Archive

World Wrap

– Global equities climbed modestly – fixed income and commodities were flat. S&P 500 hit the 20% rally threshold some use to define ends of bear markets.

– The most beaten up styles and sectors followed up with a second week of outperformance, which came at the expense of a decline in Large Cap Tech stocks.

– A 2.25% rally in Japanese equities helped push its year to date return above the US equity market.

– US Initial Jobless claims shot up to 261K, an 18 month high. Yield Curve Inversion is close to entering its ninth month.

Market Outlook – The Thumb-Nosing Bull Market

World Wrap

– Global financial assets rallied across the board last week. Commodities were flat on a drop in oil prices.

– All sectors, styles and factors advanced. The most beaten up areas snapped back sharply.

– European stocks underperformed for the second week in a row, hindering relative gains on international indices.

– Treasury Bill yields climbed above 5.5%, the highest level since January 2001. Fed Funds are pricing in a 25bp increase for June.

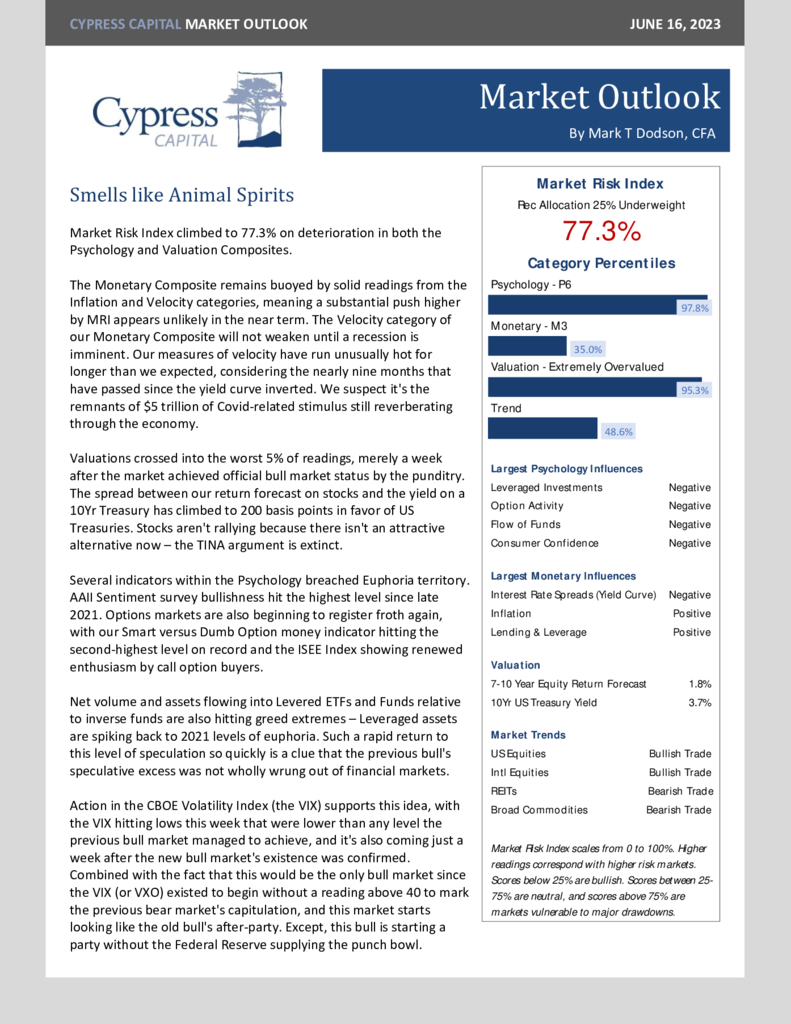

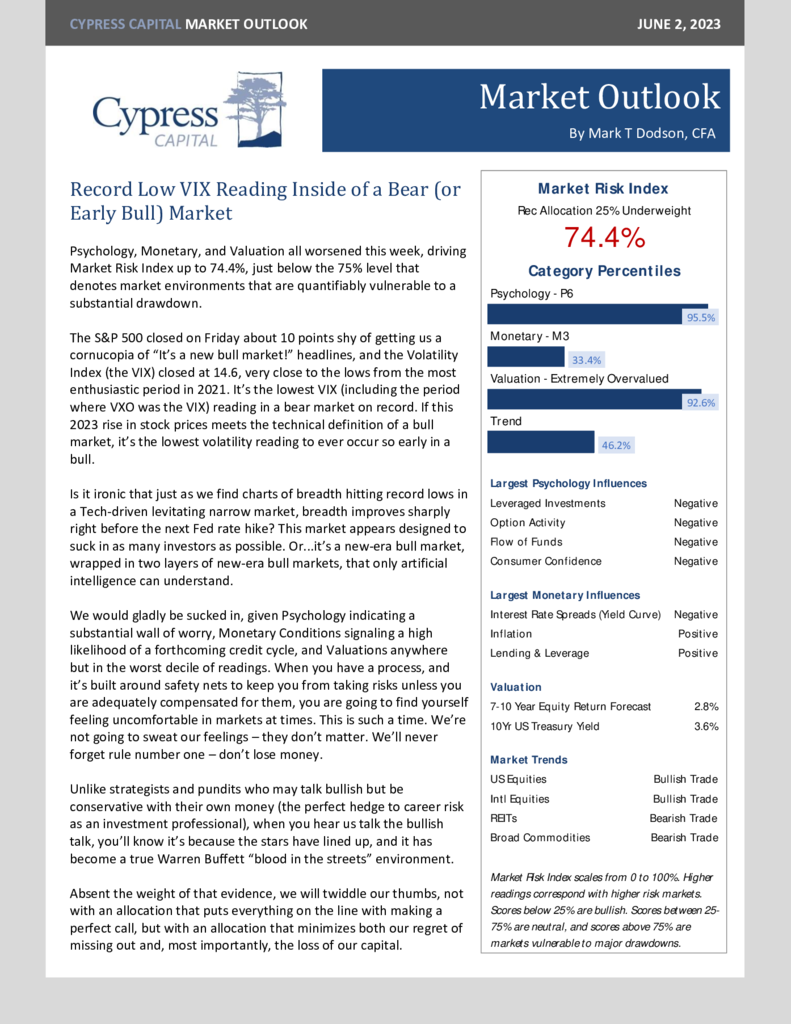

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 99.7%

- Monetary 87.2%

- Valuation 99.3%

- Market Trend 9.8%