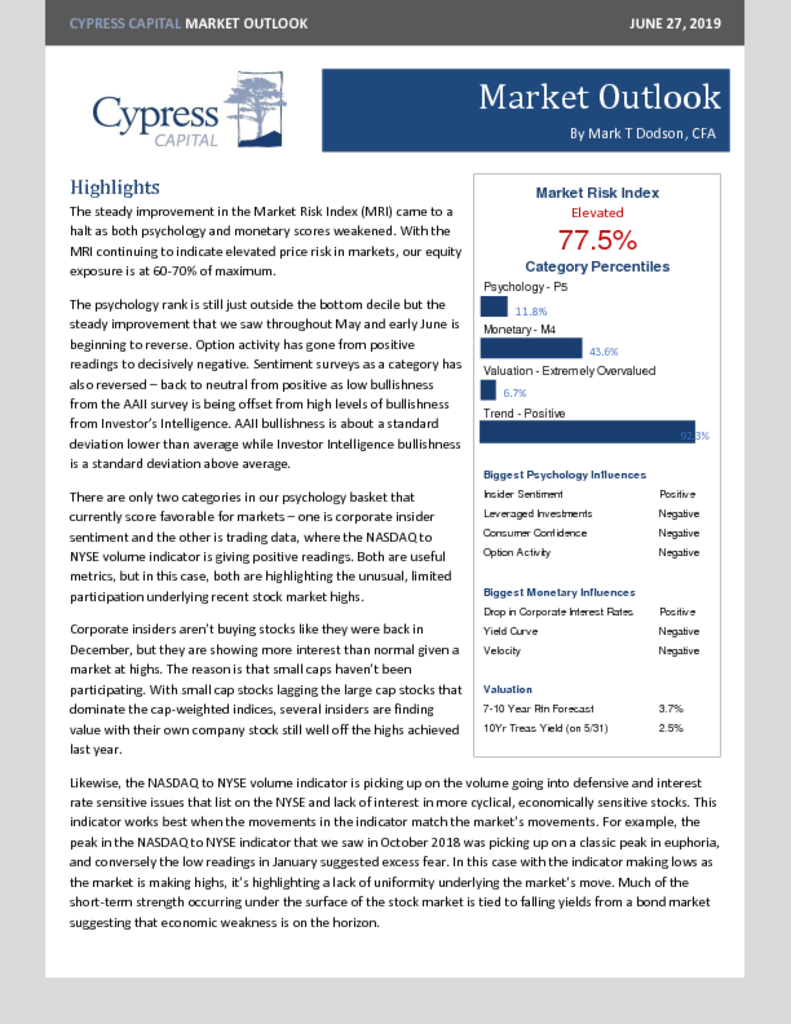

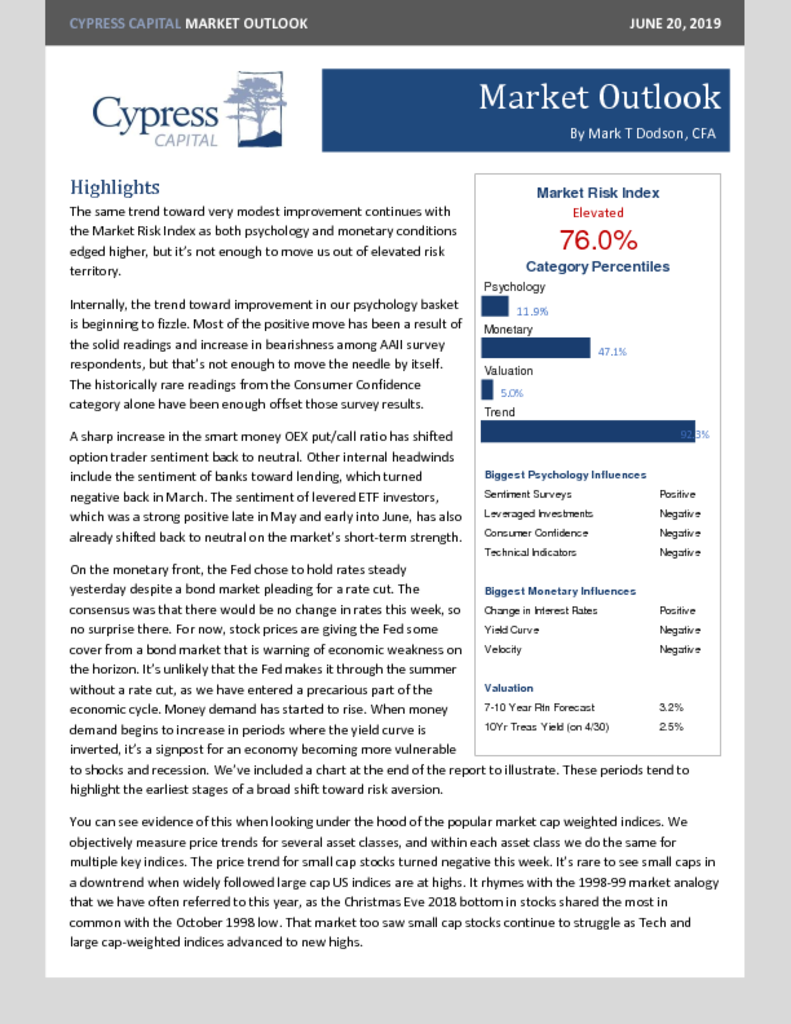

Psychology reverses course on consumer confidence release. Consumer confidence is close to rolling over.

The two most bullish indicators for psychology are highlighting some divergences occurring under the surface of the market’s highs.

Monetary conditions roll over after almost crossing above average readings.