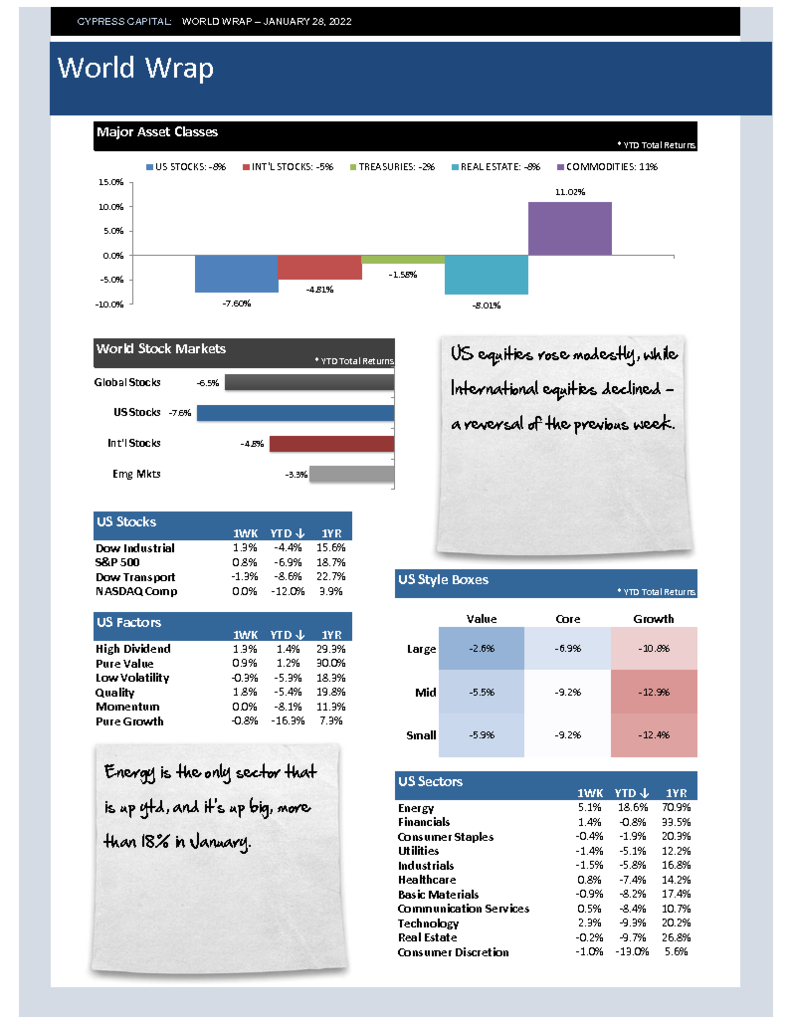

– US risk assets declined – equities, real estate, and Treasuries. Intl equities and commodities advanced.

– Value and dividend paying stocks proved a safe haven, moving higher during the week, led by another impressive performance from Energy stocks.

– Strong performance from emerging markets, which moved into positive territory year-to-date.

– Fixed income was down across the board – every sector is in the red for 2022. Lumber prices jumped a whopping 15.8% last week.