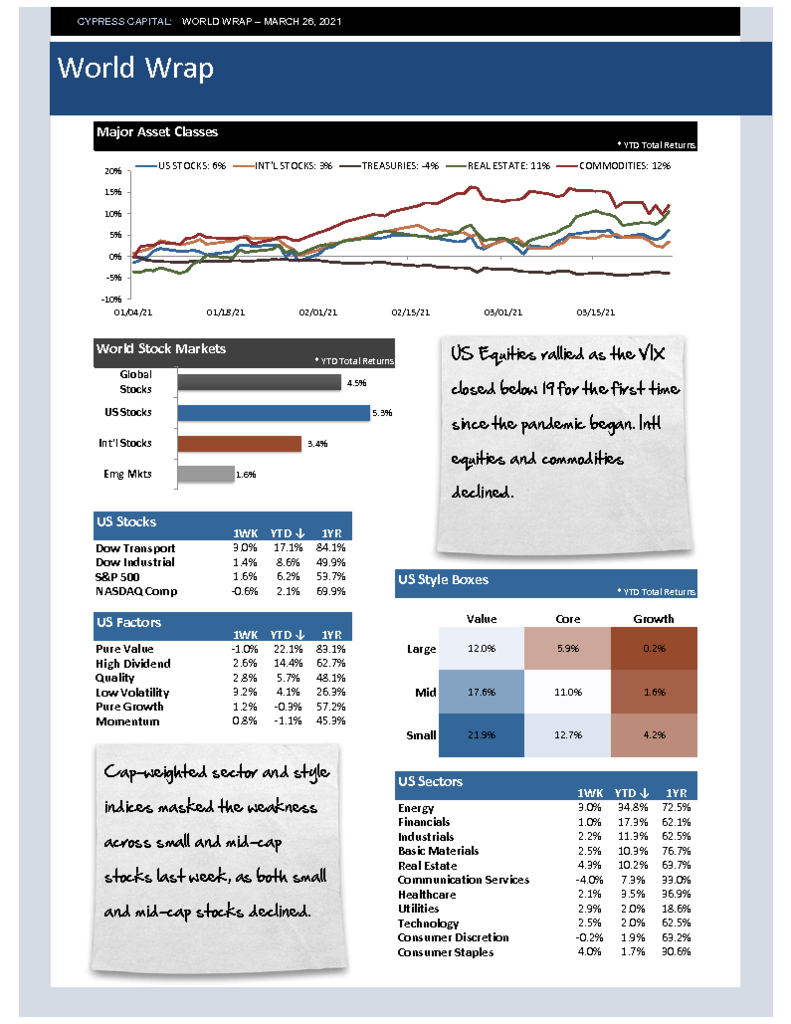

– US Equities rallied as the VIX closed below 19 for the first time since the pandemic began. Intl equities and commodities declined.

– Cap-weighted sector and style indices masked the weakness across small and mid-cap stocks last week, as both small and mid-cap stocks declined.

– Chinese equities declined by more than 4% last week and are down ytd. Twitter rumors circulating that a major Chinese family office was forced to unwind.

– Treasuries staged a modest rally last week. Meanwhile, the US Dollar continues to trend higher after bottoming in early January.