Archive

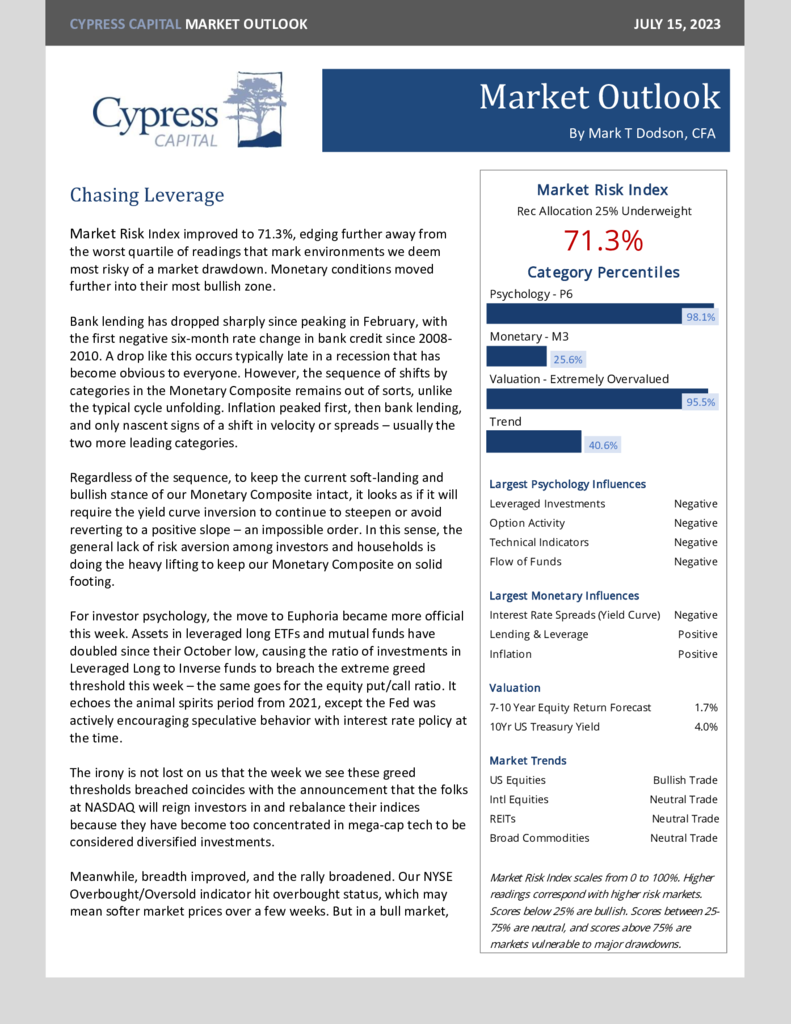

World Wrap

– Global Equities and US Treasuries declined, and Commodities advanced on a rebound in crude oil futures.

– Six-month performance spread between the S&P 500 and the Dow is the second widest on record – all-time record was set in March 2000.

– China has fallen back into a bear market – speculation increasing about potential stimulus.

– Unemployment rate dropped to 3.6% – keeping pressure on the Fed to raise rates this month.

Market Outlook – Another Case of the FOMOs

Q2 2023 World Wrap

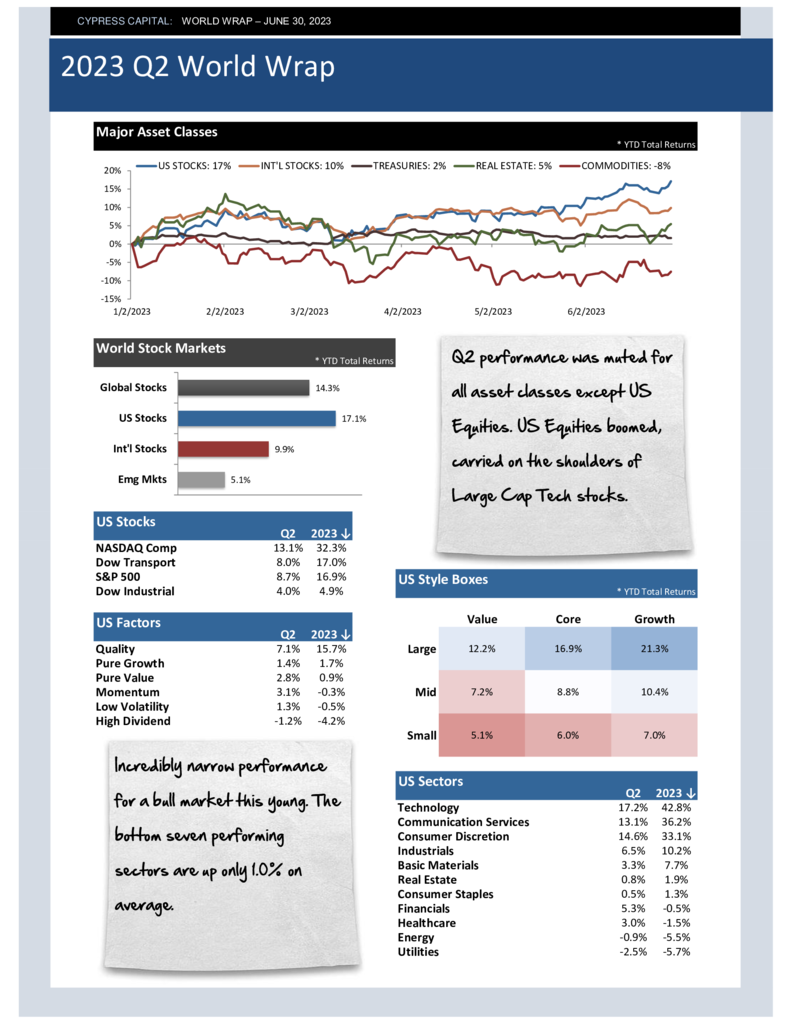

– Q2 performance was muted for all asset classes except US Equities. US Equities boomed, carried on the shoulders of Large Cap Tech stocks.

– Incredibly narrow performance for a bull market this young. The bottom seven performing sectors are up only 1.0% on average.

– The second quarter crushed the China re-opening narrative. Their stock market fell almost 10%, now down more than 5% year-to-date.

– Spread between Corporate Bond Yields and US Treasury Bills finished the quarter at the lowest level since 1981.

%

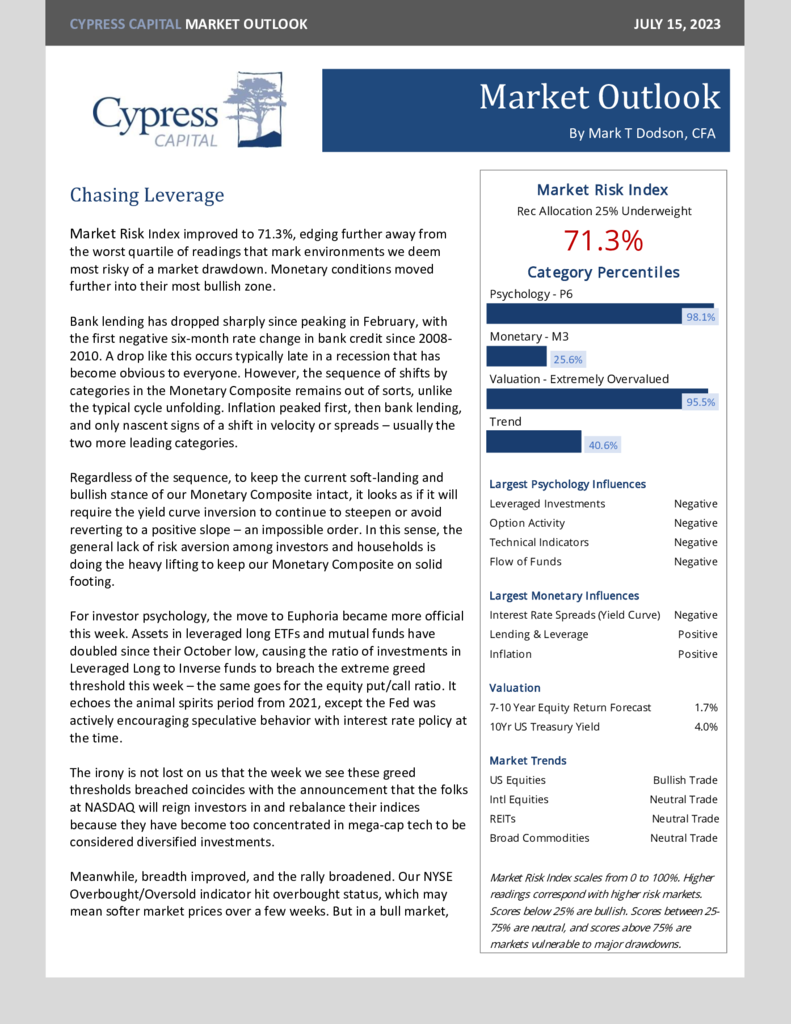

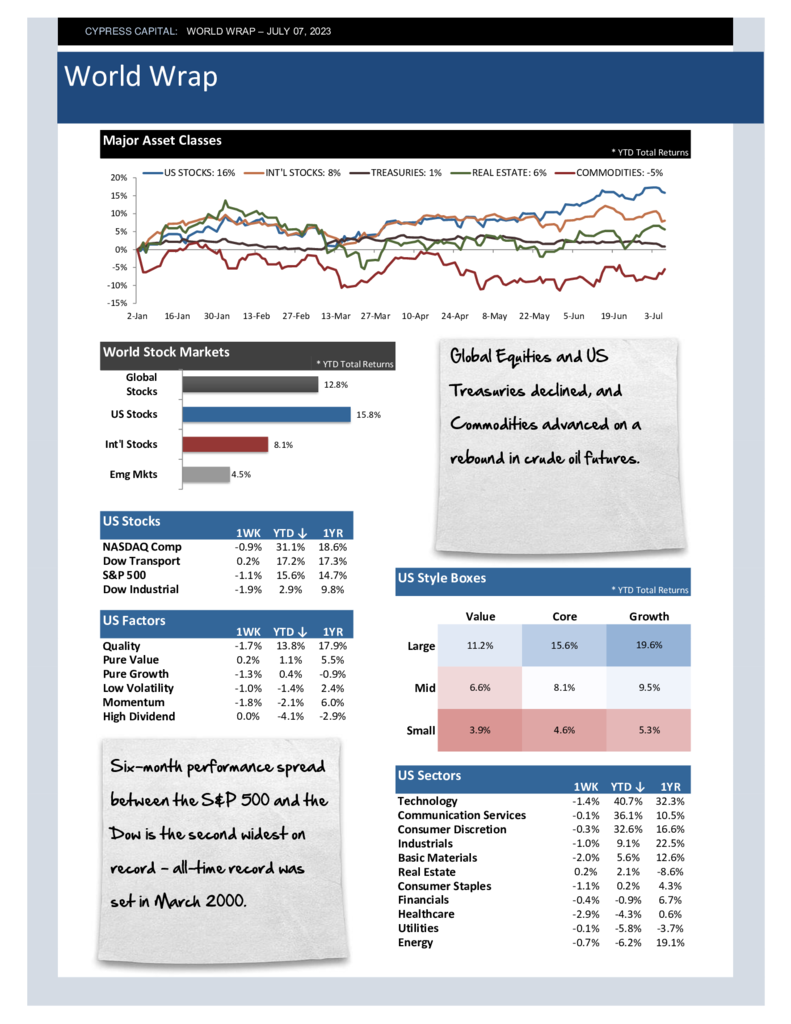

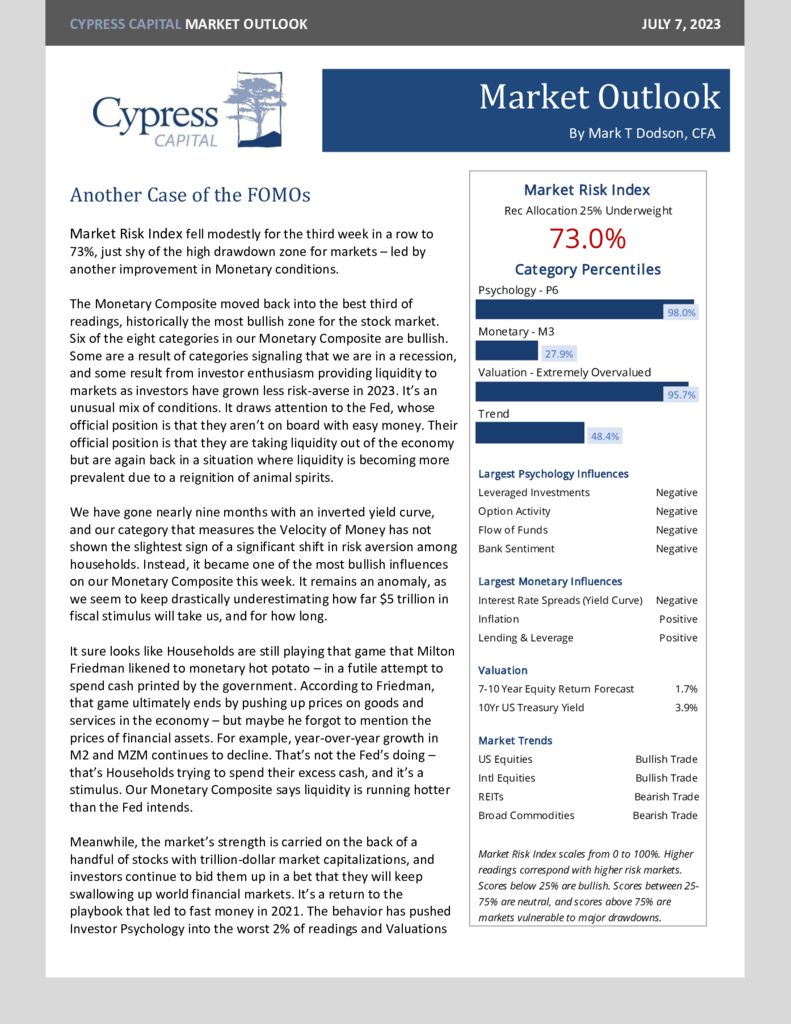

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 99.7%

- Monetary 87.2%

- Valuation 99.3%

- Market Trend 9.8%