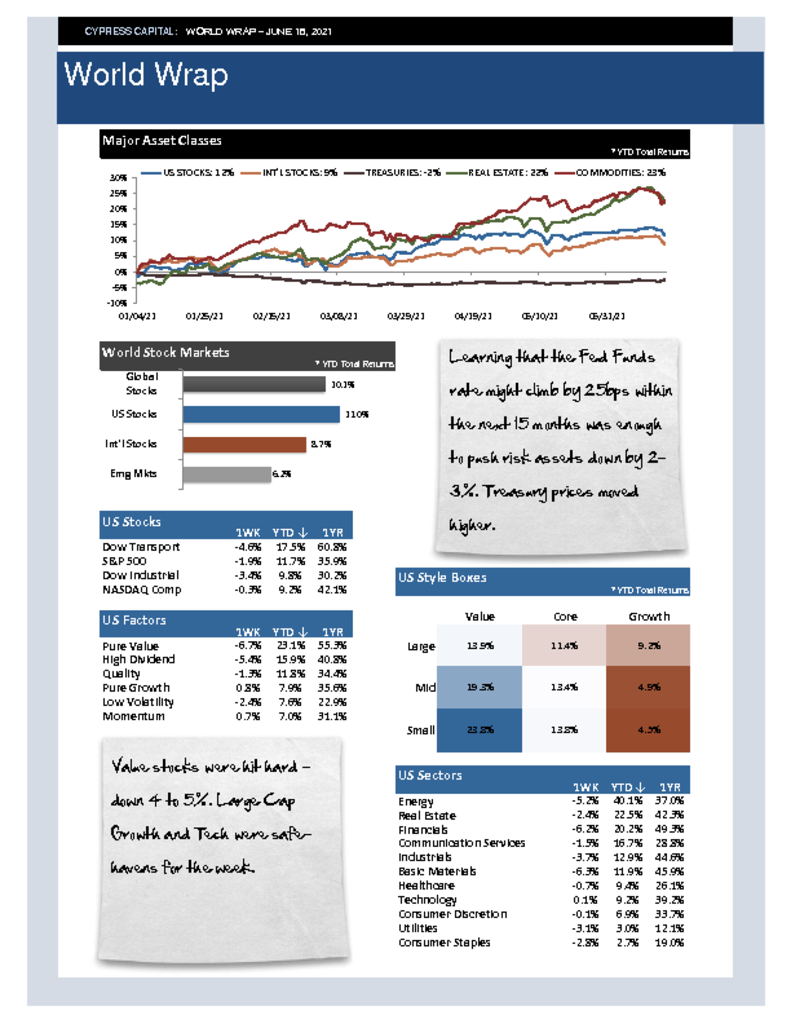

– Risk assets shook off the Fed chatter from the prior week and recovered losses while Treasury yields climbed higher in one of their worst weeks of 2021.

– Everybody was a winner – all sectors and styles moved higher. The S&P 500 made a new all-time high.

– Emerging Asia countries were the only week spot among international equities.

– Bitcoin and Lumber both declined more than 10%. Lumber prices have fallen more than 55% in less than two months.