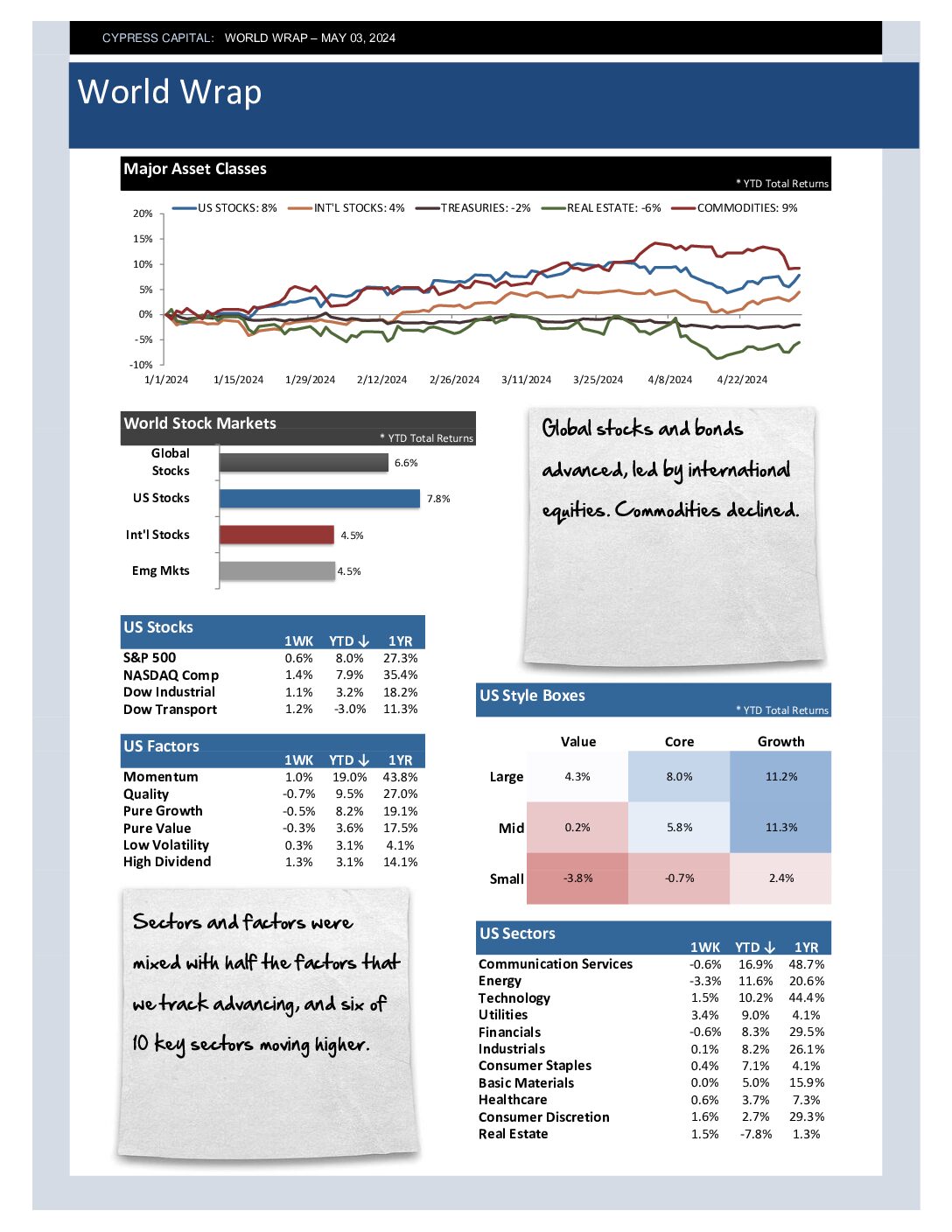

– Global equities rallied, led by US stocks. Prices on US Treasuries were flat.

– Broad move higher in stock prices as all sectors, factors, and style boxes advanced.

– Developed markets outperformed as Germany climbed more than 4%. Germany was the second best performing country in the world last week.

– Precious metals outperformed all commodity sectors, as Gold and Silver prices appear poised to test their highs.