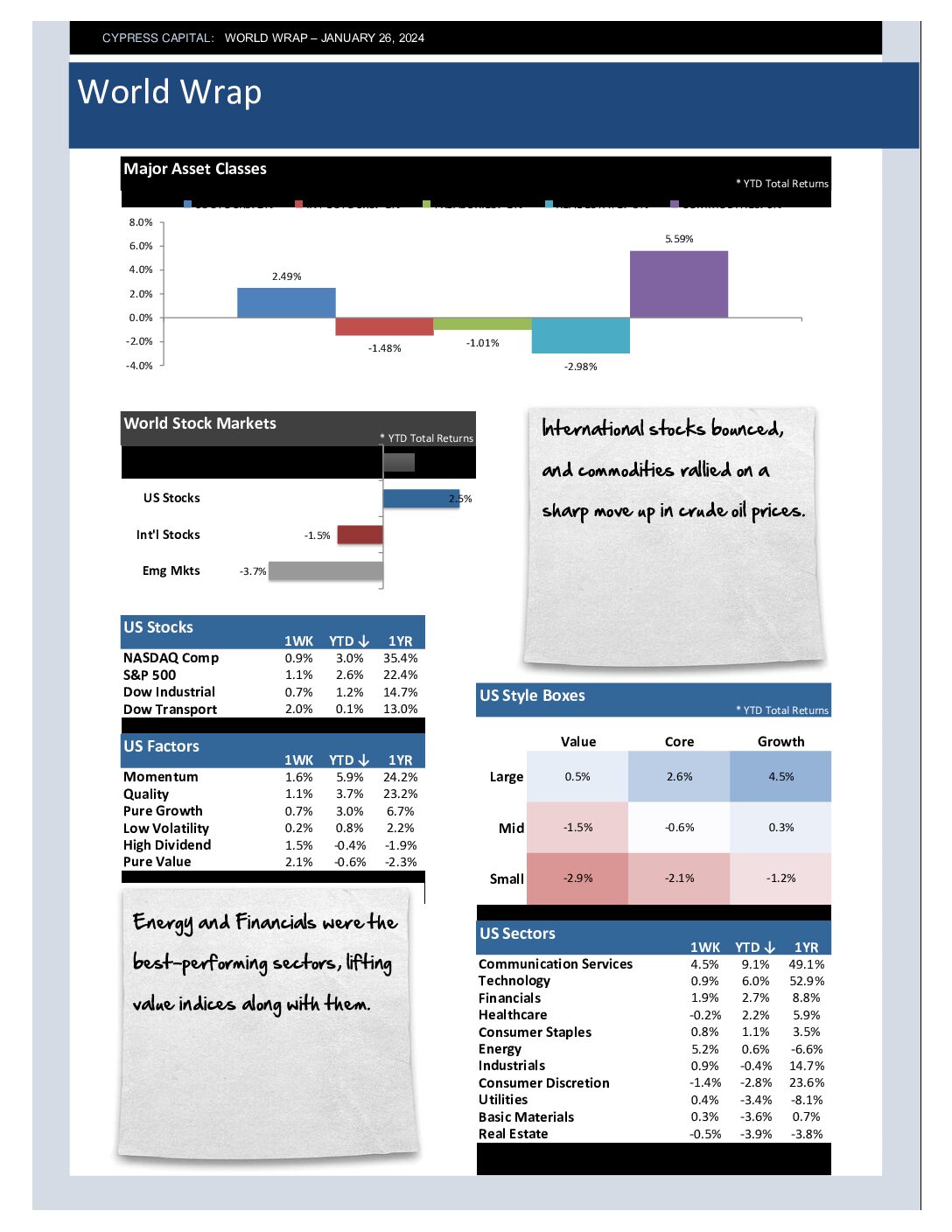

– International stocks bounced, and commodities rallied on a sharp move up in crude oil prices.

– Energy and Financials were the best-performing sectors, lifting value indices along with them.

– France, Germany, and the UK rallied strongly, helping developed markets outperform.

– Commodities had a good week – spot prices in crude oil popped by more than 5% over the week.