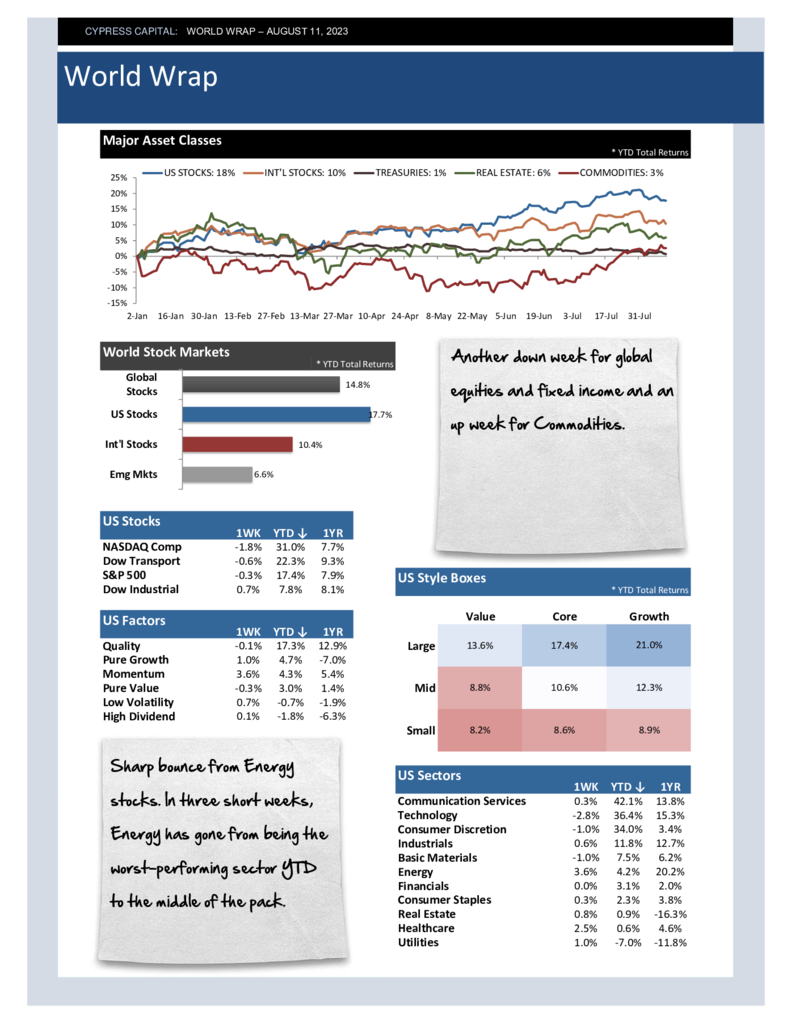

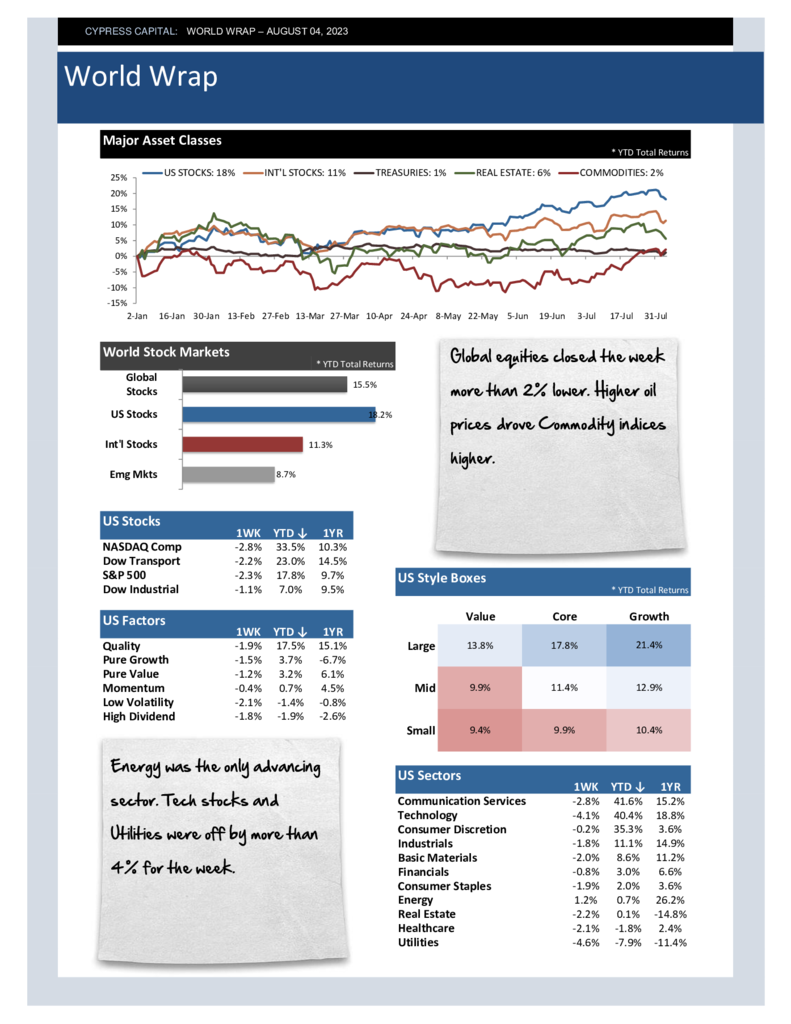

– Another down week for global equities and fixed income and an up week for Commodities.

– Sharp bounce from Energy stocks. In three short weeks, Energy has gone from being the worst-performing sector YTD to the middle of the pack.

– China continues to struggle – down 3.7% – continuing to weigh on Emerging market indices.

– The US Dollar was up sharply. The dollar bottomed when the NASDAQ peaked in July and has climbed in lockstep with the weakness of Tech stocks ever since.