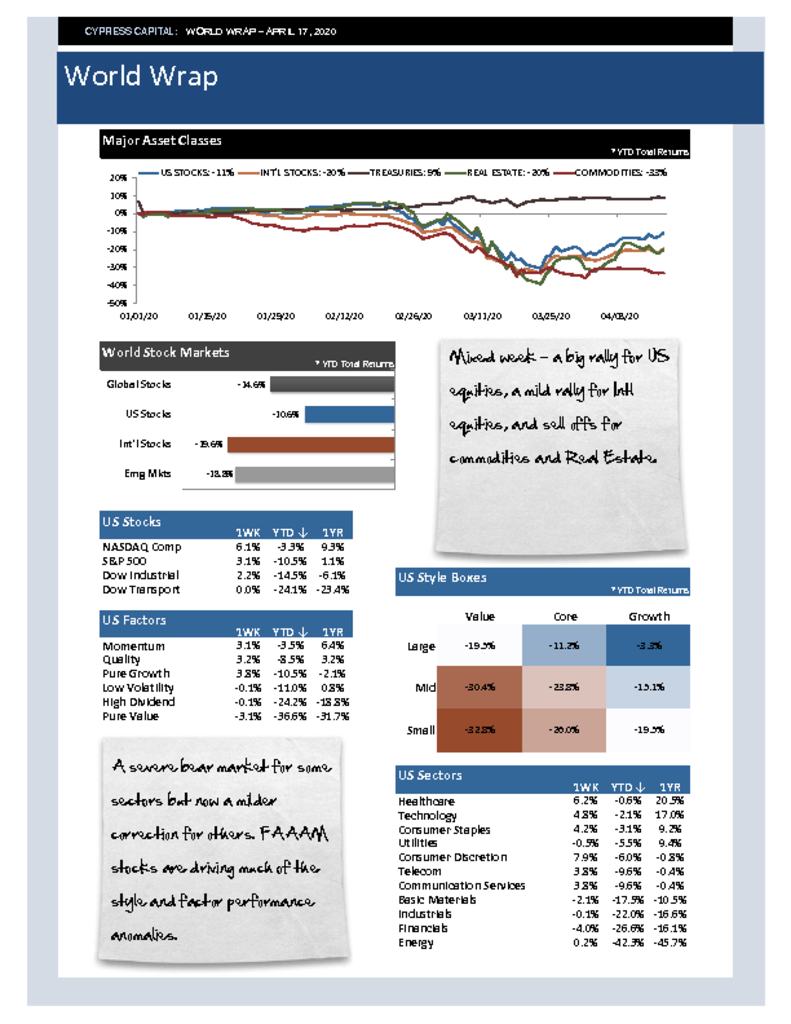

– Risk assets closed down but rallied late in the week as optimism builds around the idea of re-opening economies.

– The FAAM stocks are having a distortive effect on everything from styles, factors, and even how well US equities appear to be doing broadly.

– Bank of Japan announces more interventions. It will triple its allowed holdings of corporate bonds and allow unlimited purchases of government bonds.

– Historic week for oil markets as futures price for May delivery went negative. Storage is full. Oil demand has dropped to what it looked like in the 1960s.