Research

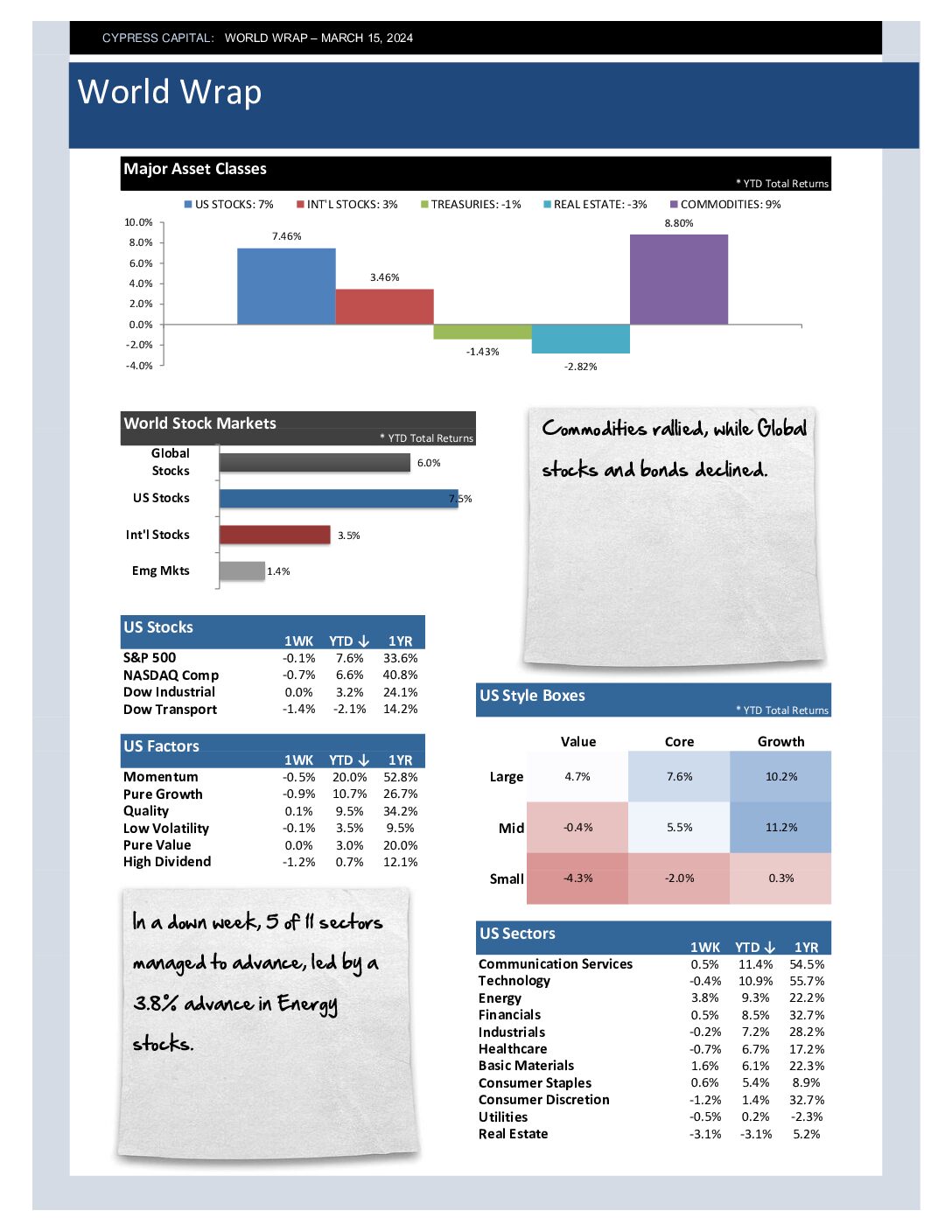

World Wrap

– Commodities rallied, but they were the exception. Global equites and fixed income declined.

– Momentum and Energy stocks were a safe haven in week where declines were pervasive.

– Emerging markets climbed on strength in China, India, and Mexico.

– Gold spiked to another all-time high, and Oil prices climbed above $87 per barrel.

Market Outlook – Bullishness among newsletter writers is pervasive

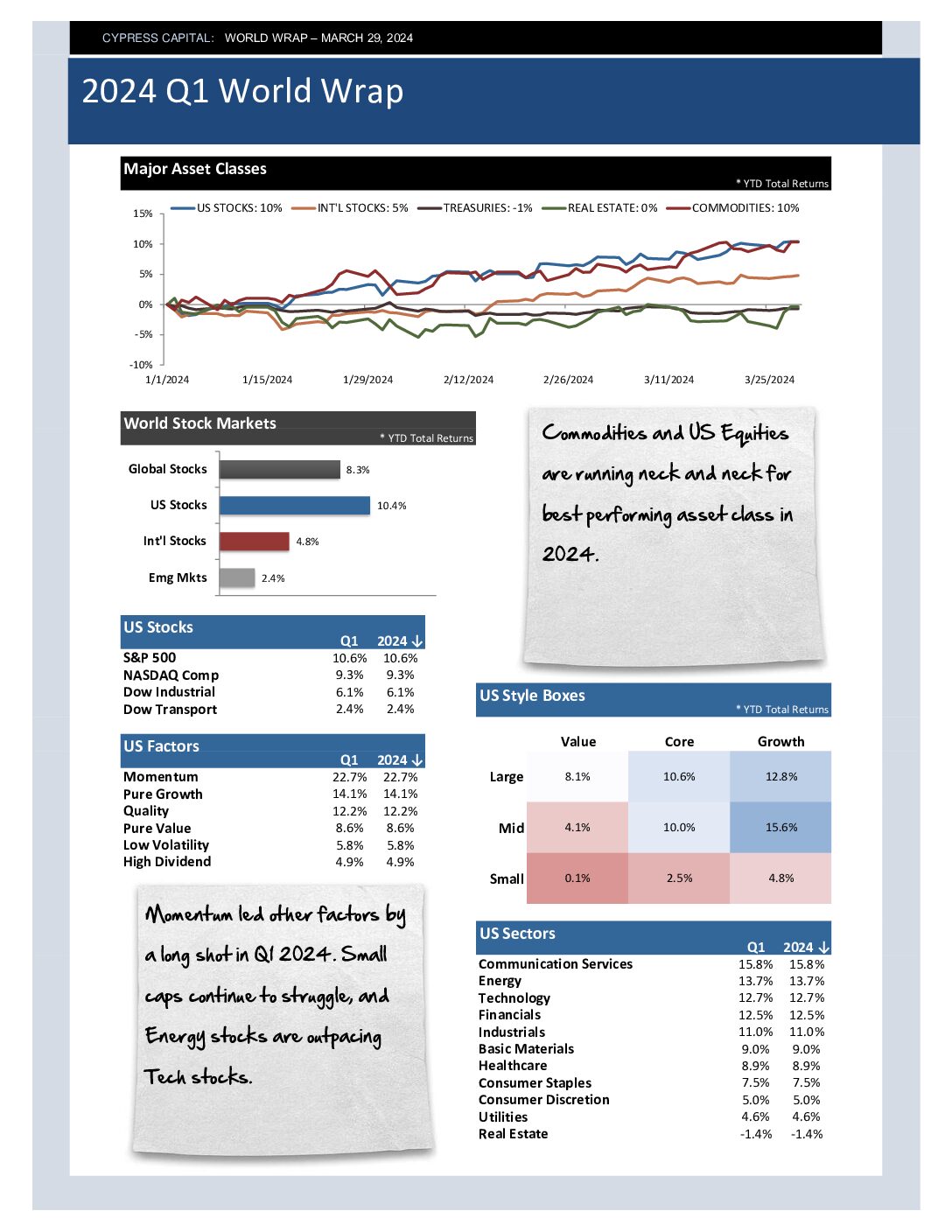

Q1 2024 World Wrap

– Commodities and US Equities are running neck and neck for best performing asset class in 2024.

– Momentum led other factors by a long shot in Q1 2024. Small caps continue to struggle, and Energy stocks are outpacing Tech stocks.

– Intl equities are up, but lagging. China declined, but avoided a new low. Should China’s poor performance persist, it will be the 4th straight yr of declines.

– Mostly declines in global fixed income for the quarter. US High Yield and Treasury bills are the only two sectors with positive returns ytd.

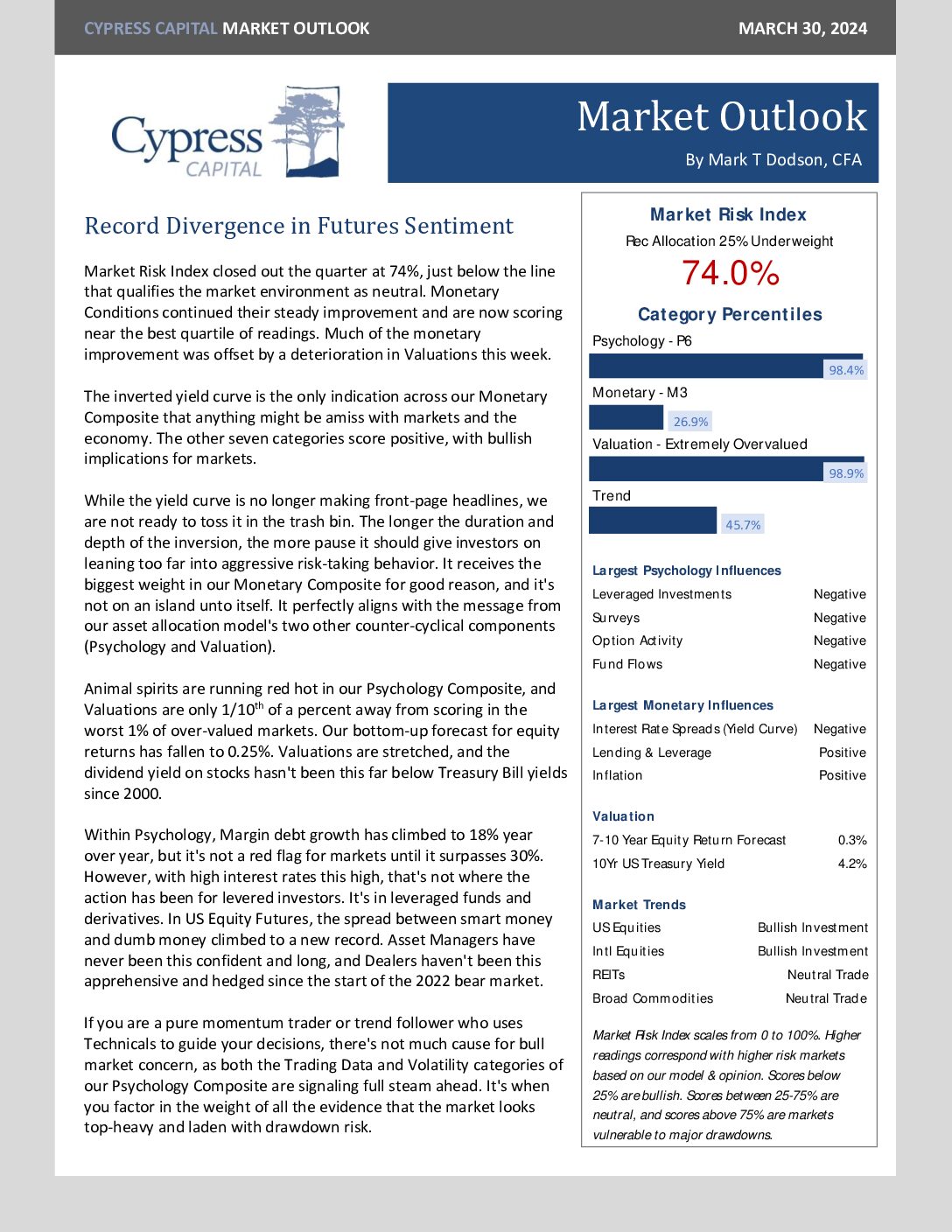

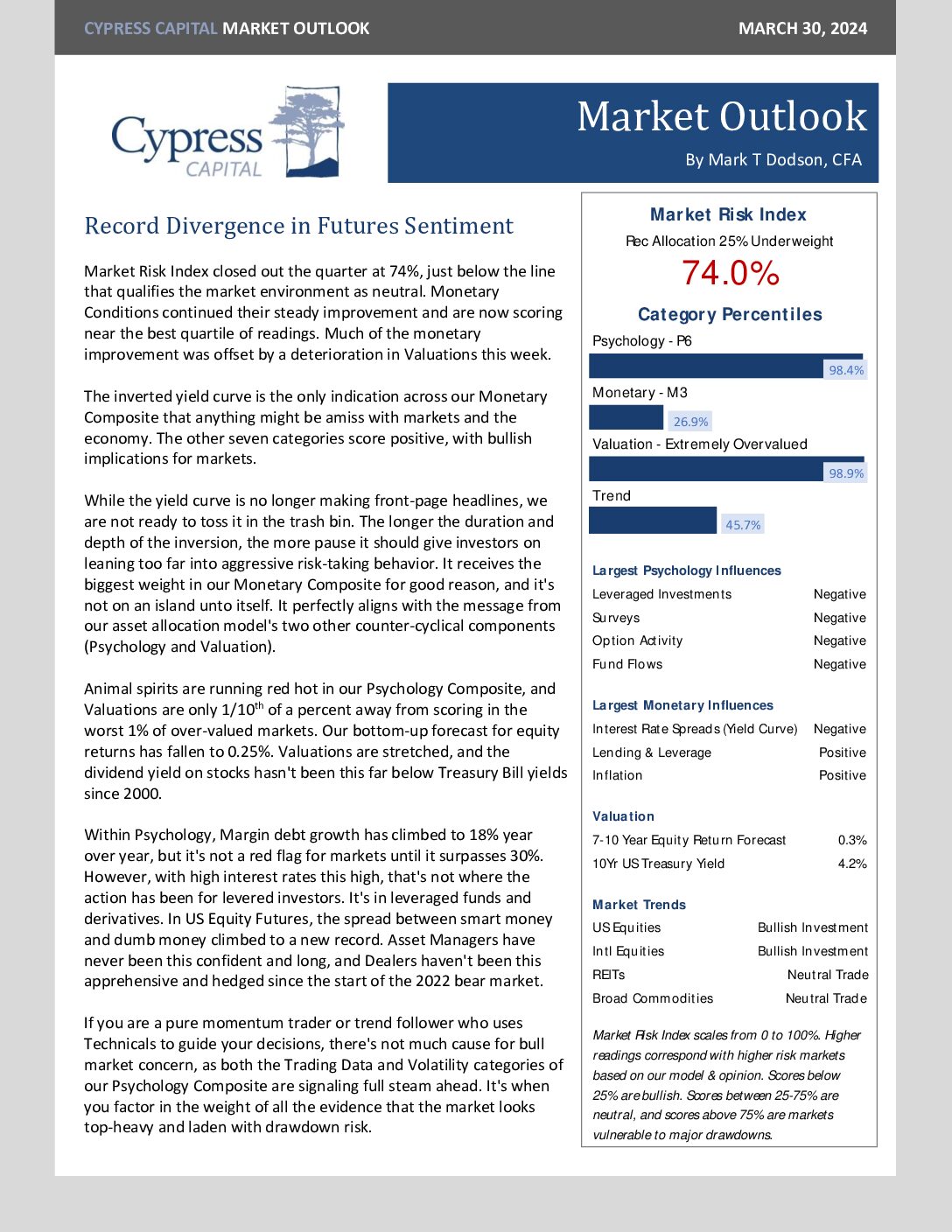

Market Outlook – Record Divergence in US Equity Futures Sentiment

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 98.1%

- Monetary 30.4%

- Valuation 98.7%

- Trend 25.9%