Archive

World Wrap

– Global equities rallied, led by US stocks. Commodities declined.

– Broad rally among styles, factors, and sectors. Momentum and Growth were the biggest winners.

– Two out of every three countries we follow advanced, but emerging markets lagged on declines in Chinese equities.

– The US Dollar and prices on US Treasuries finished the week higher on a dovish sounding Fed.

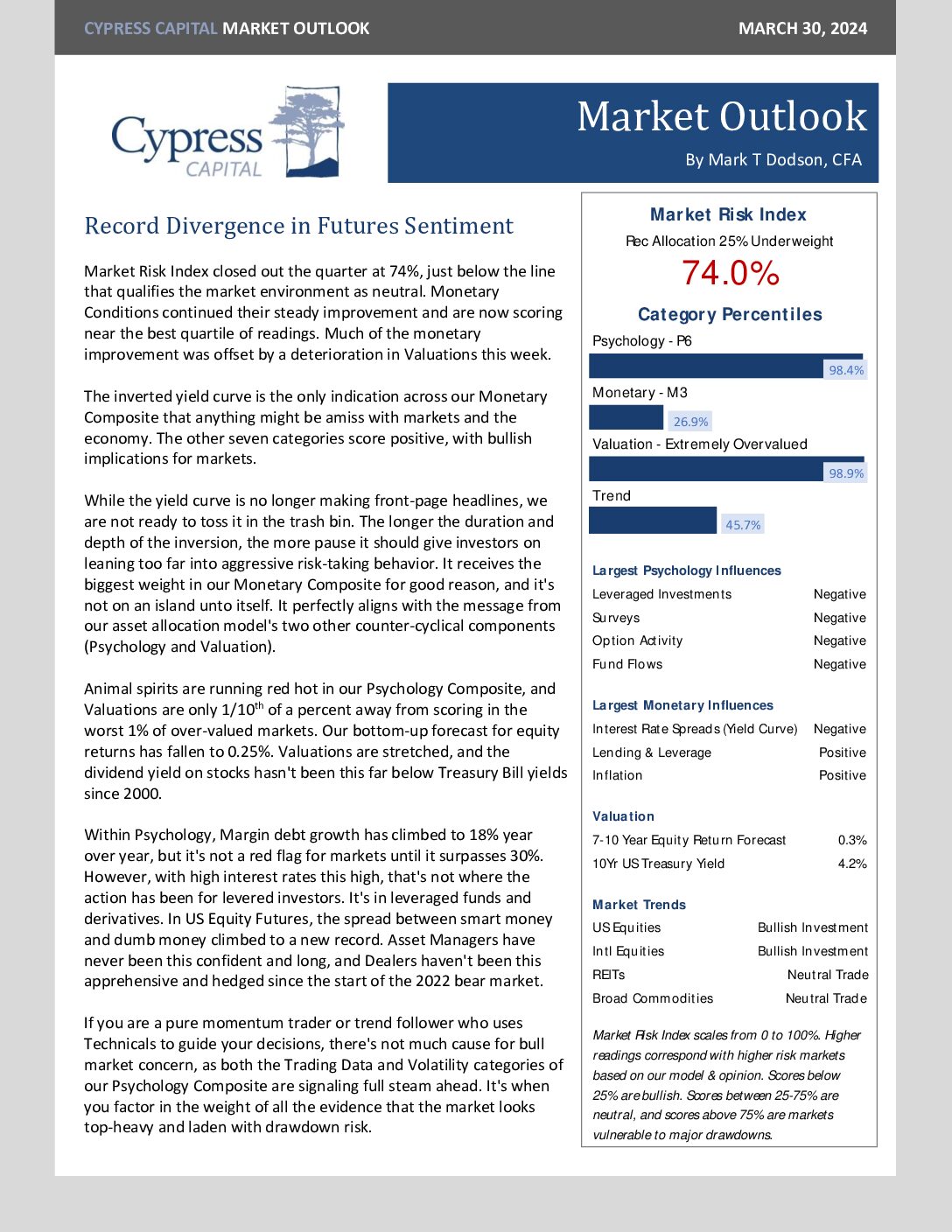

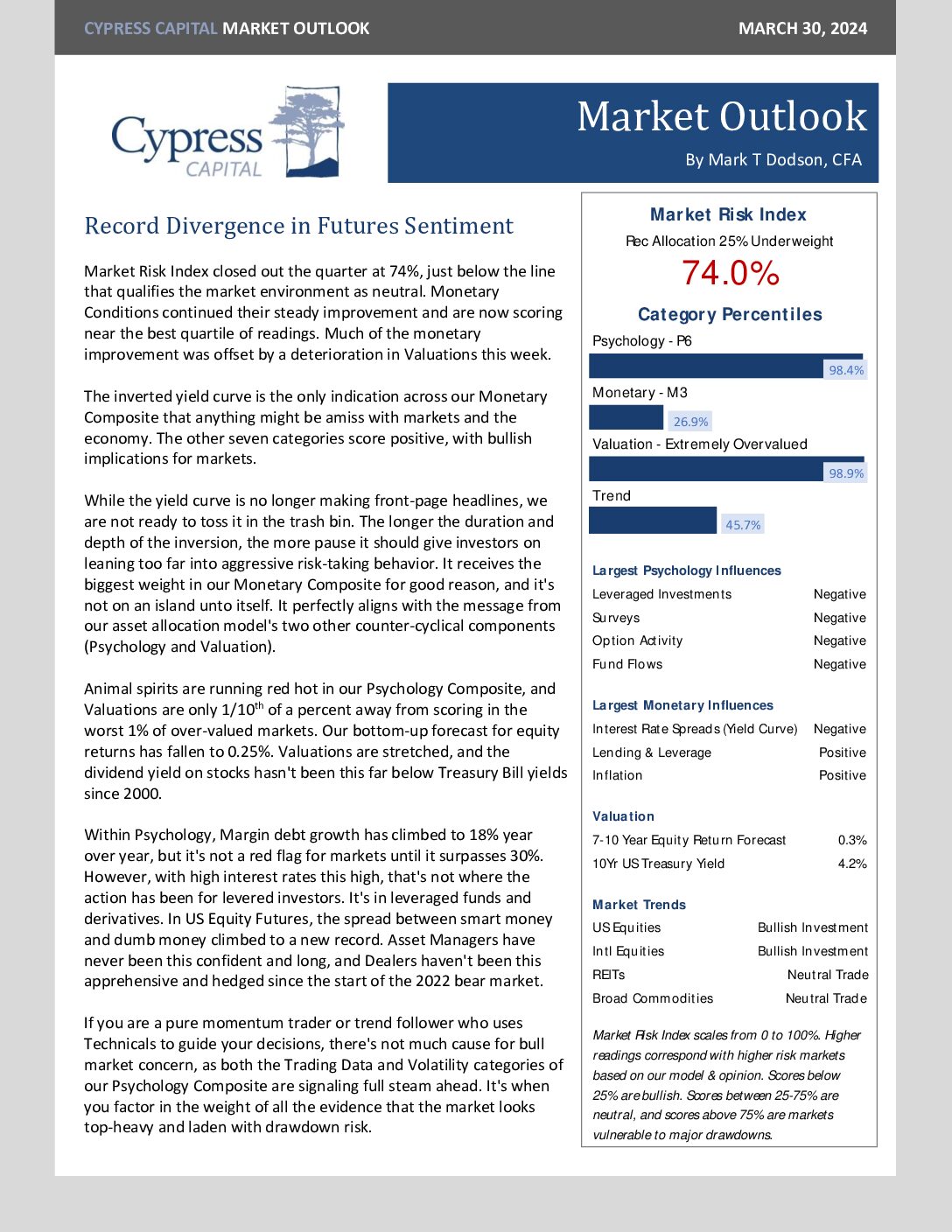

Market Outlook – Three Fed Cuts in the Bush are Worth One in the Hand.

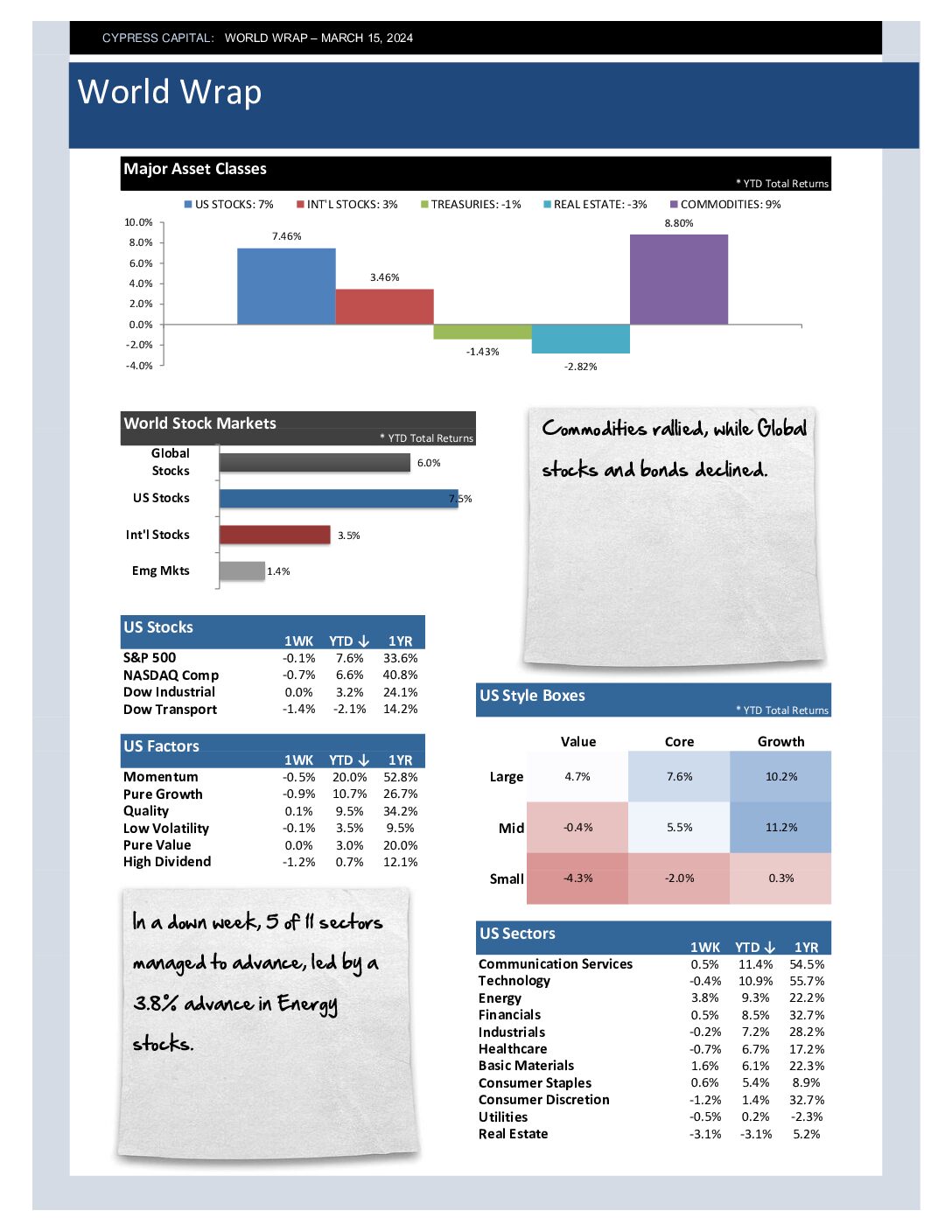

World Wrap

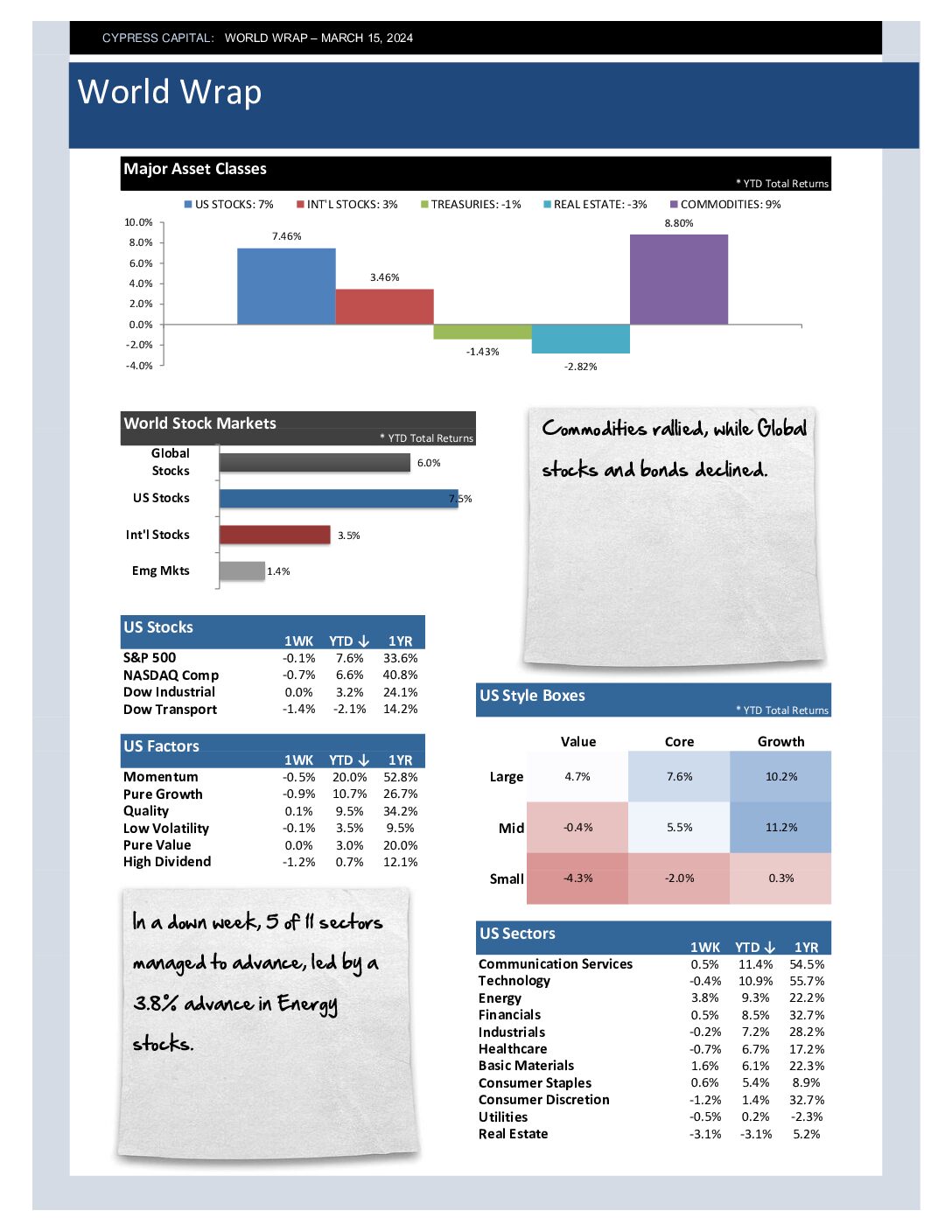

– Commodities rallied, while Global stocks and bonds declined.

– In a down week, 5 of 11 sectors managed to advance, led by a 3.8% advance in Energy stocks.

– Emerging markets were flat, buoyed by a 3.3% move higher in China.

– Both Crude oil and 2Yr Treasury yields climbed to higher highs last week, in a clear sign that inflation concerns are coming to the forefront again.

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 99.7%

- Monetary 87.2%

- Valuation 99.3%

- Market Trend 9.8%