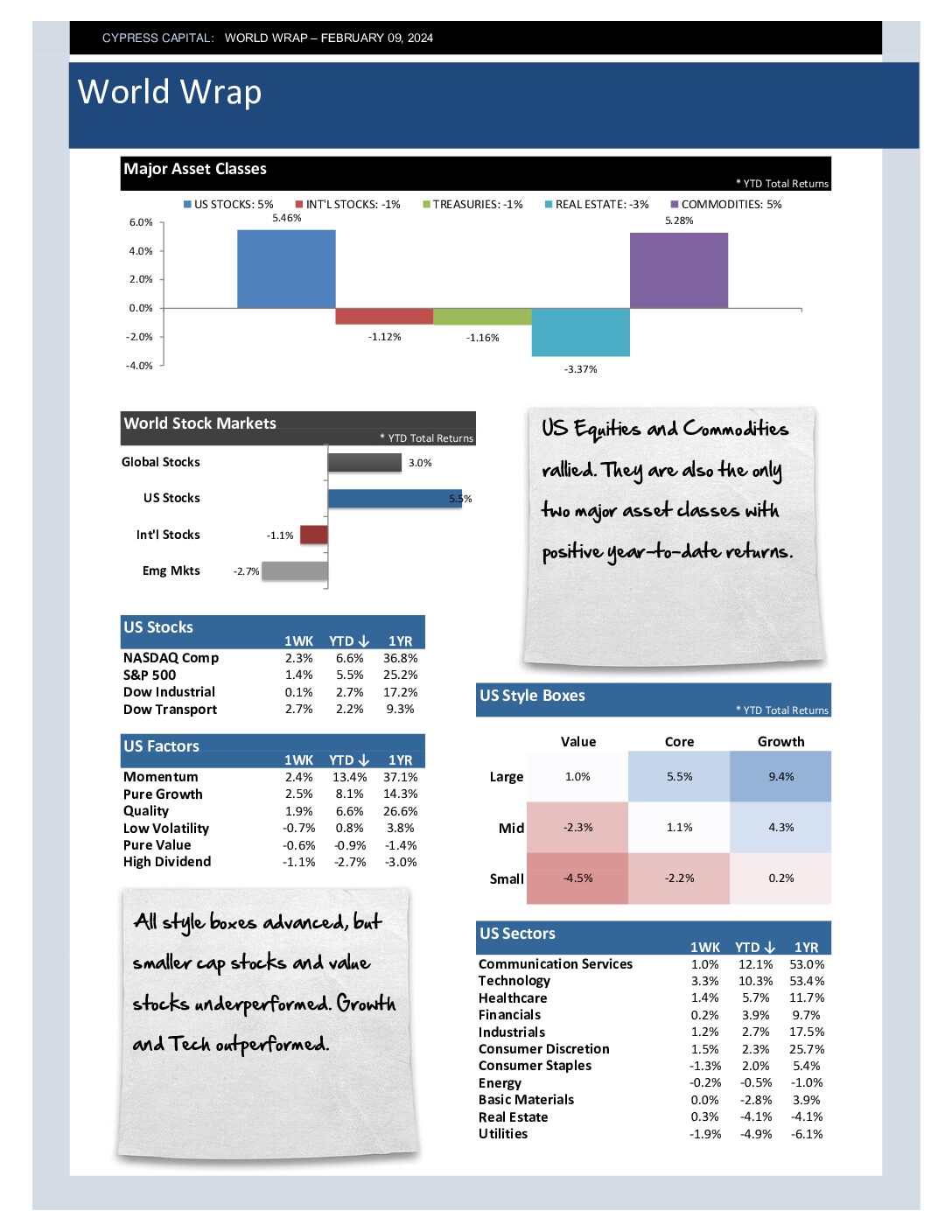

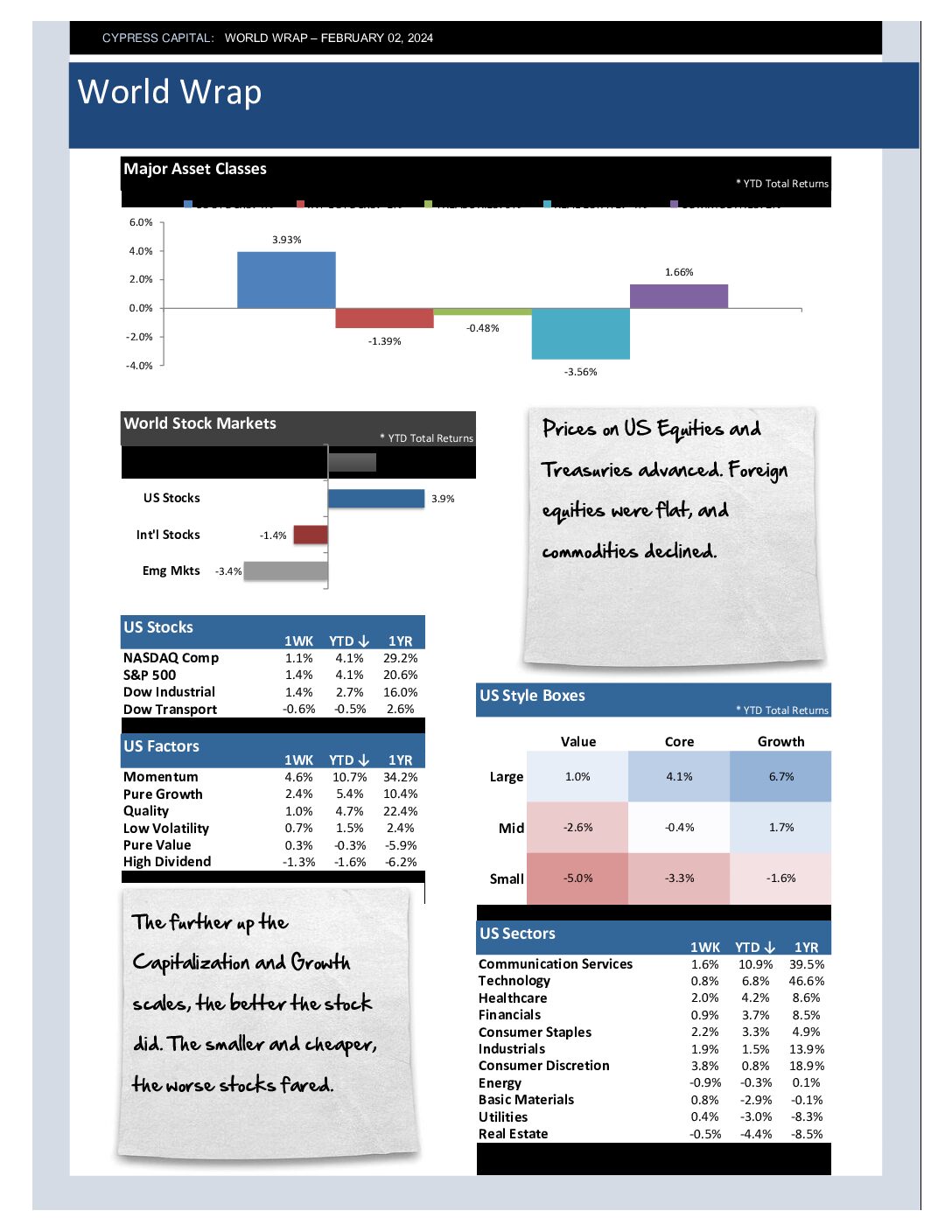

– US Equities and Commodities rallied. They are also the only two major asset classes with positive year-to-date returns.

– All style boxes advanced, but smaller cap stocks and value stocks underperformed. Growth and Tech outperformed.

– International equities were flat, with slightly more than half of countries advancing. More than 60% of countries are down year-to-date.

– US Treasuries declined, and breakevens on US TIPS are starting to signal a rebound in the rate of inflation.