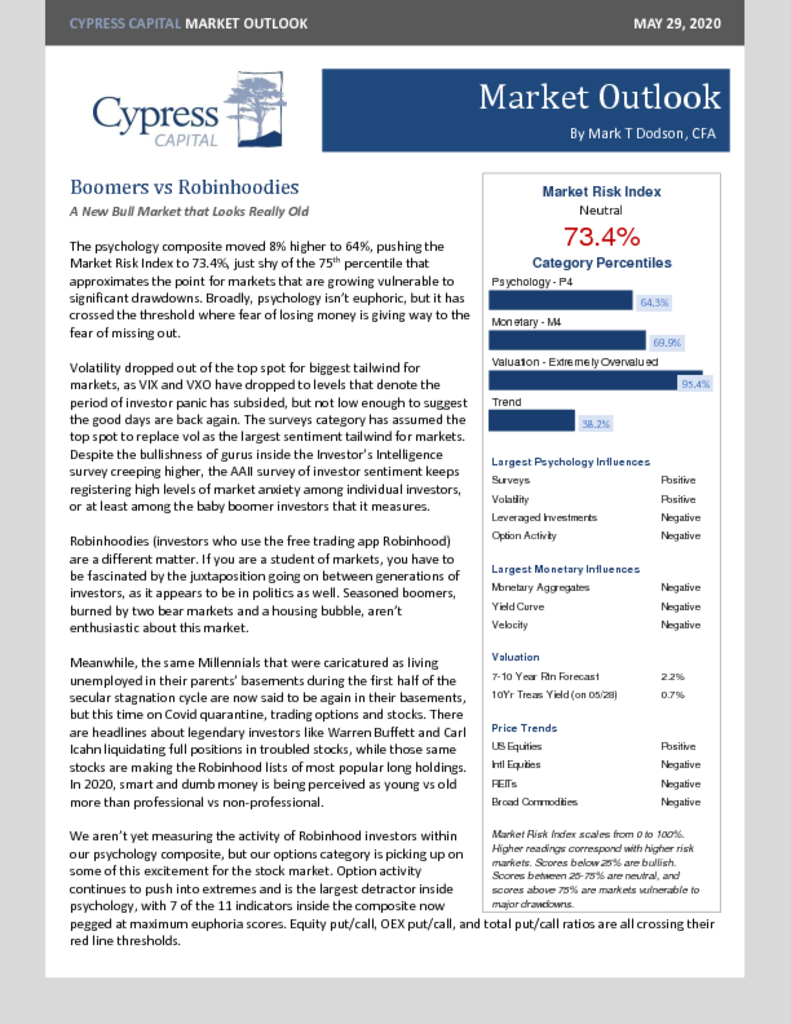

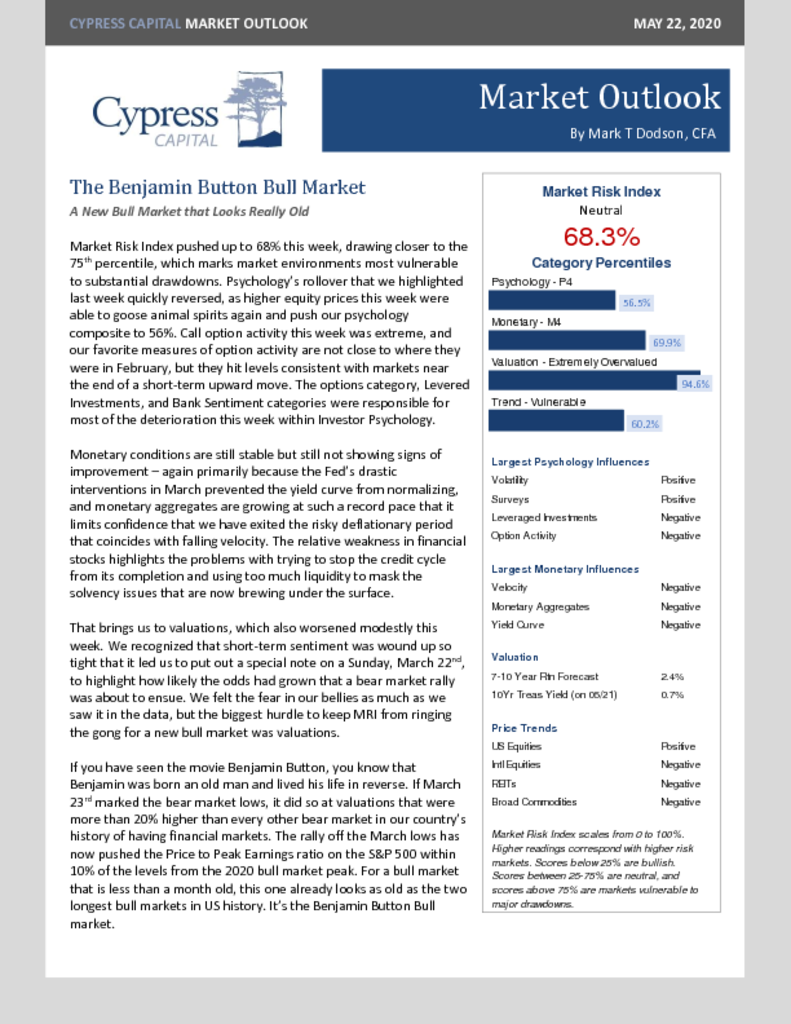

– Market Risk Index moves higher to 73.4%, on another big move within investor psychology.

– Option Activity is hitting extremes, which only happens at the ends of bear rallies, at the ends of bulls, or at the beginning of new bulls.

– In 2020, smart versus dumb money, has become young versus old money.

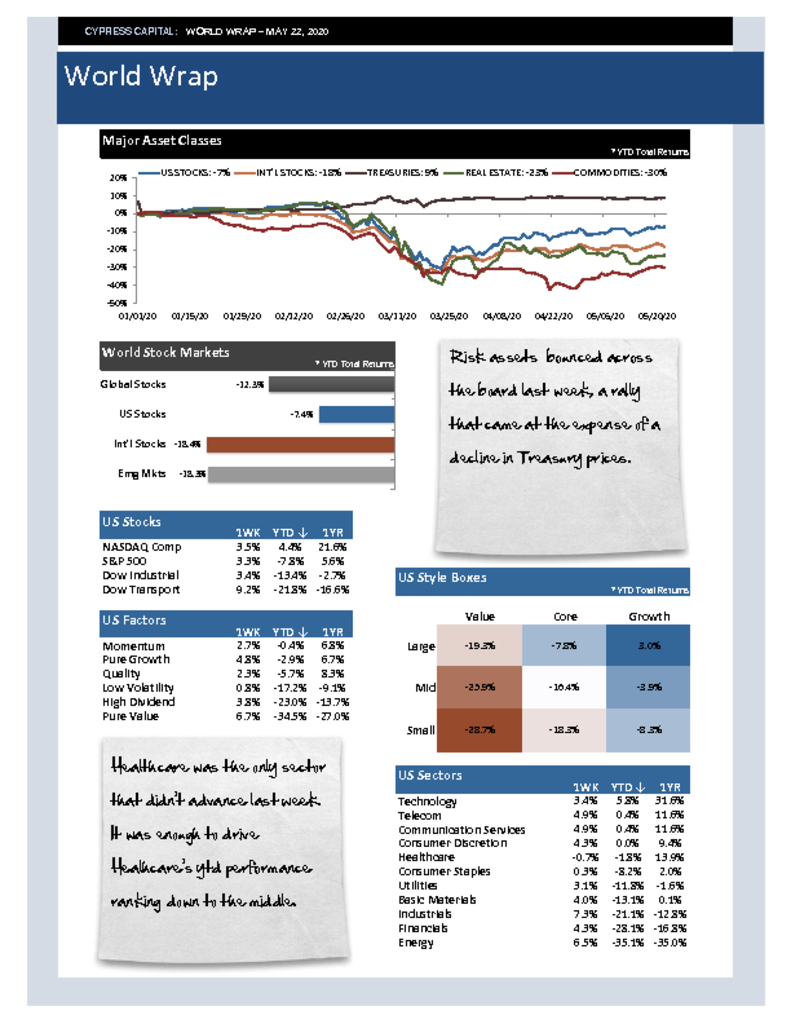

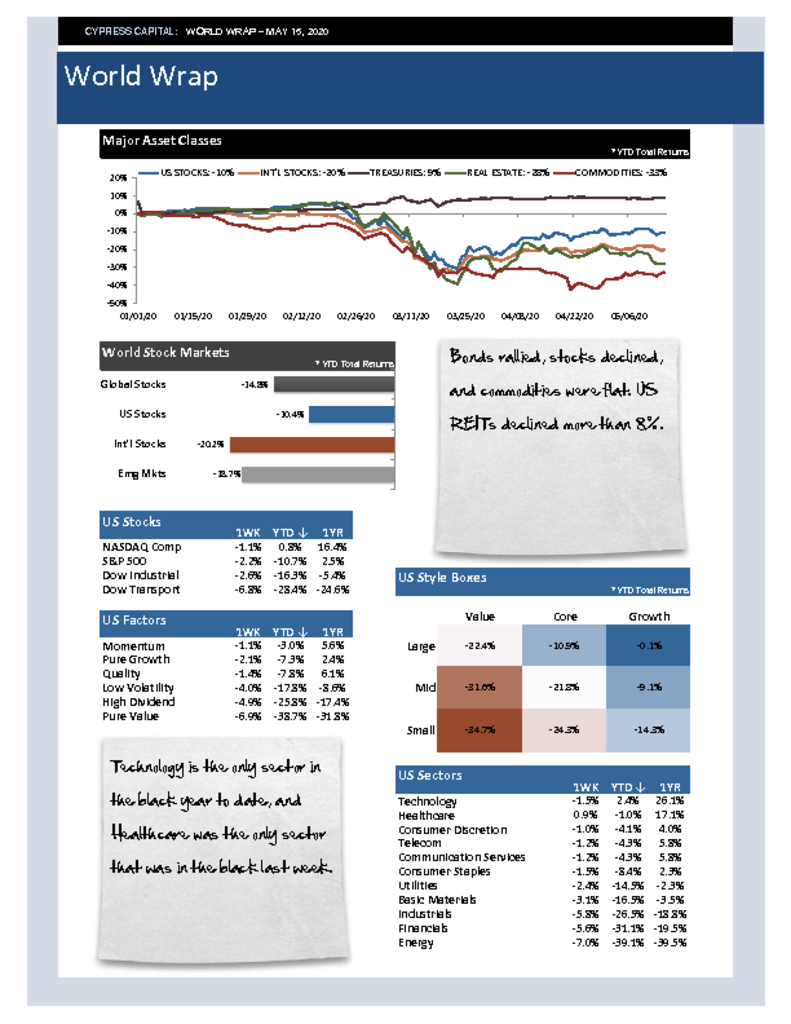

– …and this week’s best charts.