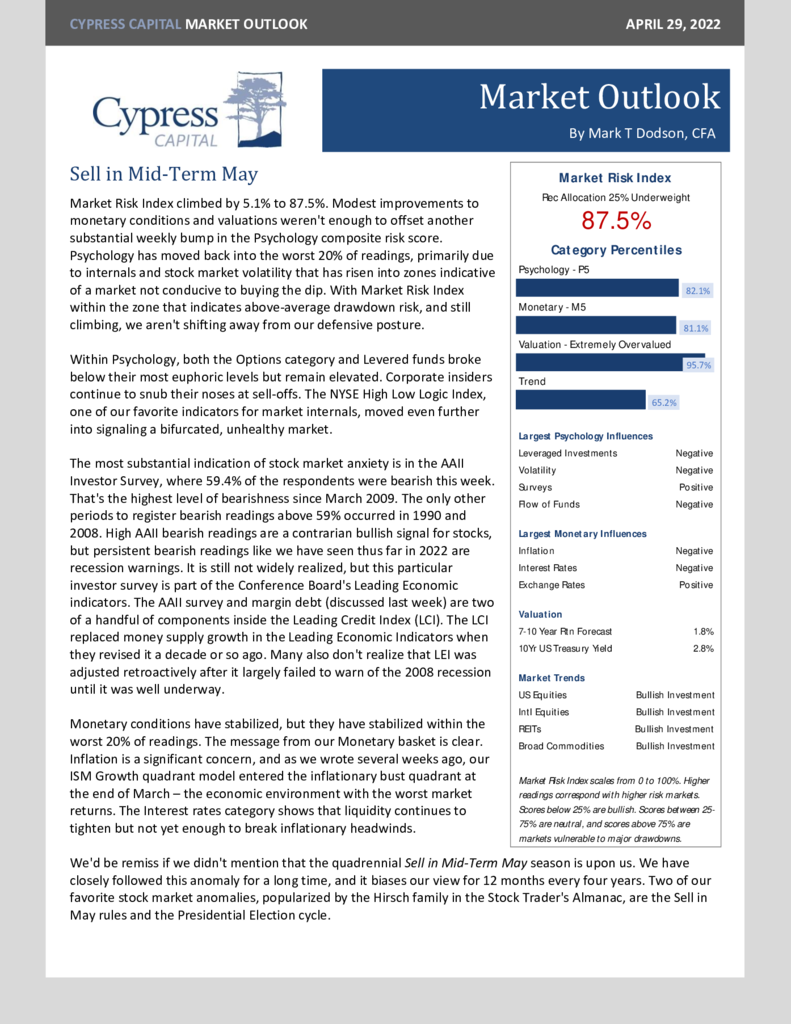

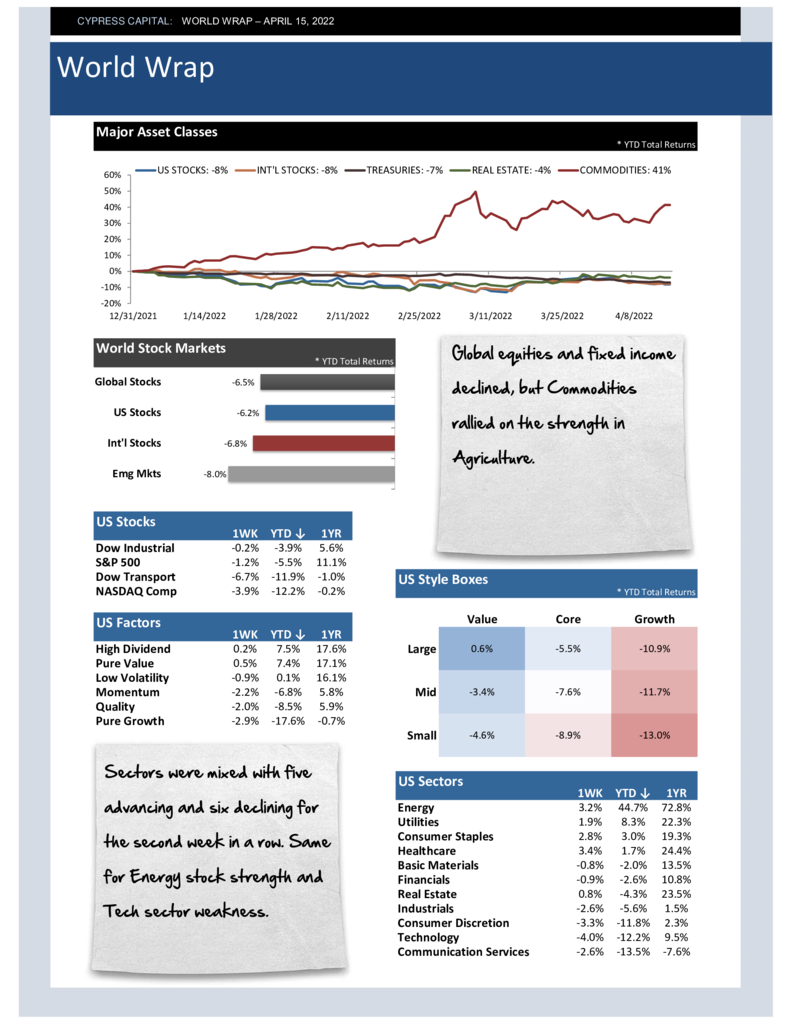

– Risk assets declined. Real Estate was an exception, climbing more than 1% for the week.

– For the first time this month, Energy stocks underperformed Tech stocks on the downside.

– Emerging markets fell by 3.3%, driven by a 6.8% weekly decline in China. The bear market in China began in February 2021.

– Oil prices decline 4%, marking the second lower high in crude since prices topped above $120/bbl. in early March.

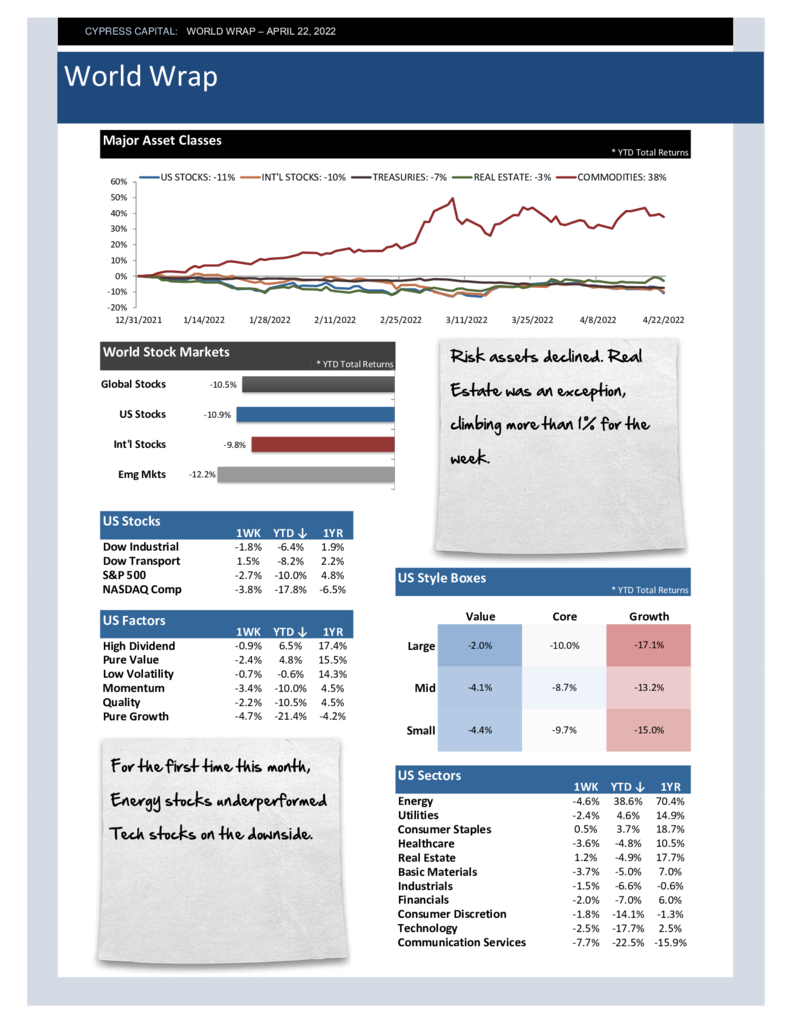

– Psychology composite risk score increased more than 16%, despite substantial improvements in Investment Surveys.

– The 22nd Margin Debt deleveraging in 95 years has begun.

– NYSE High Low Logic Index moves even higher.

– Global equities and fixed income declined, but Commodities rallied on the strength in Agriculture.

– Sectors were mixed with five advancing and six declining for the second week in a row. Same for Energy stock strength and Tech sector weakness.

– Fixed income continued to struggle across the board. The dollar made a new 52week high and rallied to the highest level since April 2020.

– Agriculture rallied 5.2% to drive broad commodity indices higher despite a decline in oil prices for the week.

%

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)