Archive

World Wrap

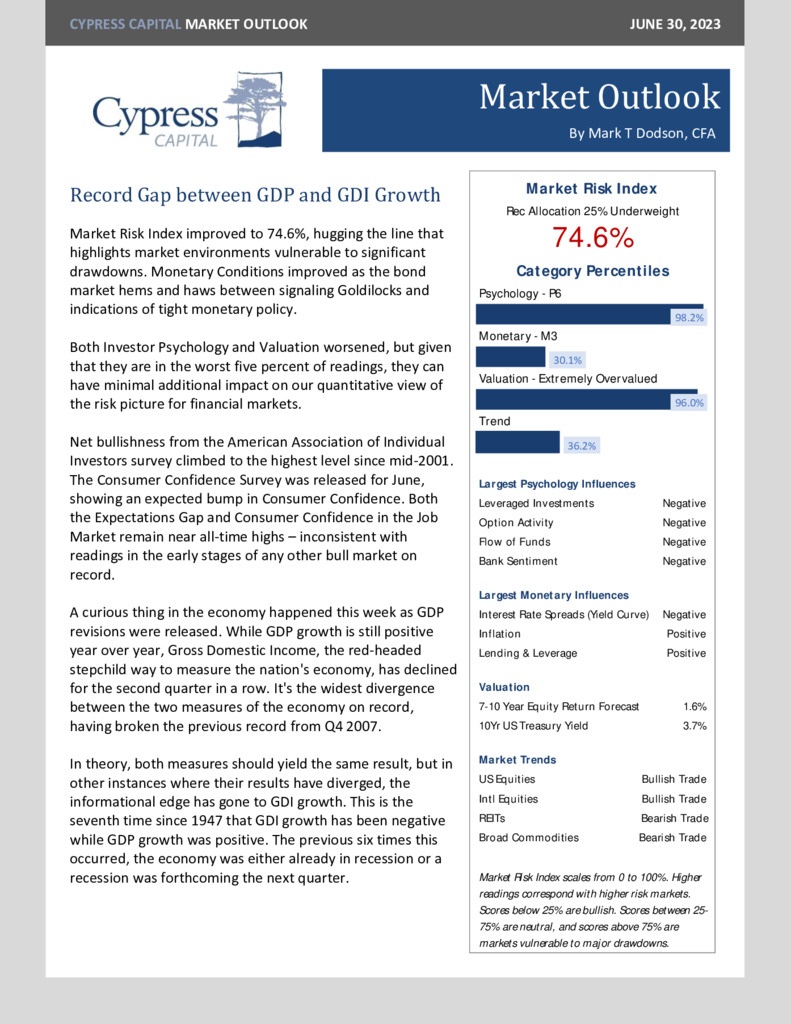

– Complete reversal of the action from the prior week – Global equities and commodities declined, while Treasuries and the Dollar rallied.

– Sharpest one week drop for stocks since March. Ten of 11 sectors closed lower – Healthcare stocks advanced.

– Short-lived return to positive year-to-date returns for China – Chinese equities fell 6.7% last week.

– Bitcoin rallied 17%, making a new 52 week high in the process.

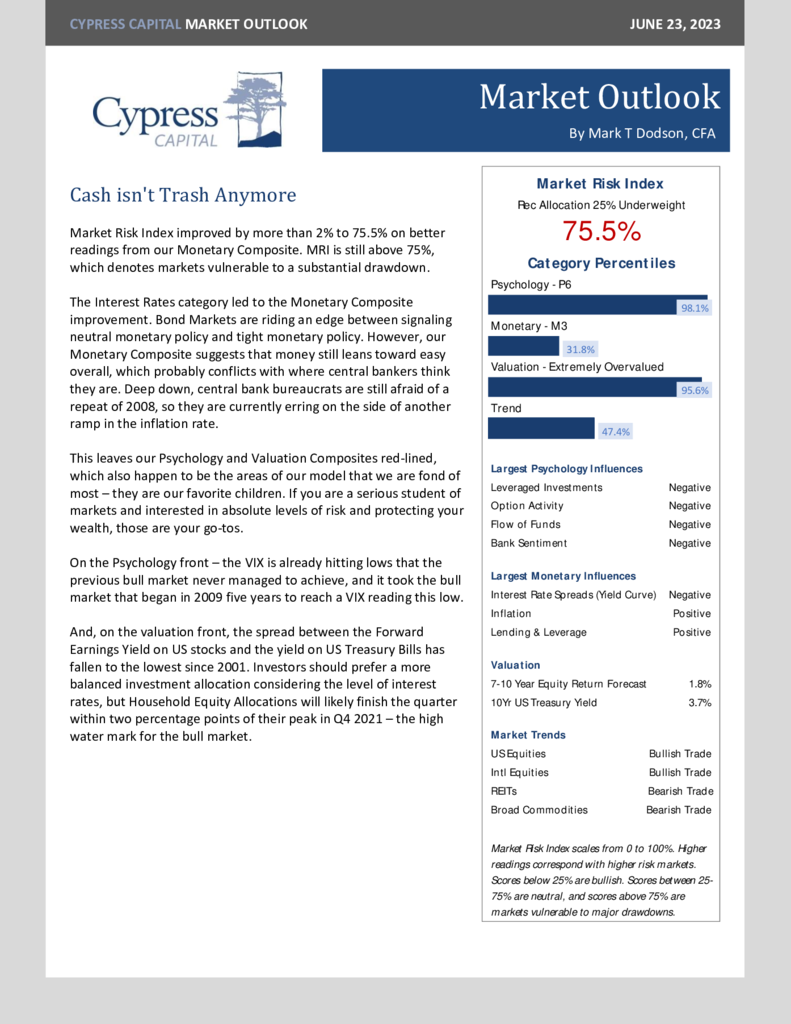

Market Outlook – Cash isn’t Trash Anymore

World Wrap

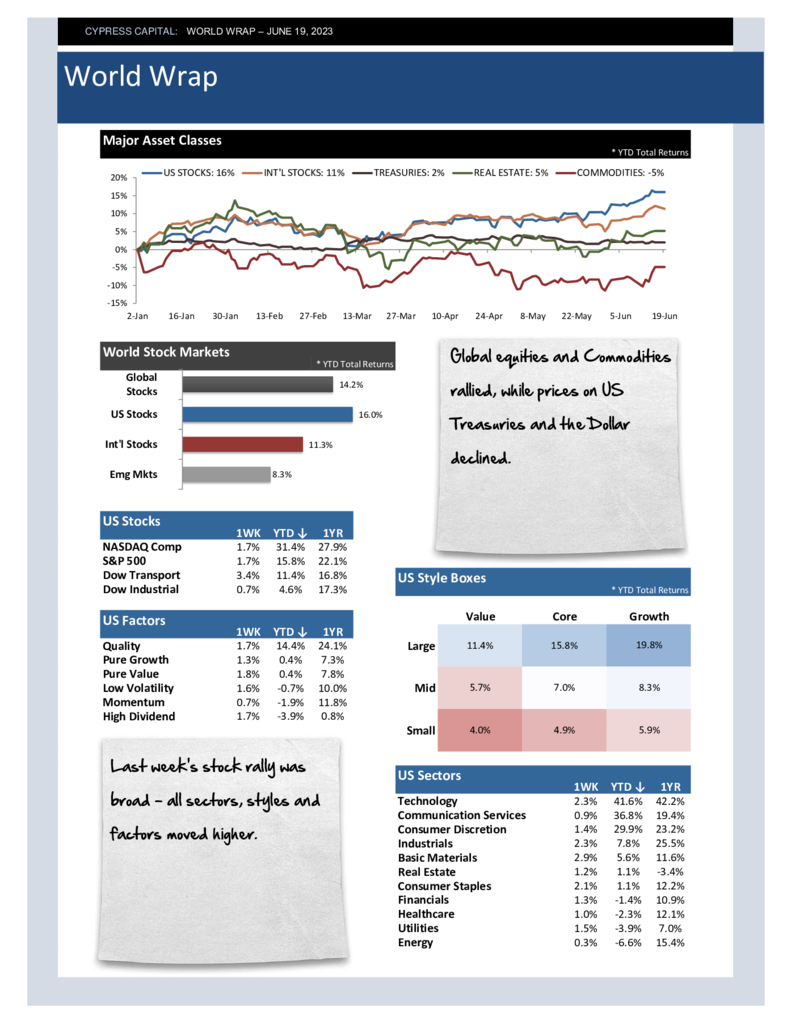

– Global equities and Commodities rallied, while prices on US Treasuries and the Dollar declined.

– Last week’s stock rally was broad – all sectors, styles and factors moved higher.

– China’s re-opening narrative has been a dud, but their stock market managed to cross into positive return territory for 2023 after a one week increase of 3.6%.

– Crude oil futures advanced by 7% in a week where all key commodities climbed.

%

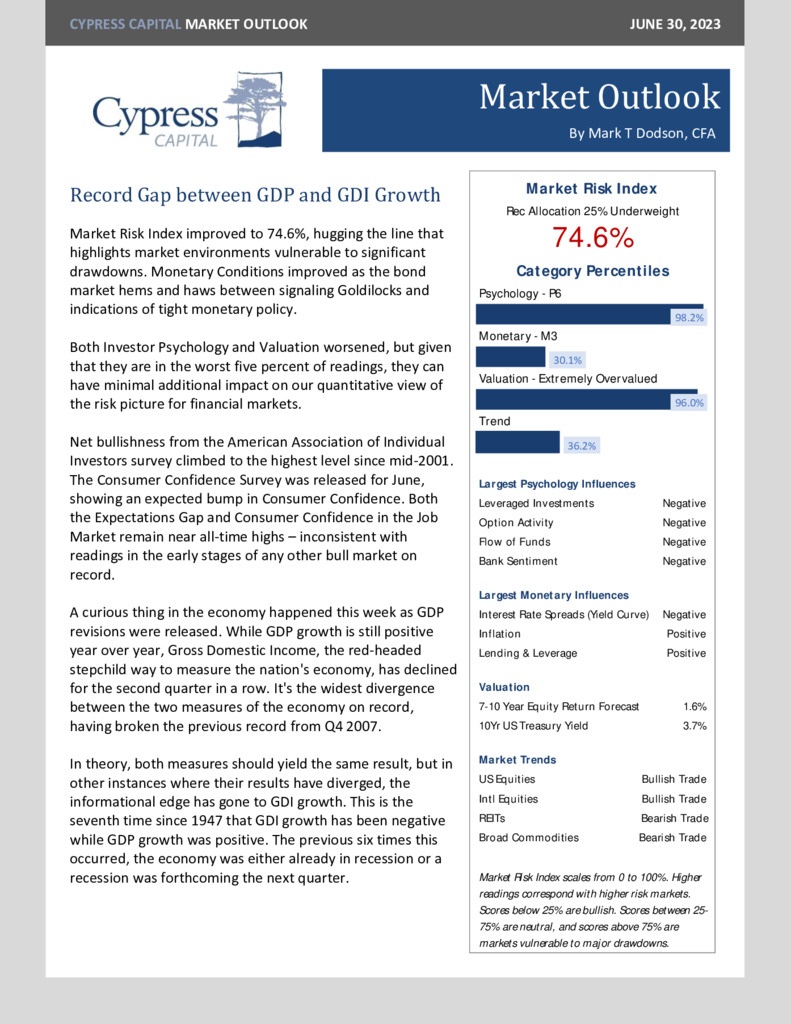

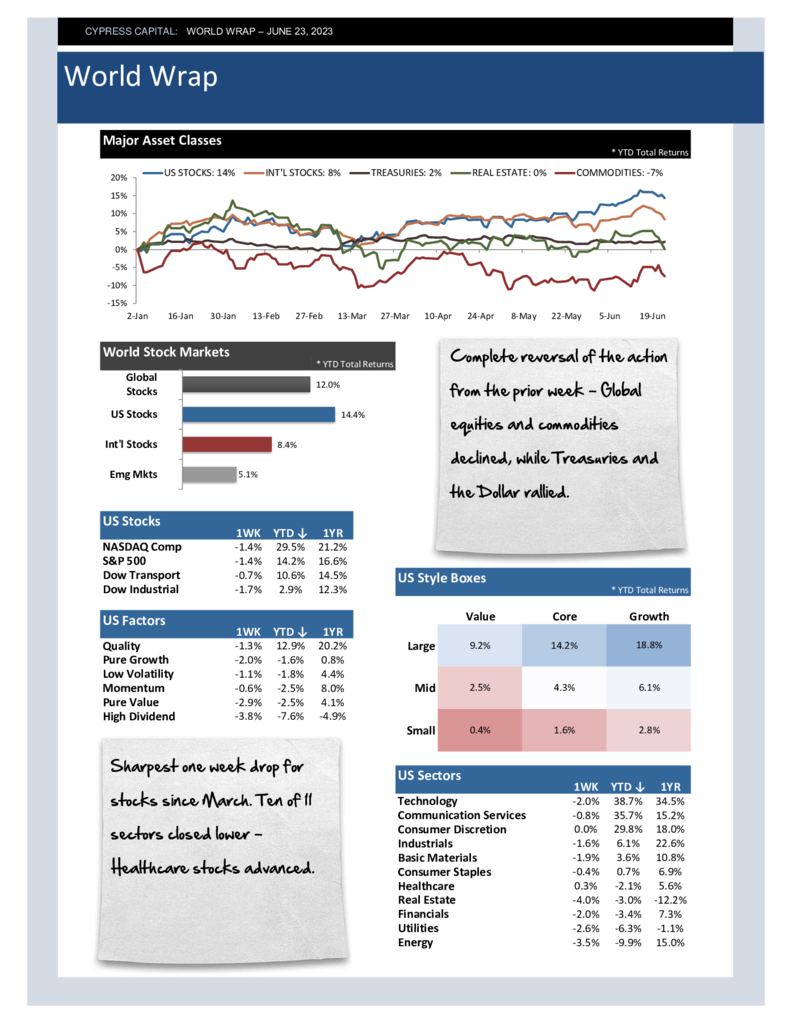

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 99.7%

- Monetary 87.2%

- Valuation 99.3%

- Market Trend 9.8%