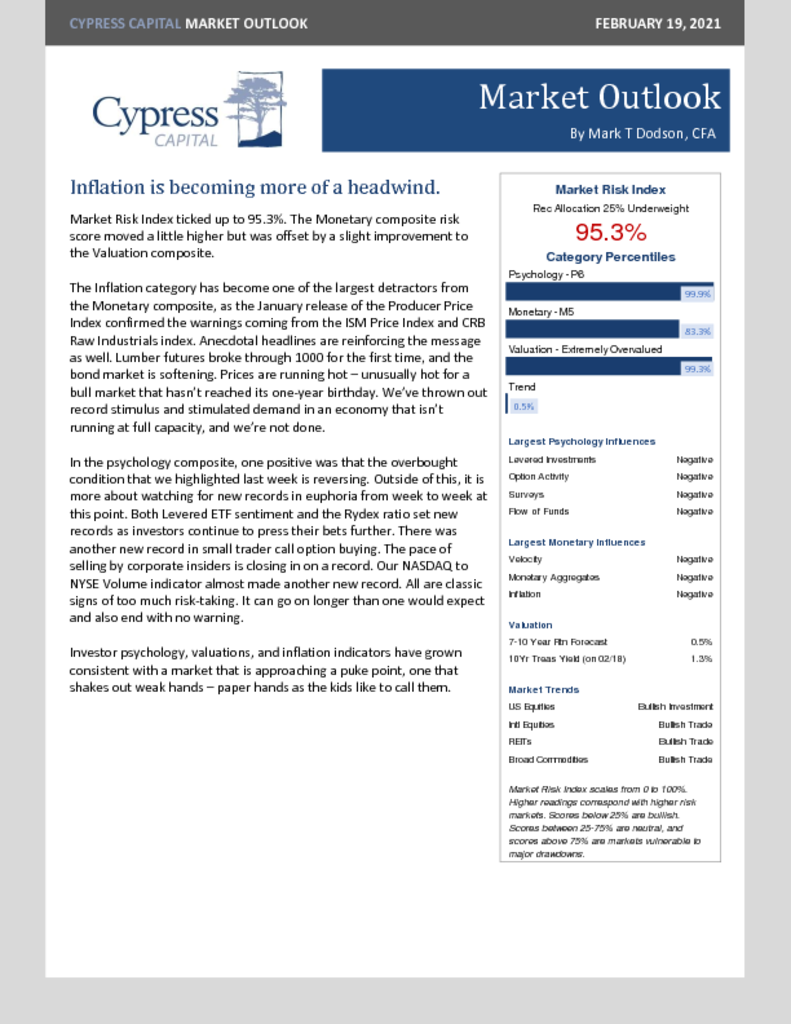

– Psychology didn’t budge this week, other than a spike in volatility.

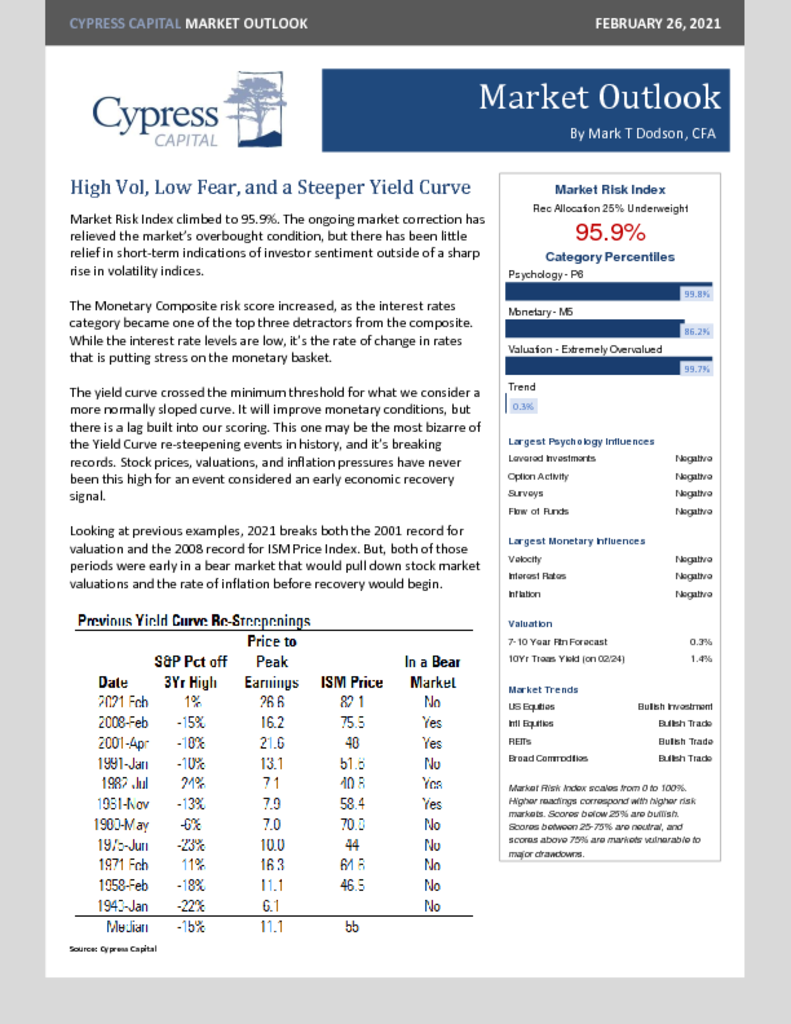

– The yield curve slope has normalized, and it is breaking all the records…and norms.

– Psychology didn’t budge this week, other than a spike in volatility.

– The yield curve slope has normalized, and it is breaking all the records…and norms.

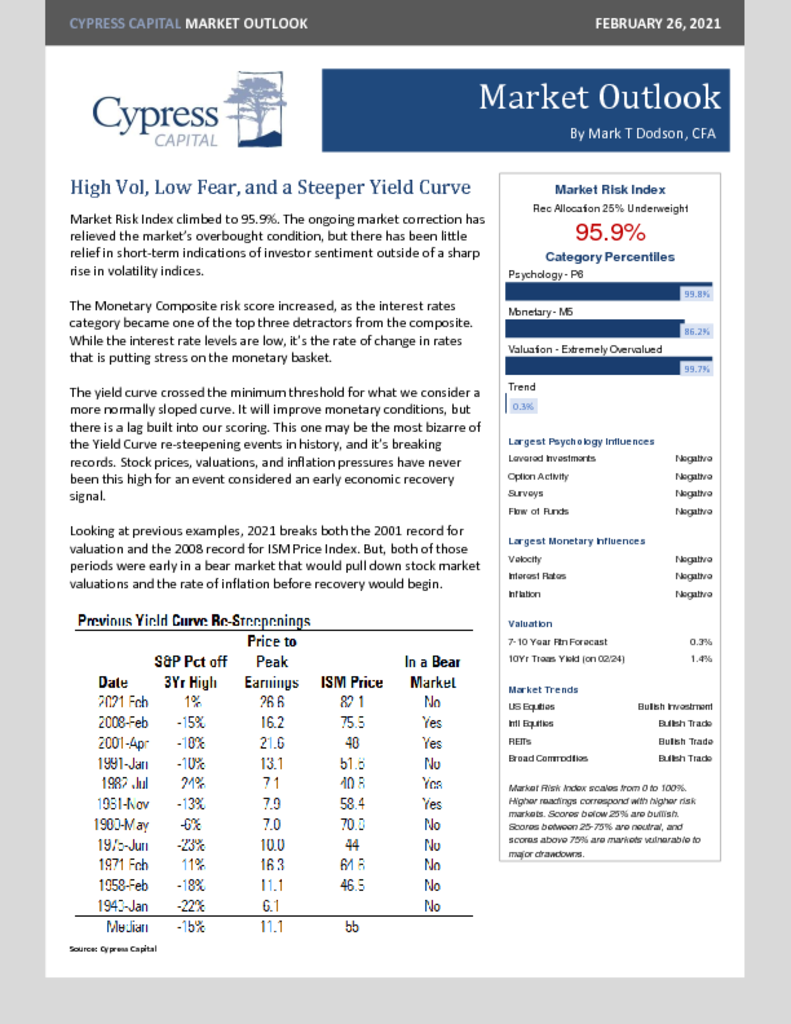

– Commodities and international equities were the only bright spots last week. Commodities continue to signal building inflationary pressures.

– Value beat out Growth. It was one of the first weeks this year where the style factor was more important than market capitalization.

– The median country return is lagging. Most international performance has been driven by China and Asian equities ytd.

– Lumber futures broke above 1,000 for the first time. Prices on 20Yr Treasuries had a rough week, declining 2.7%.

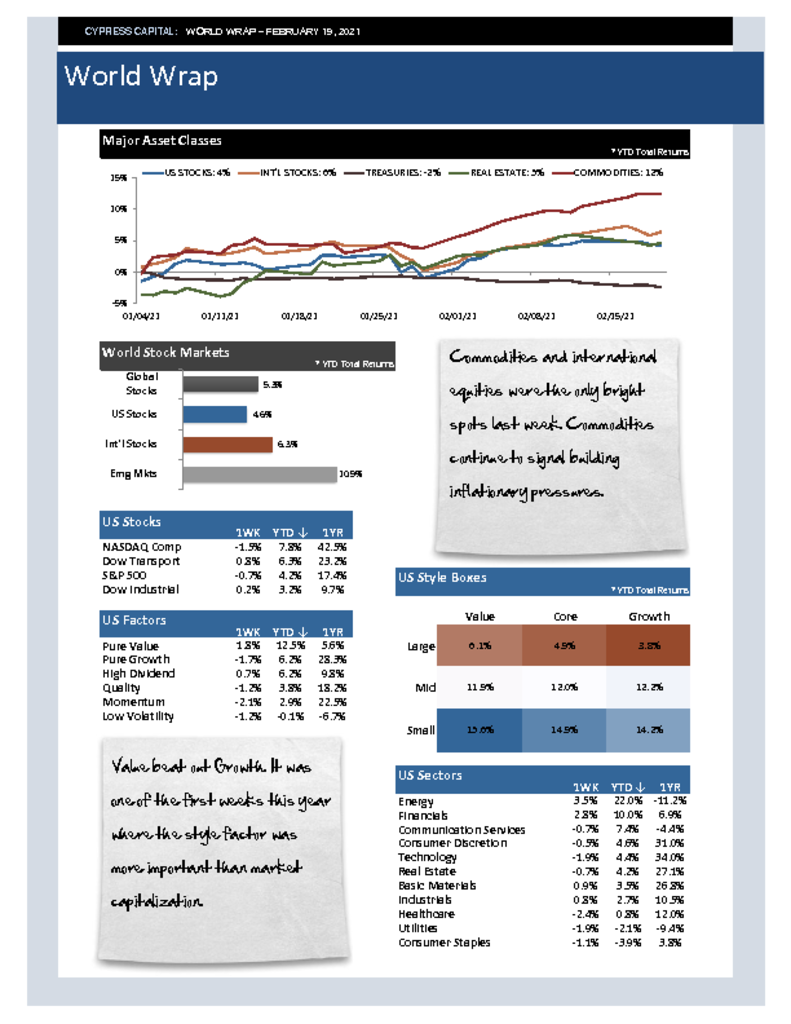

– The inflation category has become one of the largest detractors from our Monetary composite.

– More euphoria records broken within investor psychology.

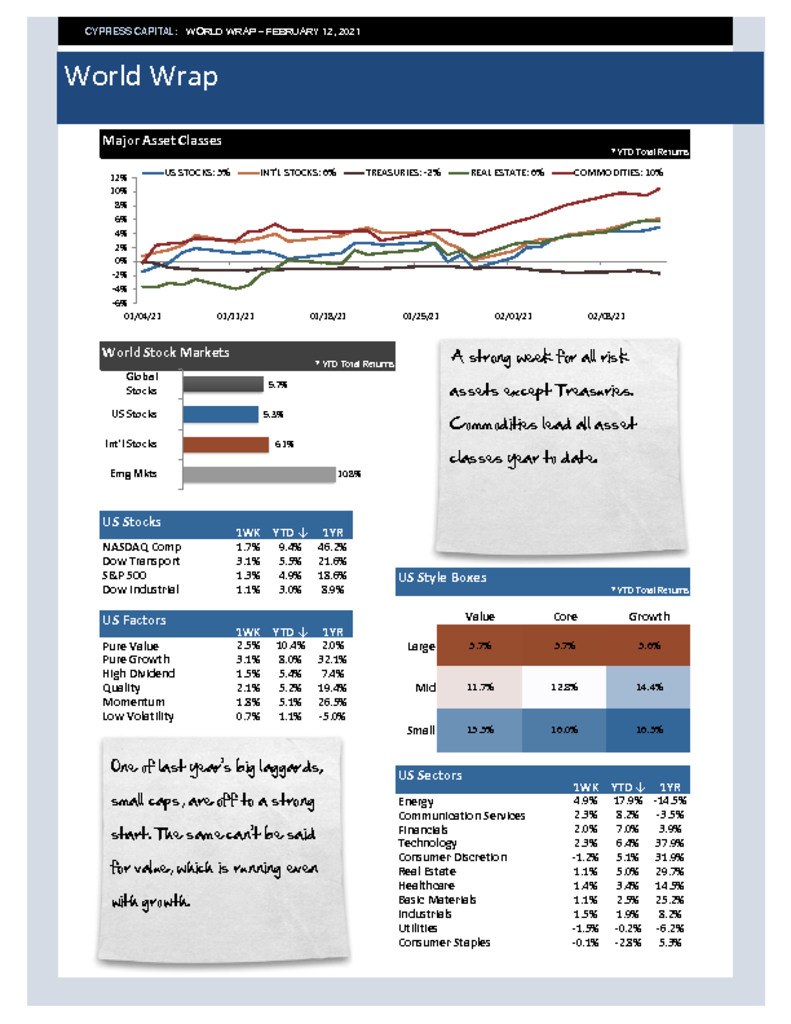

– A strong week for all risk assets except Treasuries. Commodities lead all asset classes year to date.

– One of last year’s big laggards, small caps, are off to a strong start. The same can’t be said for value, which is running even with growth.

– The out-performance gap between Emerging and Developed markets widened.

– A down dollar sent commodity prices higher. The coming week may be key to see if the dollar can put in another higher low.

%

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)