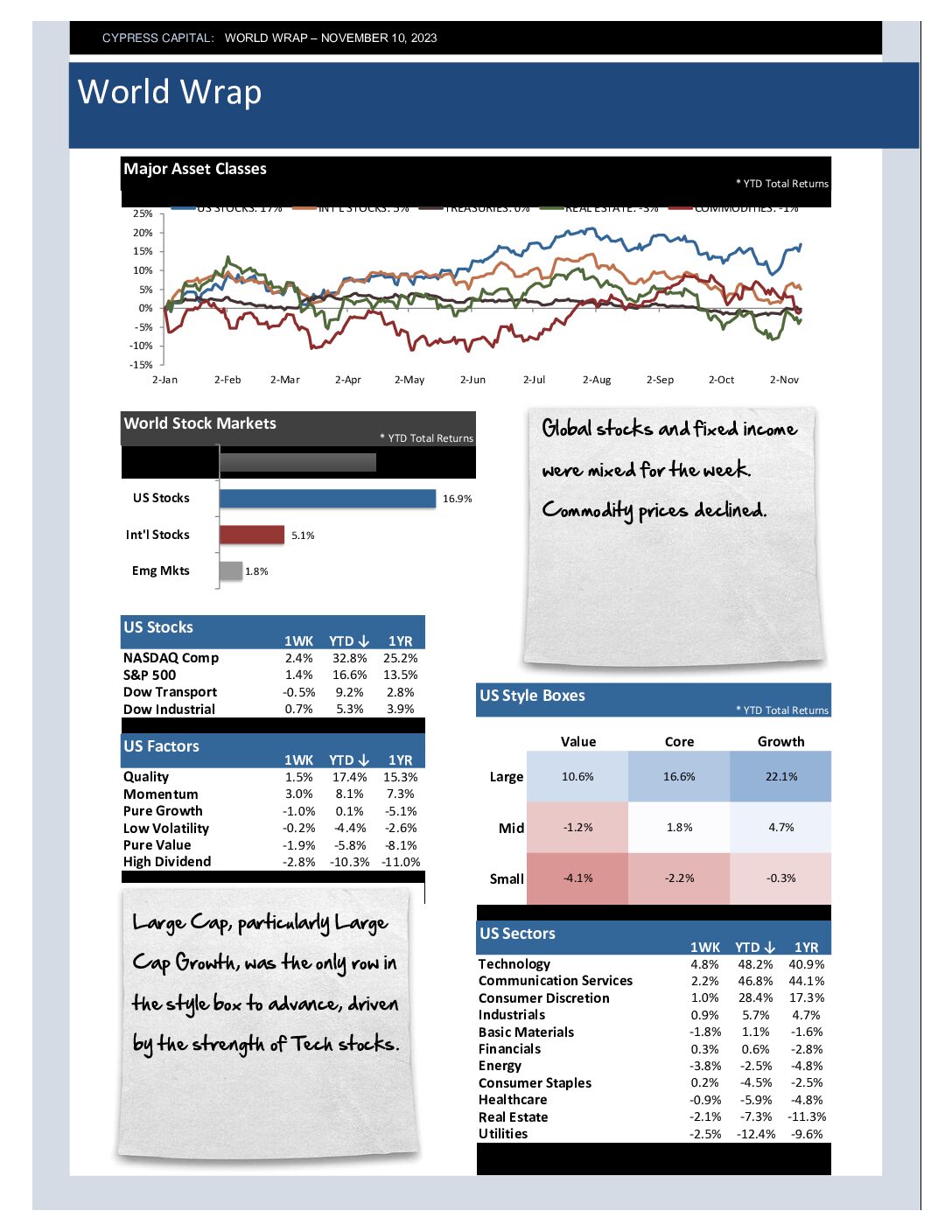

– Global stocks advanced on the shortened holiday week. Commodities were off modestly on another weekly decline in crude oil prices.

– All sectors, styles, and factors moved higher. Unlike the prior week, small caps and value stocks lagged.

– Developed markets outperformed. China was up 1.3%, helping mask a challenging week for Emerging market equities.

– Precious Metals and Bitcoin experienced good performance. Prices on longer duration Treasuries were off slightly.