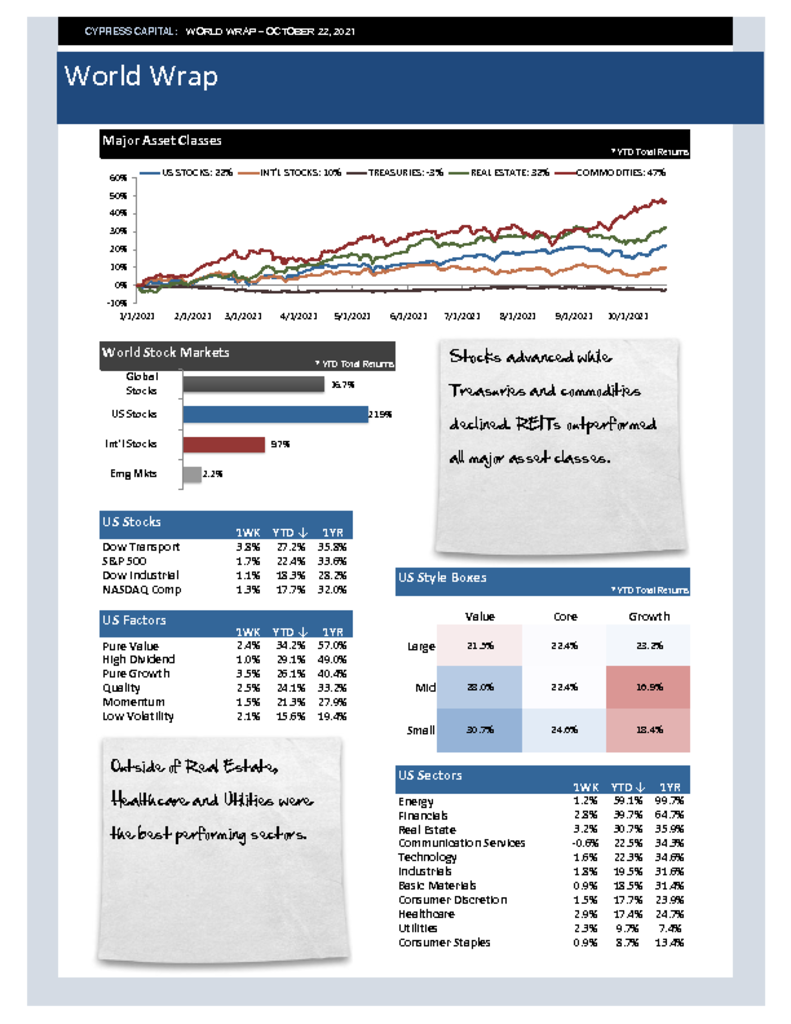

– An 8.7% jump in Tesla’s stocks price was responsible for almost 15% of the performance of US equity markets this week.

– Growth stocks had such a strong week relative to value, that Large Growth pulled within 2% of 2021’s performance leader Small Cap Value.

– A 4.3% decline in Chinese equities took emerging markets down with it. Emerging market equities are flat on the year.

– US Treasuries rebounded from recent losses. Prices on 20Yr Treasuries climbed more than 3%.