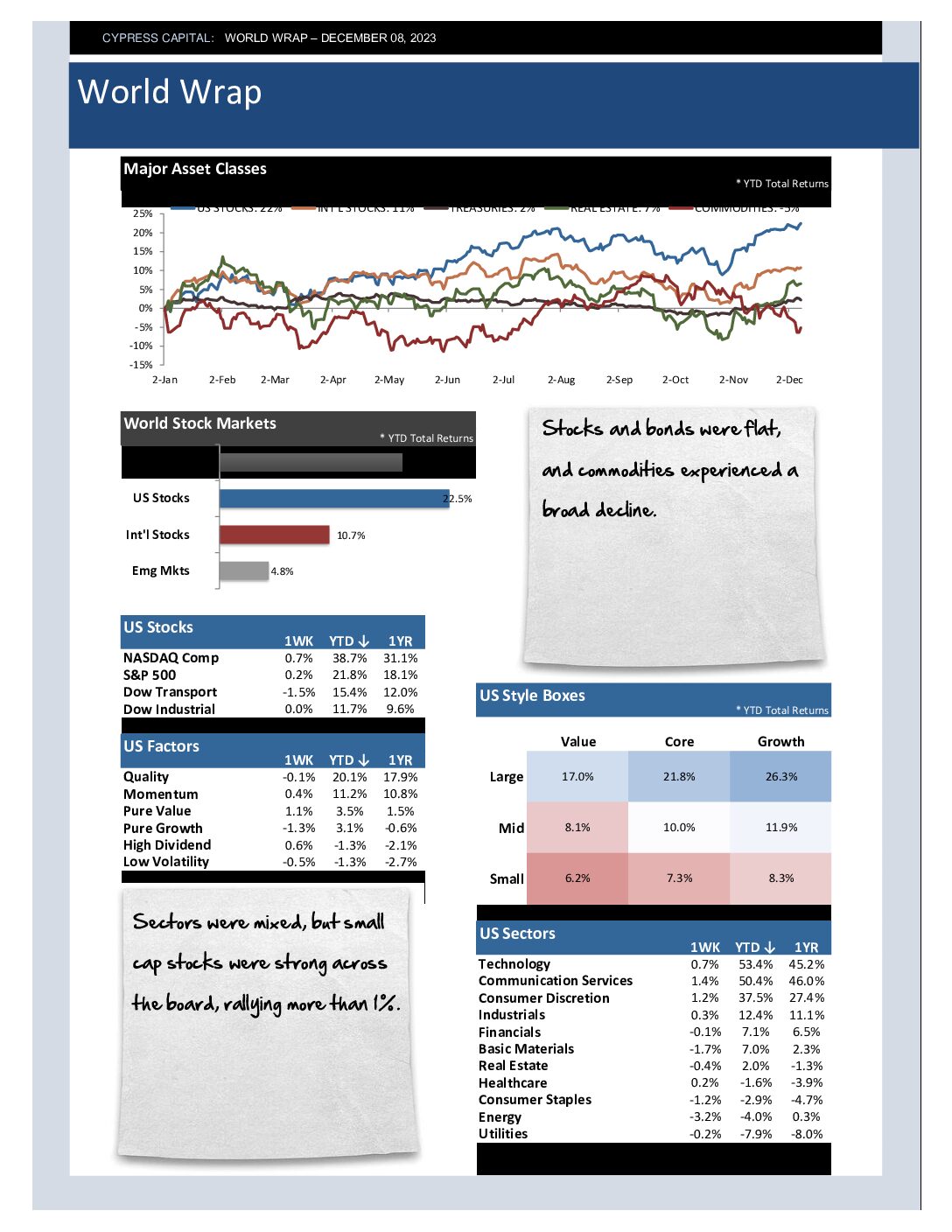

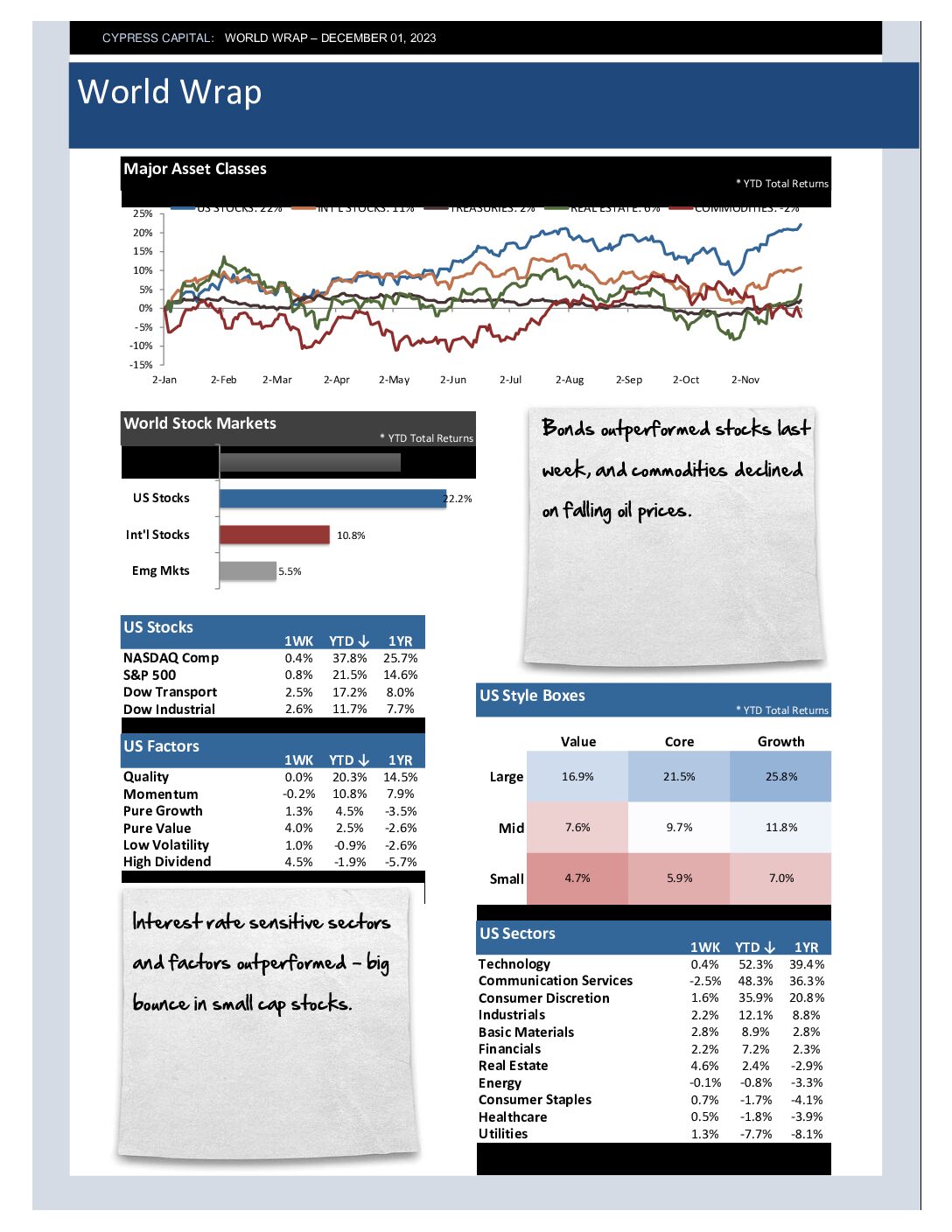

– Stocks and bonds were flat, and commodities experienced a broad decline.

– Sectors were mixed, but small cap stocks were strong across the board, rallying more than 1%.

– China fell more than 3.5% setting a new 52 week low. This coming February will mark three years since the bull market peak in China.

– Crude oil is down more than 25% off its September peak, falling below $70bbl last week.