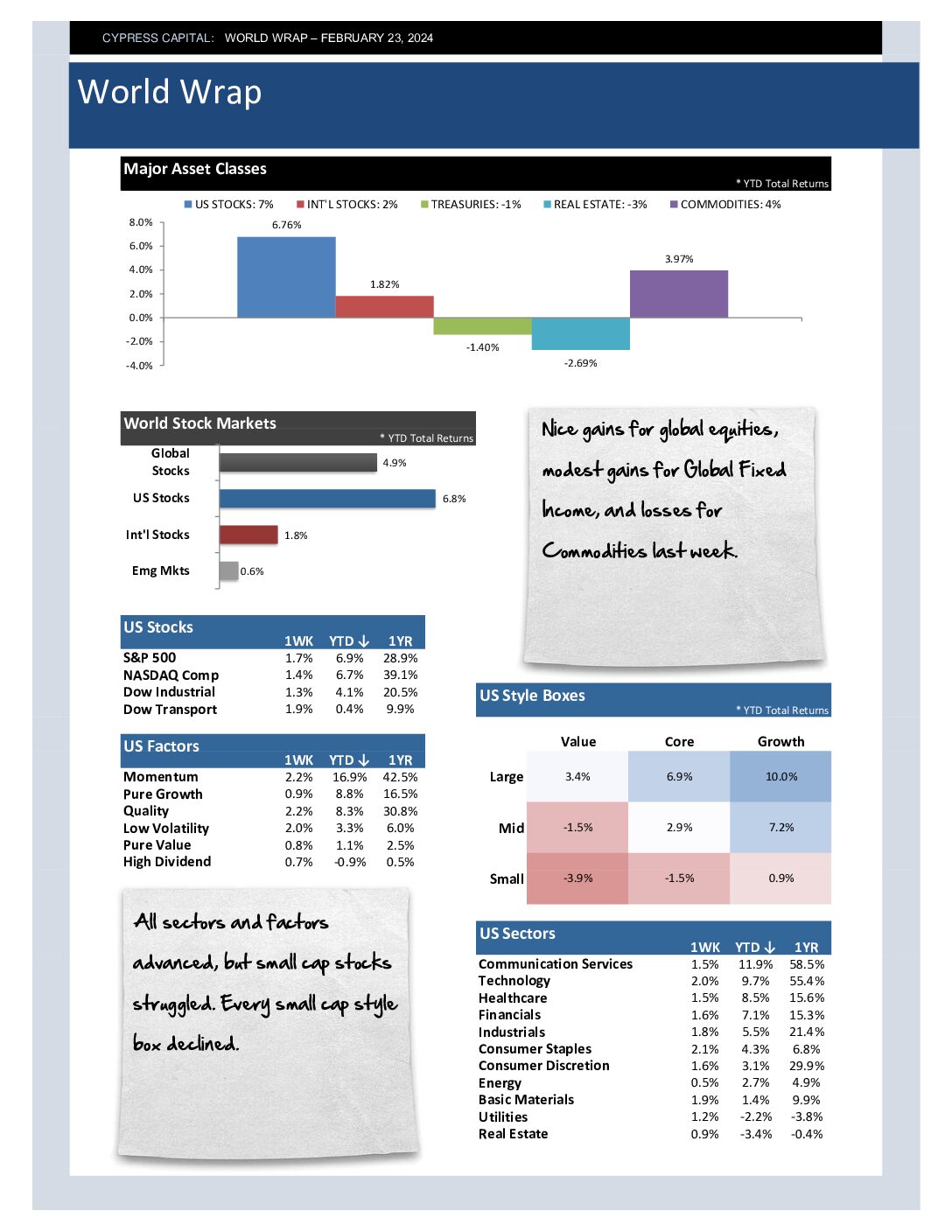

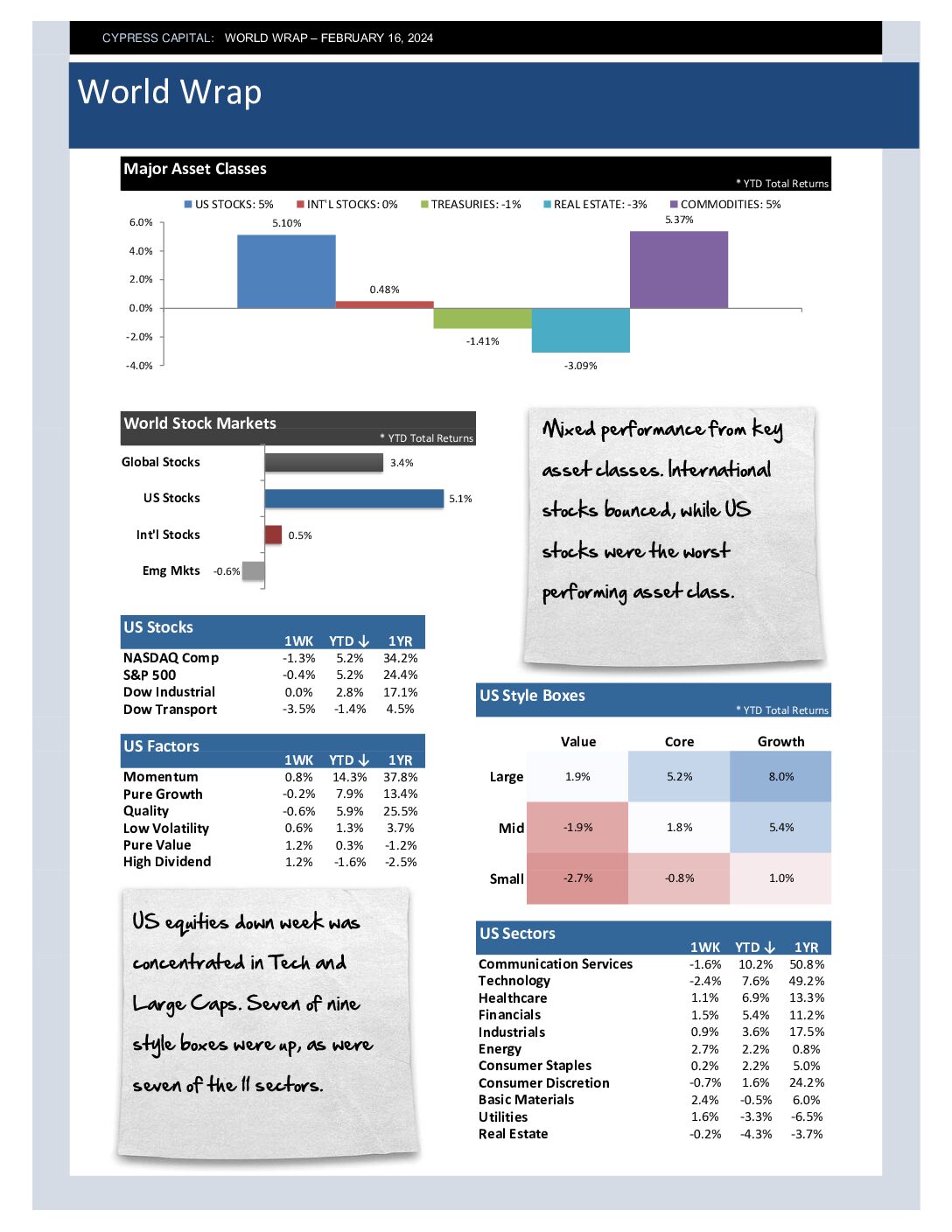

– Nice gains for global equities, modest gains for Global Fixed Income, and losses for Commodities last week.

– All sectors and factors advanced, but small cap stocks struggled. Every small cap style box declined.

– 34 of 45 countries that we follow advanced. China’s equity market has had strong performance two weeks in a row.

– REITs are struggling across the board. They lagged this week despite a rally in bonds. They are the worst performing key asset class year-to-date.