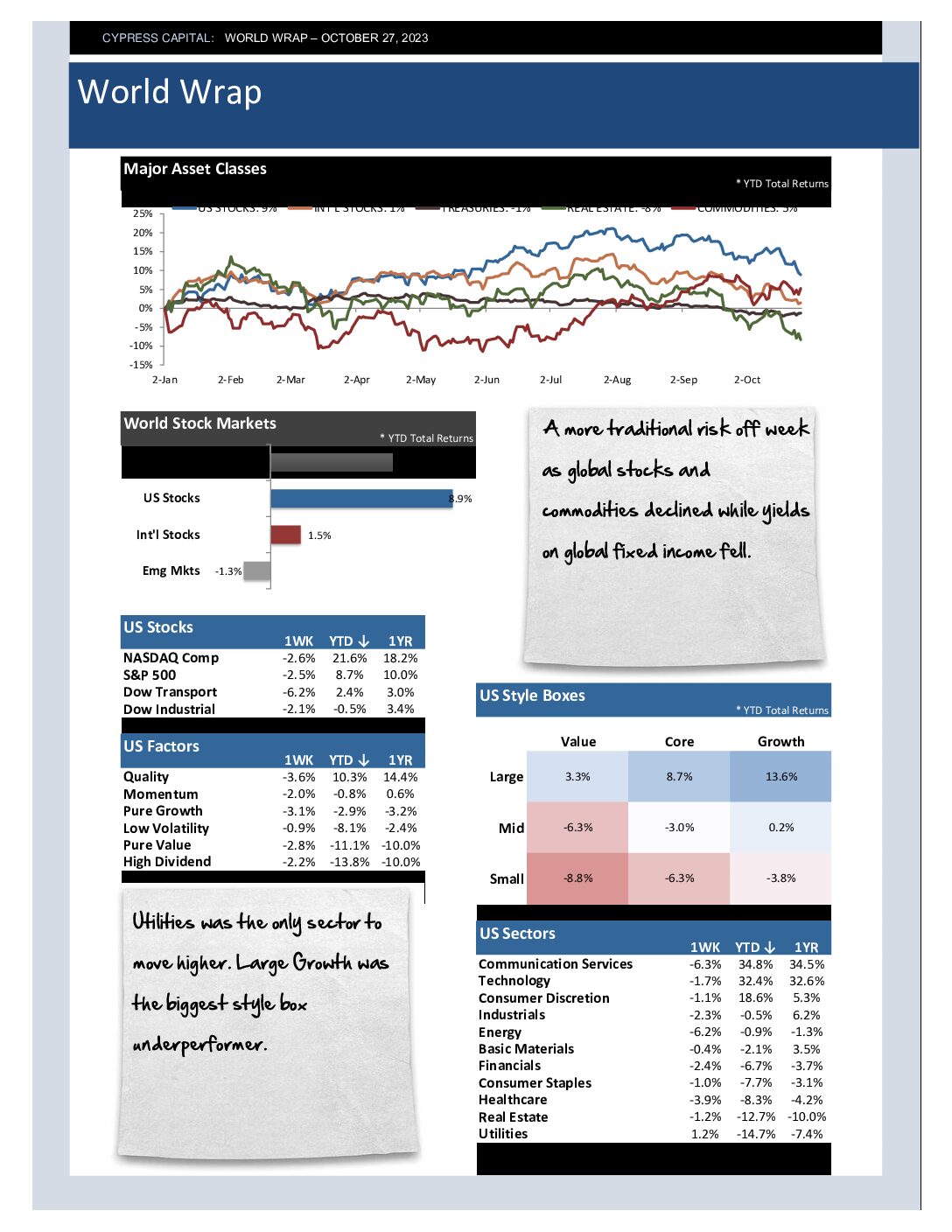

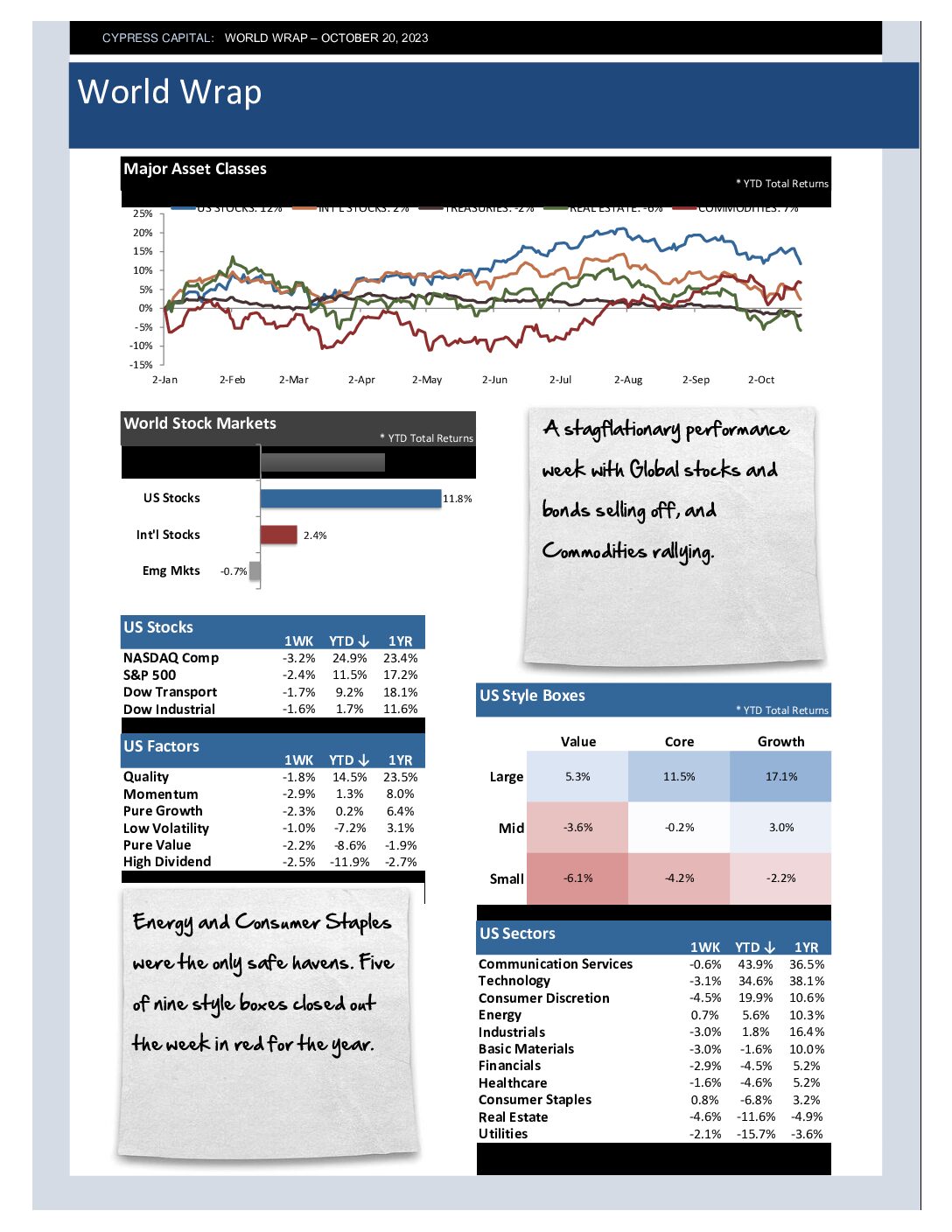

– A more traditional risk off week as global stocks and commodities declined while yields on global fixed income fell.

– Utilities was the only sector to move higher. Large Growth was the biggest style box underperformer.

– Emerging markets outperformed Developed markets with declines being mitigated by a 2.5% rebound in Chinese equities.

– Bitcoin rallied 14% amid continued speculation surrounding a possible Bitcoin spot ETF.