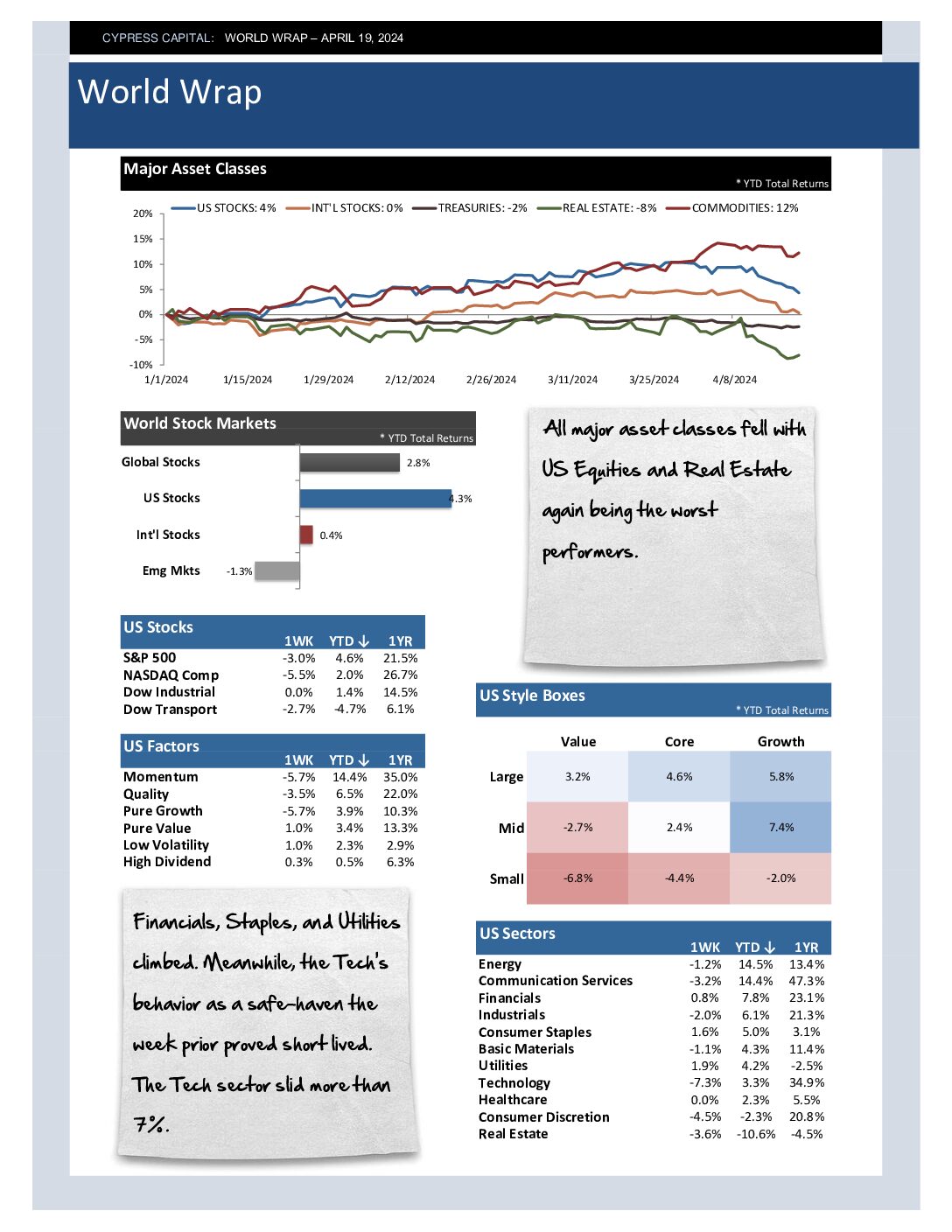

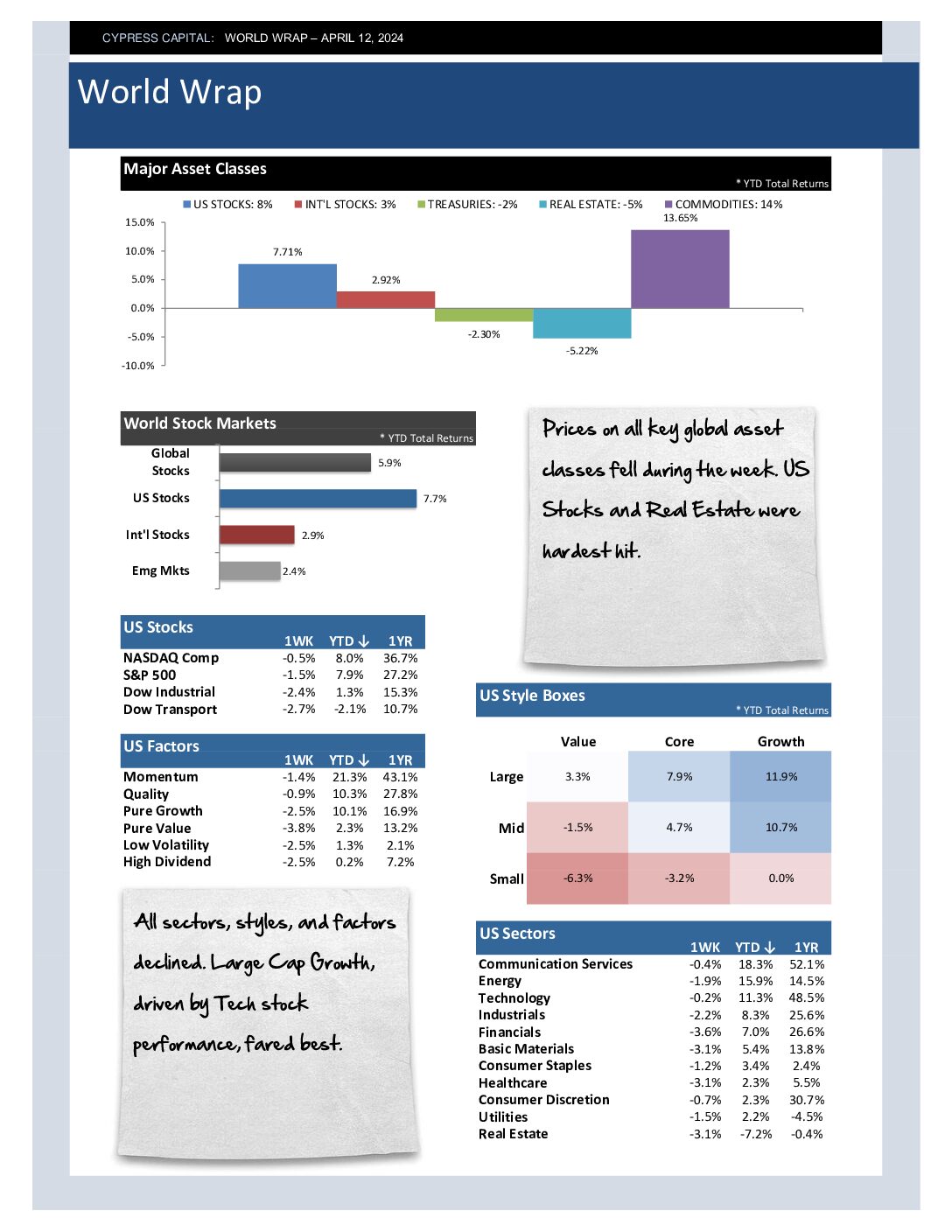

– All major asset classes fell with US Equities and Real Estate again being the worst performers.

– Financials, Staples, and Utilities climbed. Meanwhile, the Tech’s behavior as a safe-haven the week prior proved short lived. The Tech sector slid more than 7%.

– Thirty-nine of the 45 countries we track declined. The Asia region was hardest hit.

– Gold climbed, and Copper surged to a 52 week high. Global Fixed Income and Bitcoin struggled.