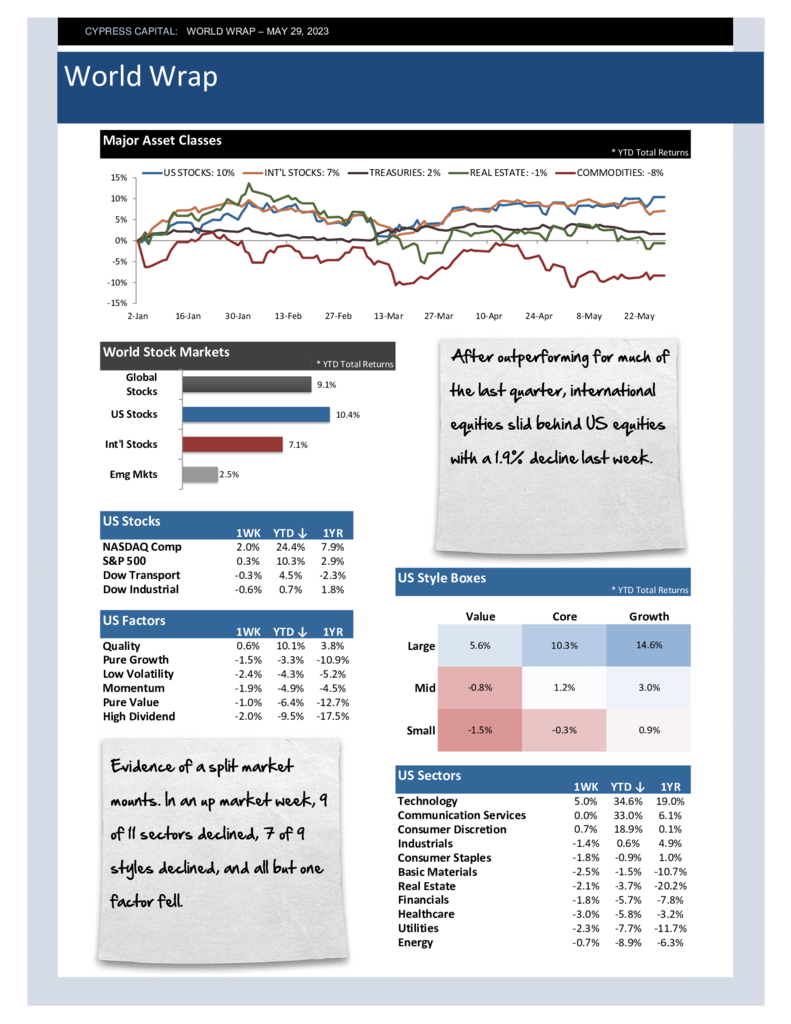

– After outperforming for much of the last quarter, international equities slid behind US equities with a 1.9% decline last week.

– Evidence of a split market mounts. In an up market week, 9 of 11 sectors declined, 7 of 9 styles declined, and all but one factor fell.

– Developed Europe was a drag on foreign equities. Germany declined 2.5%.

– US Treasuries are set for a relief rally on the announcement of the US debt-ceiling deal.