Archive

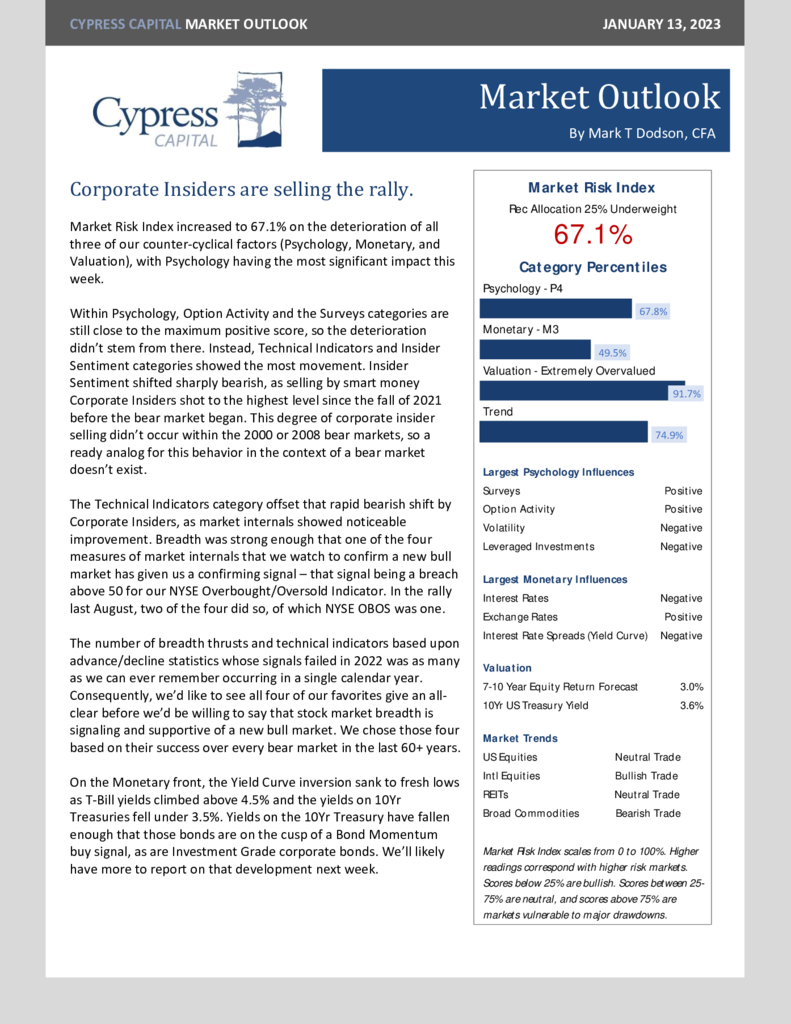

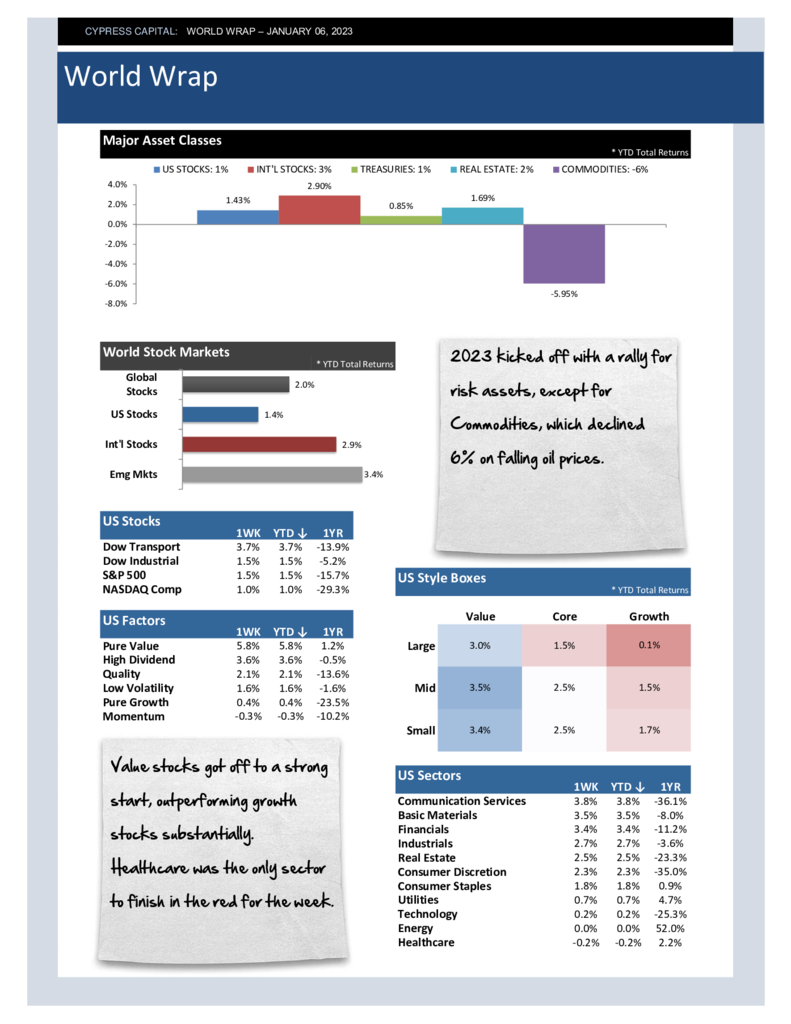

World Wrap

– 2023 kicked off with a rally for risk assets, except for Commodities, which declined 6% on falling oil prices.

– Value stocks got off to a strong start, outperforming growth stocks substantially. Healthcare was the only sector to finish in the red for the week.

– German stocks advanced 5.3% driving developed international equity indices higher.

– Yields on 10Yr Treasuries fell while T-Bill yields rose, leading to the deepest yield curve inversion since the early 80s.

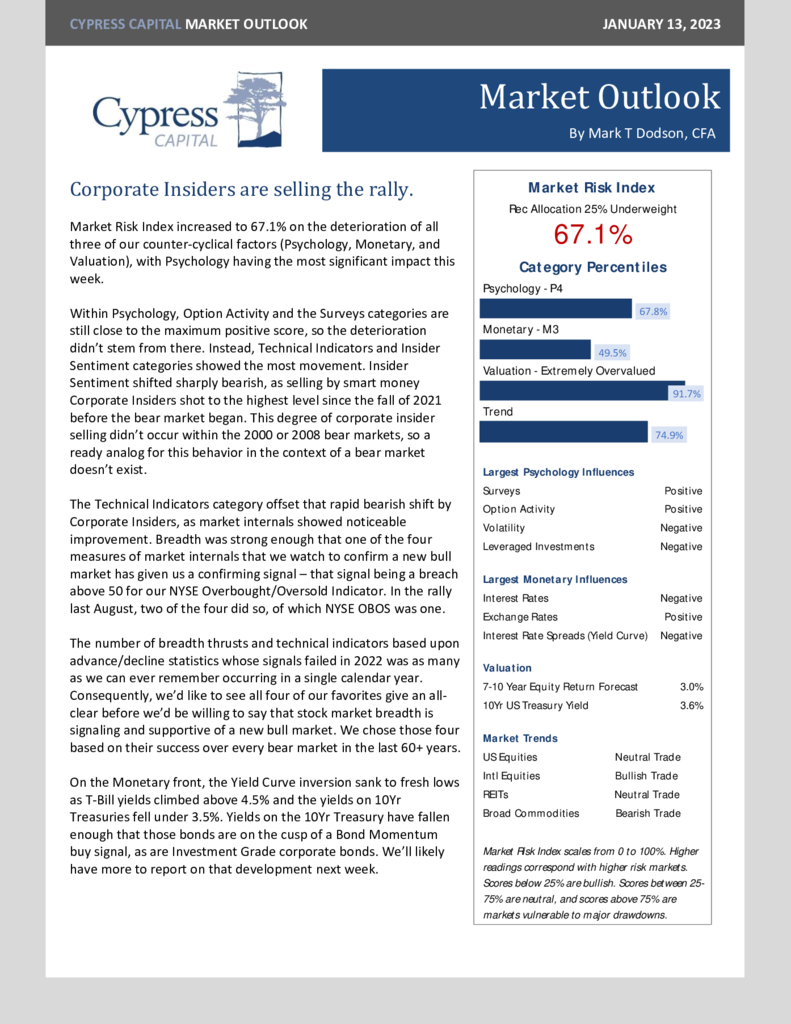

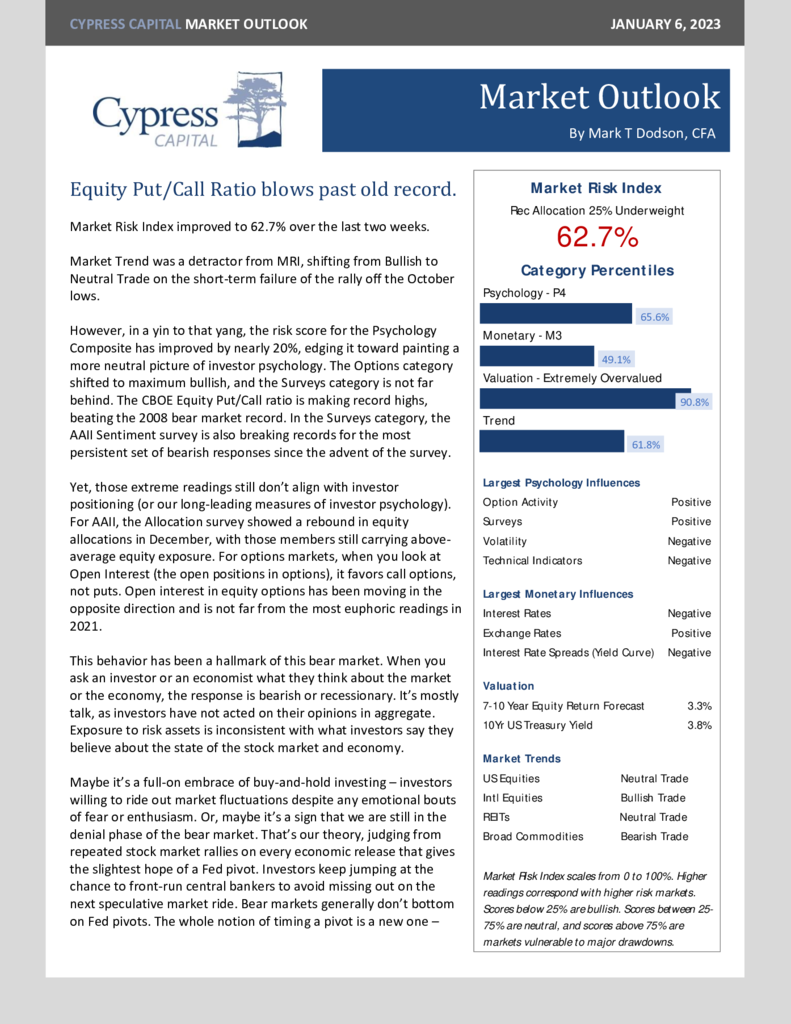

Market Outlook – Equity Put/Call Ratio blows past old record.

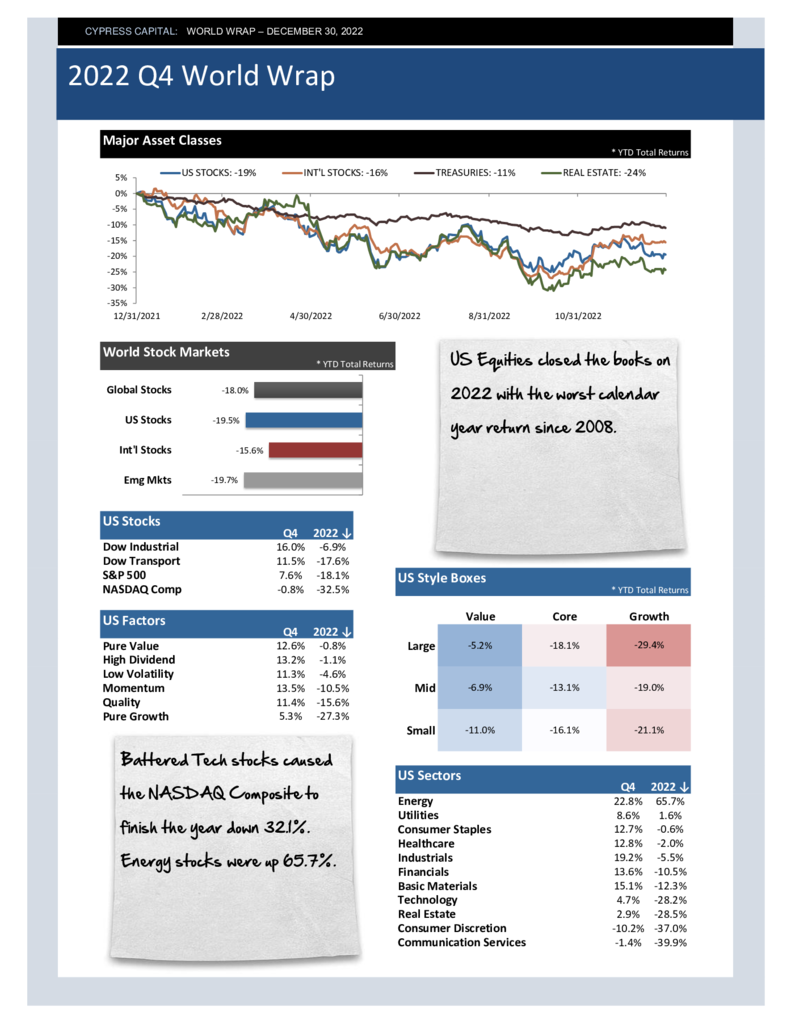

Q4 2022 World Wrap

– US Equities closed the books on 2022 with the worst calendar year return since 2008.

– Battered Tech stocks caused the NASDAQ Composite to finish the year down 32.1%. Energy stocks were up 65.7%.

– After bottoming in July, Latin America managed to finish the year up 9.5%. Meanwhile, China’s bear market continued into its 2nd year, down 22%.

– US Treasuries with long maturities fared worse than stocks, with a negative total return of more than 30%. The dollar climbed 7.9% in 2022.

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 99.7%

- Monetary 87.2%

- Valuation 99.3%

- Market Trend 9.8%