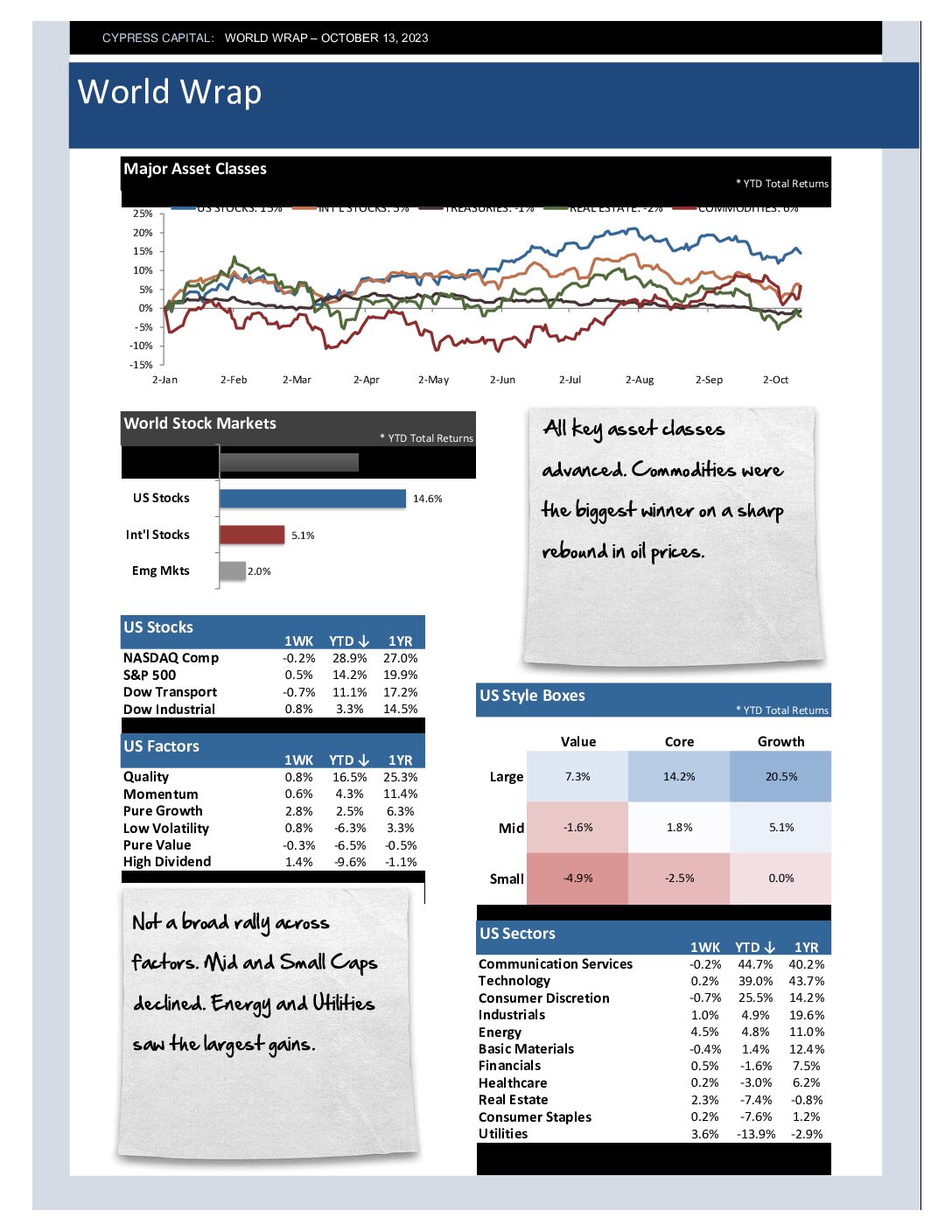

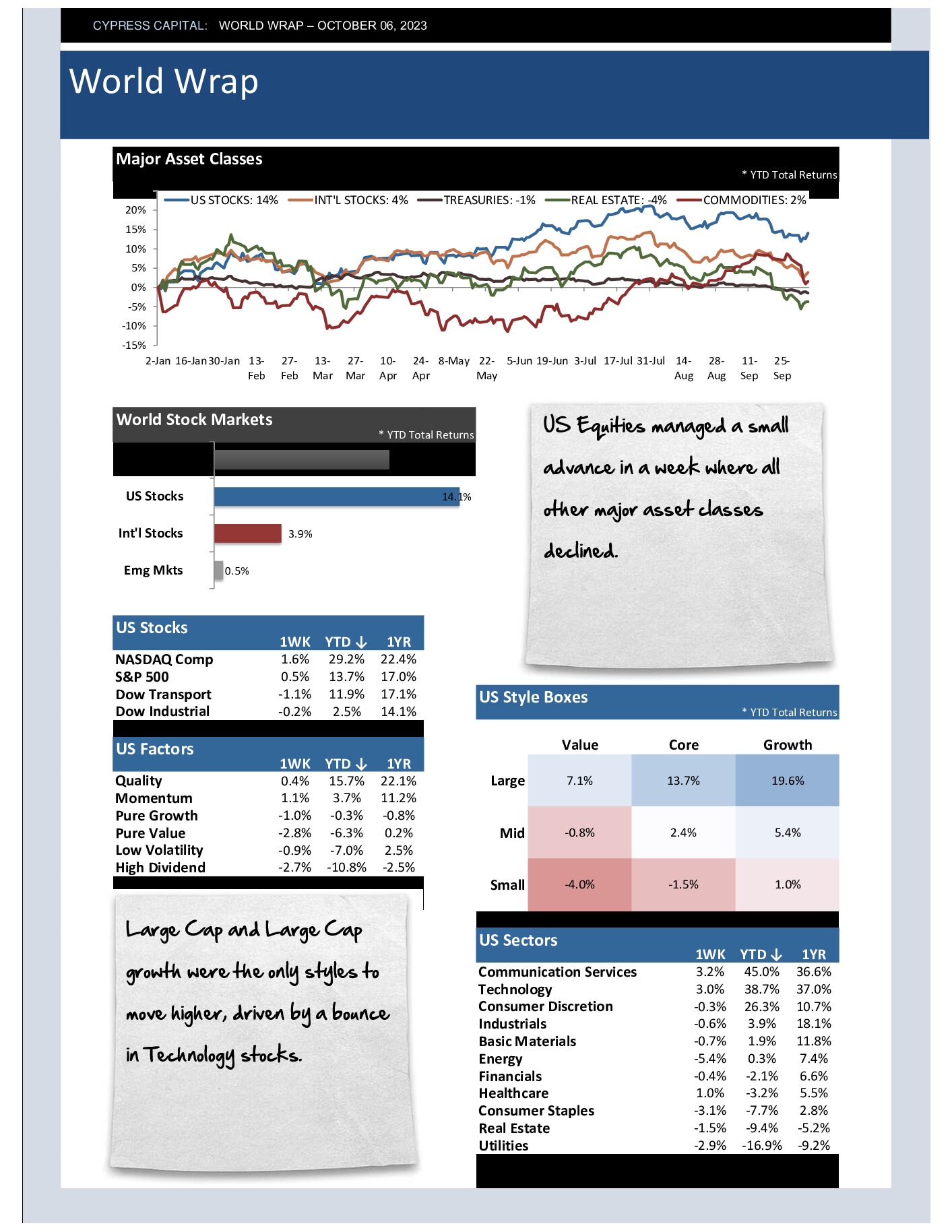

– All key asset classes advanced. Commodities were the biggest winner on a sharp rebound in oil prices.

– Not a broad rally across factors. Mid and Small Caps declined. Energy and Utilities saw the largest gains.

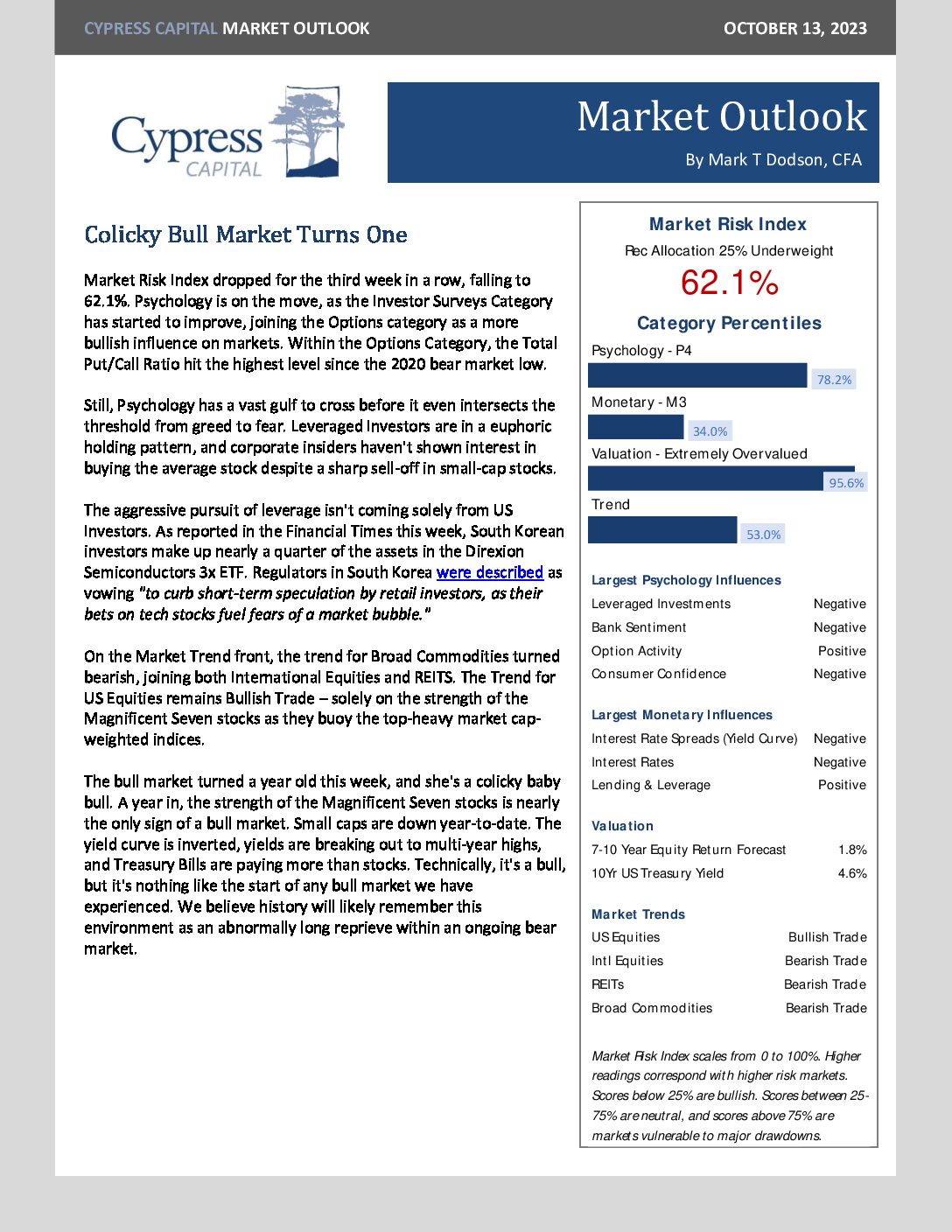

– International equities rallied. Israel’s equity market declined 8.8% after the Hamas attack.

– Fixed income markets advanced, and yields fell. Gold prices also rebounded by more than 5%.