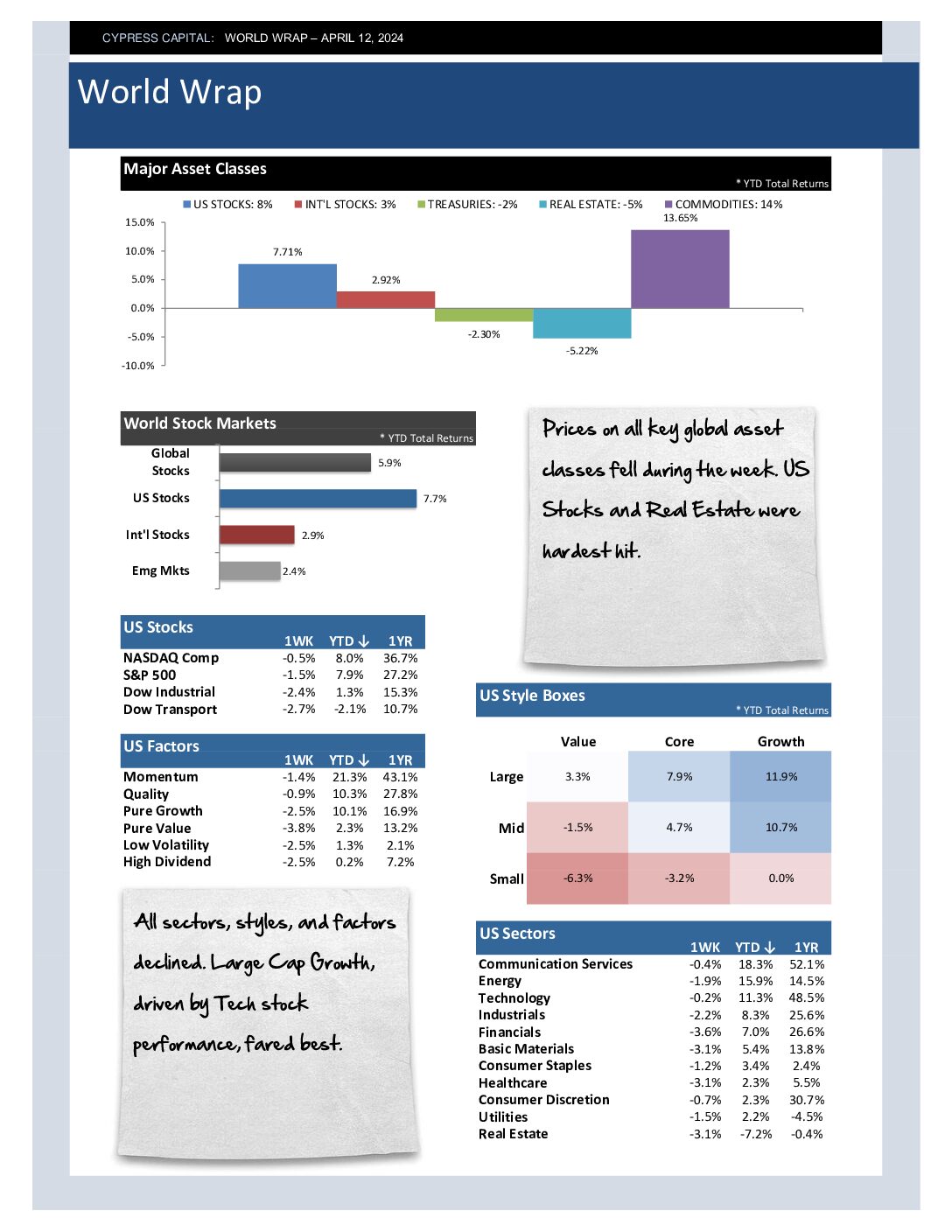

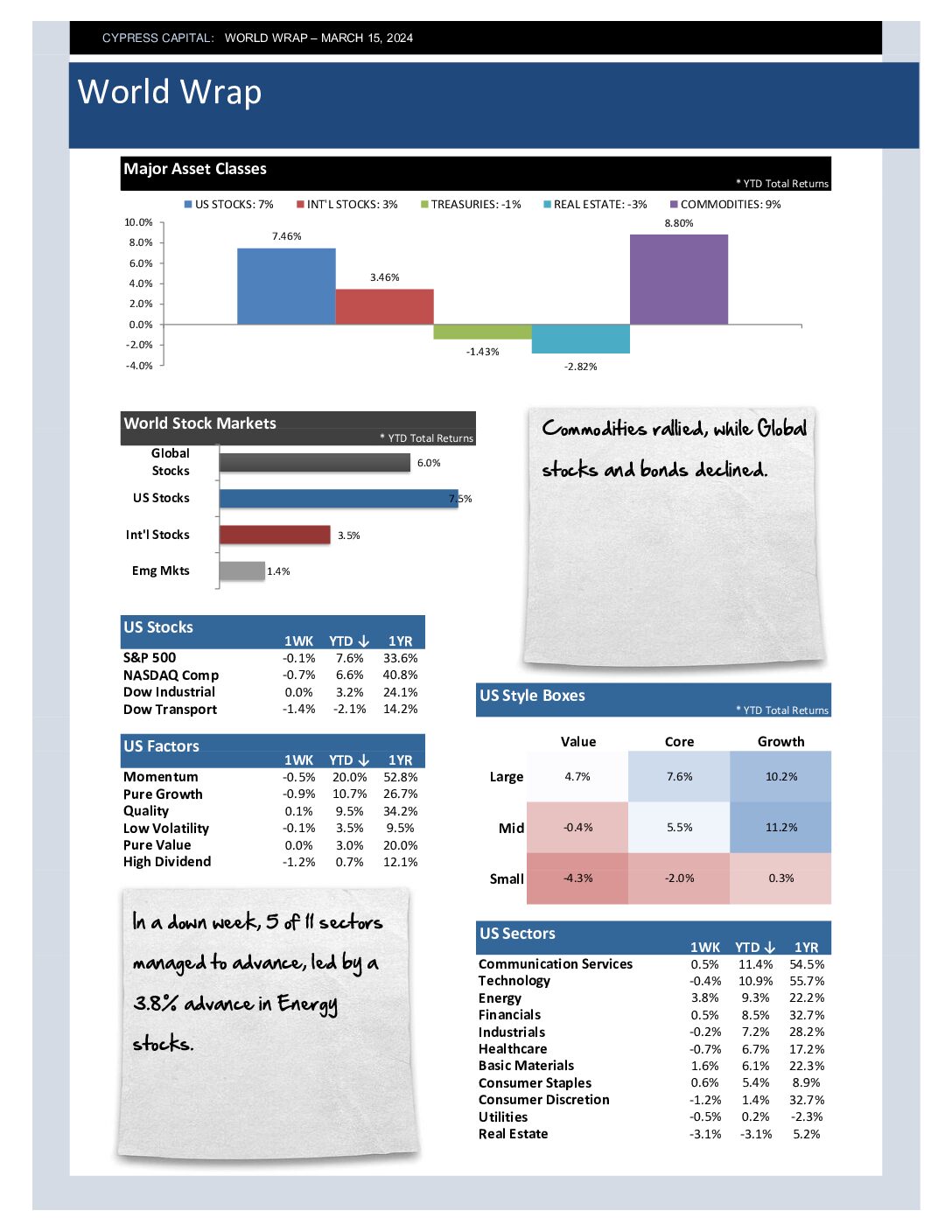

– Prices on all key global asset classes fell during the week. US Stocks and Real Estate were hardest hit.

– All sectors, styles, and factors declined. Large Cap Growth, driven by Tech stock performance, fared best.

– Emerging markets held up well in a down week – led by India, China, and Taiwan.

– Gold shot to another new all time high, and the US dollar was up a whopping 1.7% – surging to the highest level since November.