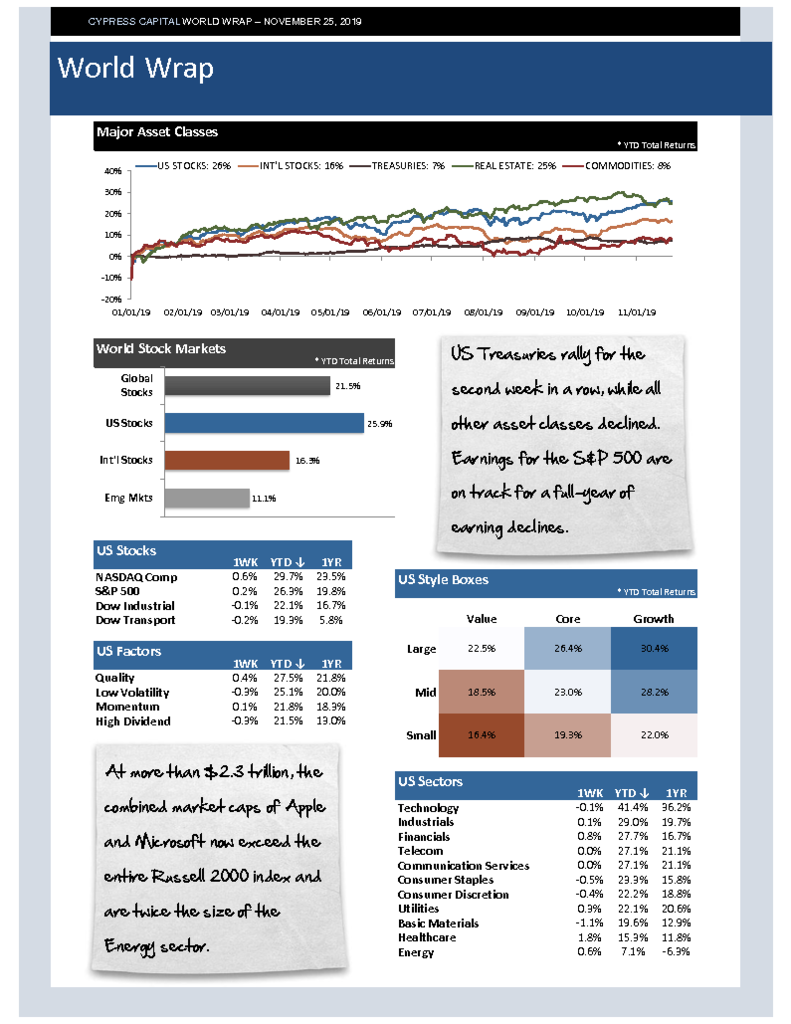

– US Treasuries rally for the second week in a row, while all other asset classes declined. Earnings for the S&P 500 are on track for a full-year of earning declines.

– At more than $2.3 trillion, the combined market caps of Apple and Microsoft now exceed the entire Russell 2000 index and are twice the size of the Energy sector.

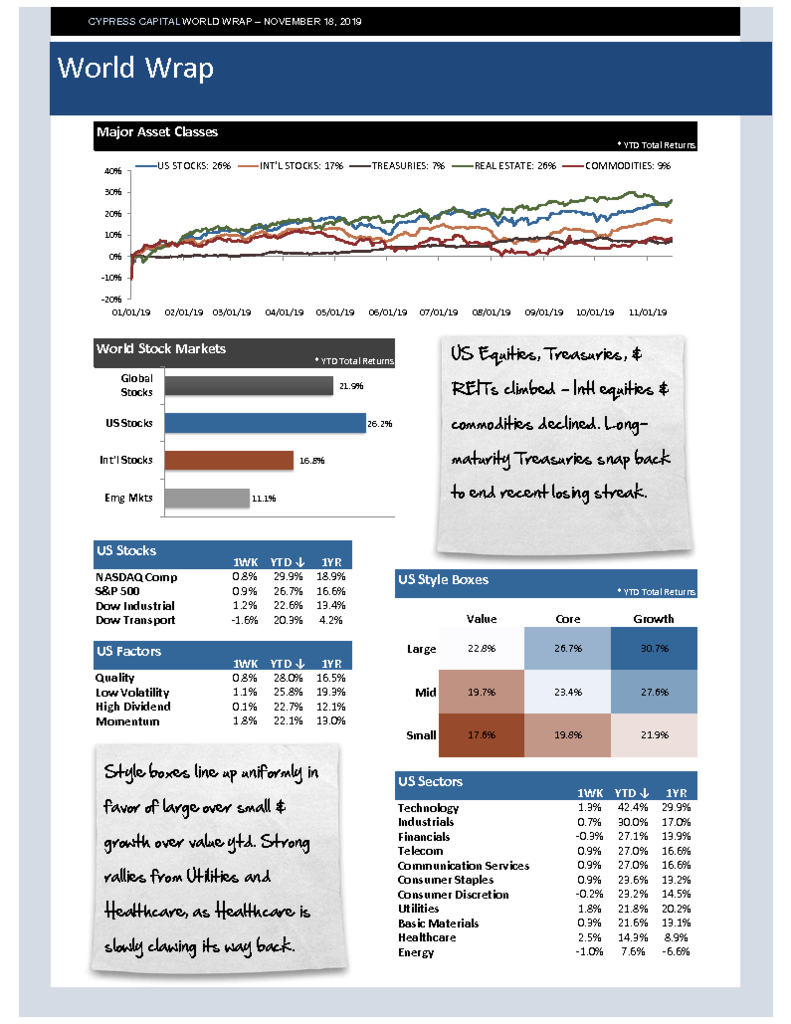

– Sweeping election wins by pro-democracy candidates in Hong Kong over the weekend increases pressure on Beijing after months of unrest.

– WSJ reports that U.S. cos are pulling back on investment. Capital spending by S&P 500 cos grew less than 1% in Q3 and would have fallen without Apple & Amazon.