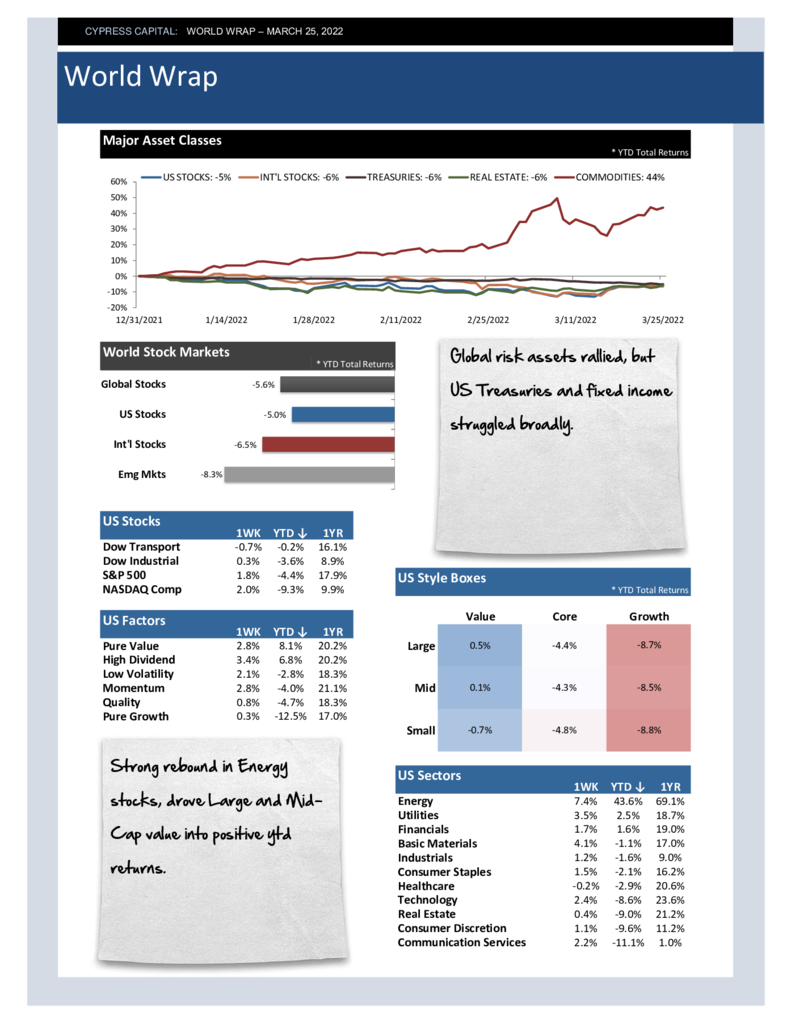

– Global risk assets rallied, but US Treasuries and fixed income struggled broadly.

– Strong rebound in Energy stocks, drove Large and Mid-Cap value into positive ytd returns.

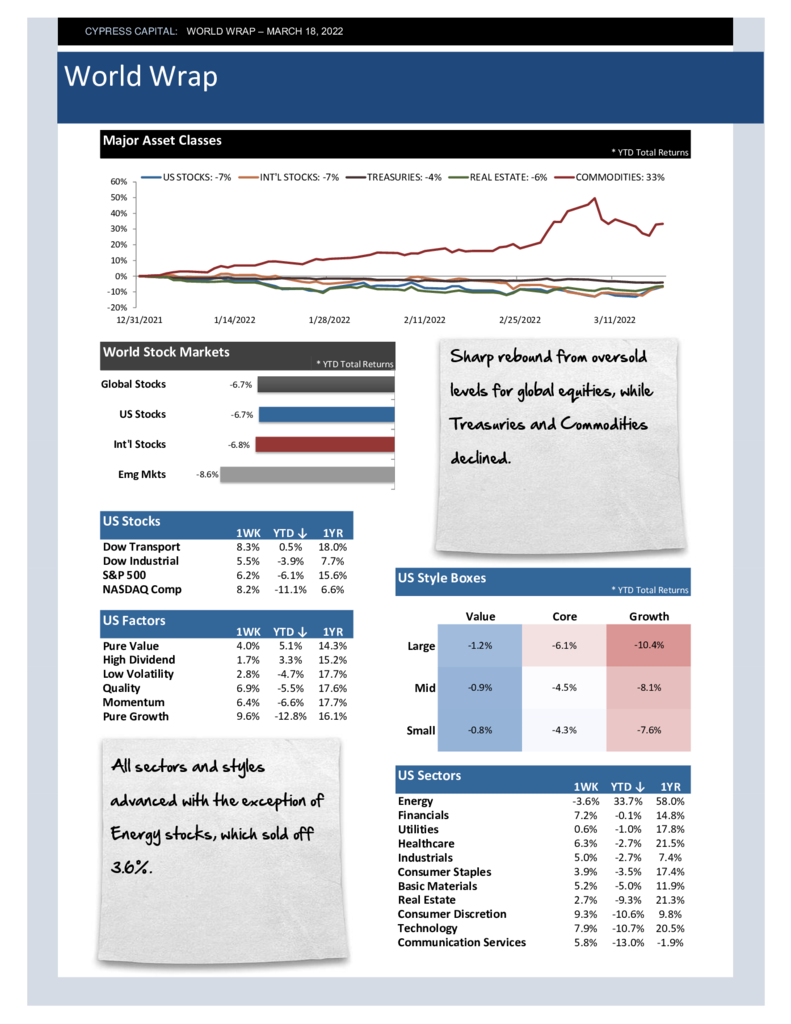

– Sharp increase in Latin American stocks for the week – now up 26% year to date.

– Fixed income was hammered across the board. Every major fixed income sector is in the red thus far in 2022.