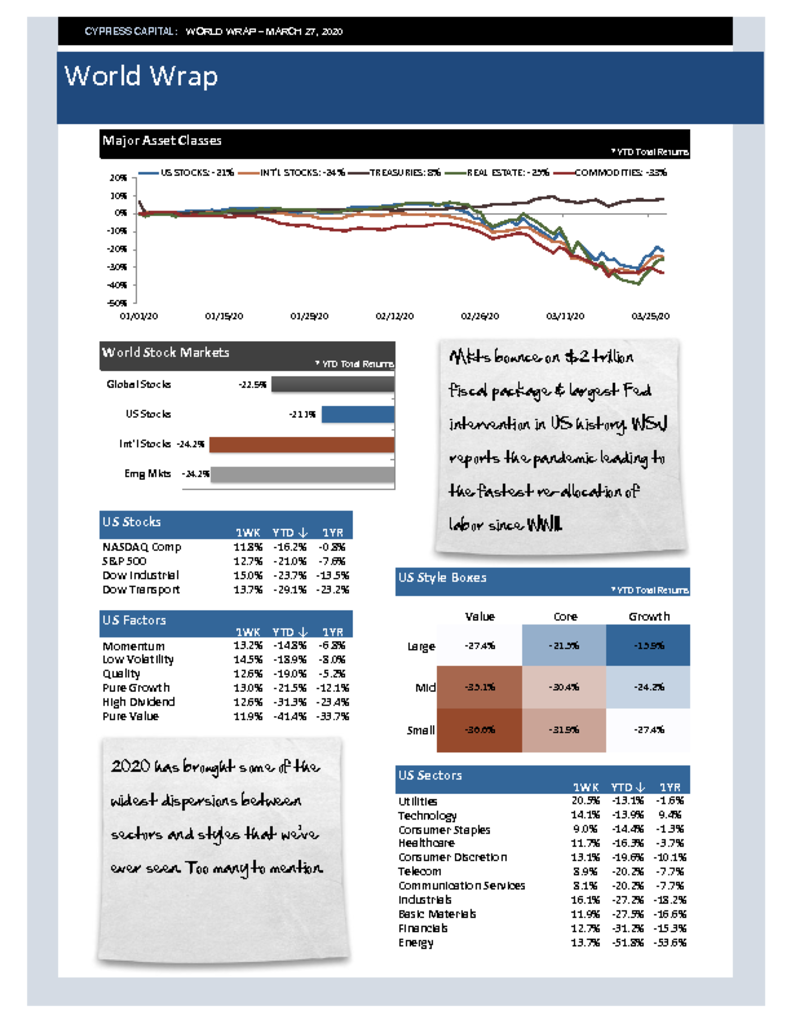

– Mkts bounce on $2 trillion fiscal package & largest Fed intervention in US history. WSJ reports the pandemic leading to the fastest re-allocation of labor since WWII.

– 2020 has brought some of the widest dispersions between sectors and styles that we’ve ever seen. Too many to mention.

– Too much oil, not enough gold. Oil prices, down more than 65% ytd, have sunk to 17 yr lows. Meanwhile, WSJ reports a shortage of physical gold bars and coins.

– Fed intervention in corporate credit markets led to a rally in both investment grade and high yield corporate bonds.