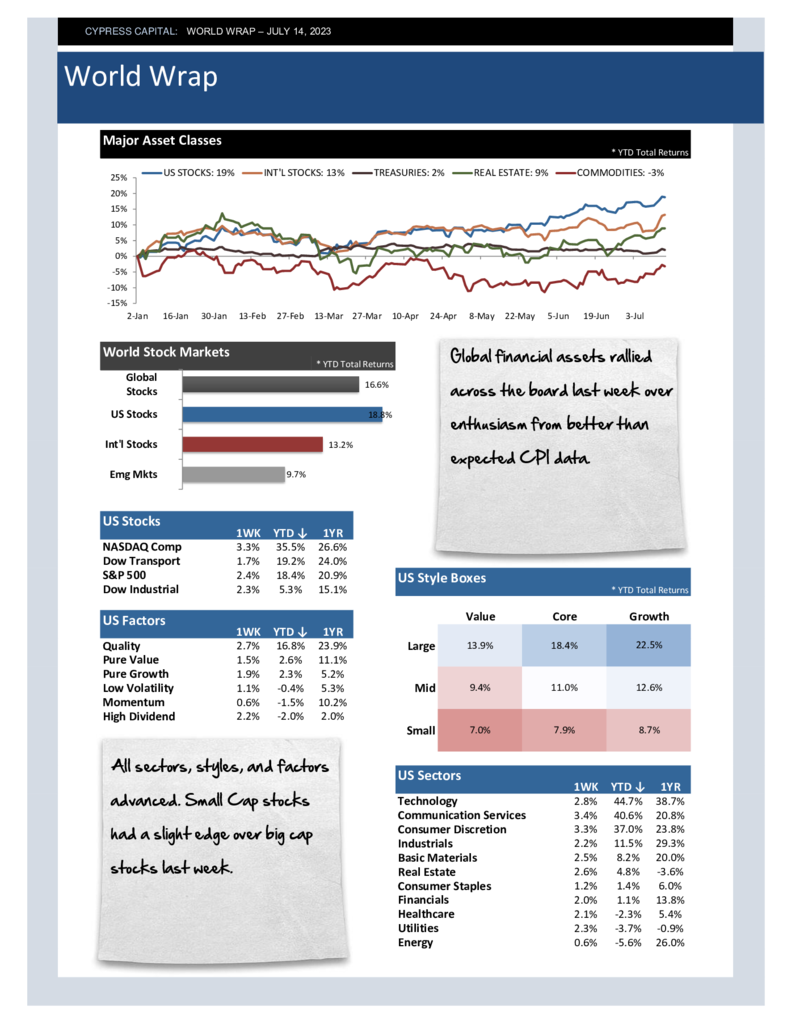

– Global equities and Commodities climbed, while Fixed Income and interest rate-sensitive assets declined.

– Seven of 11 sectors advanced. Large Growth outperformed, but Value was better for Small and Mid-Cap stocks.

– Emerging markets outperformed, driven by a 6.8% one week increase in China equities.

– The Federal Reserve increased the Fed Funds Rate to 5.5% – the highest level since February 2001.